Food Lion 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group - Annual Report 2003

28

Fi n a n c i a l

2001 2002 2003

Sales

(in billions of EUR)

21.4 20.7 18.8

Income Statement (p. 40)

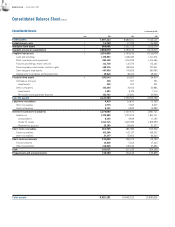

In 2003, Delhaize realized total sales of EUR 18.8 billion, a 9.0%

decrease compared to 2002. Sales were infl uenced by the

signifi cant weakening of the U.S. dollar by 16.4% against the euro,

the closing of 46 stores in the U.S., the deconsolidation of Shop

N Save (Singapore) from October 1, 2003, the acquisition of 43

Harveys stores from October 26, 2003, and 53 weeks of sales in

the U.S., compared to 52 weeks in 2002. The positive sales impact

of the 53rd sales week in the U.S. amounted to EUR 272.8 million

(USD 308.6 million). Seventy-three percent of the Group’s sales

were generated in the U.S., 19.5% in Belgium, 6.4% in Southern

and Central Europe, and 1.1% in Asia.

At identical exchange rates, sales would have increased 4.2%,

while organic sales growth was 2.4%. Sales continued to be

strong for another year at Hannaford, in Belgium and in Greece.

The sales momentum at Food Lion and Kash n’ Karry improved

throughout the year due to a continued focus on better execution

and successful sales initiatives. In 2003, Food Lion experienced

91 net competitive openings in its market areas and Hannaford

experienced 13 net competitive openings, increasing the amount

of grocery square footage available to consumers. Net competitive

openings are new stores, net of closings, by competitors that

negatively impact sales at existing stores.

Comparable store sales growth at the Delhaize Group’s U.S.

companies was 0.6% for 2003 (-1.0% in 2002), improving throughout

the year and culminating in 2.9% comparable store sales growth

in the last quarter of the year. All four U.S. companies recorded

positive comparable store sales growth in the second half of

the year. In Belgium, comparable store sales increased 5.6%

(+3.7% in 2002), due to successful commercial initiatives and the

continued renewal of its store concepts. In 2003, Delhaize Group’s

sales network increased by 32 stores, net of 46 stores closed in

the U.S. and the disposal of Shop N Save (35 stores) in Singapore

and including the 43 Harveys stores acquired in October 2003.

Gross profi t decreased by 10.2% due to the weakening of the

U.S. dollar and the reduction of gross margin from 25.9% in

2002 to 25.6% in 2003. This was primarily due to investments

in price competitiveness by Food Lion and Kash n’ Karry. The

gross margin of the U.S. operations decreased from 27.6% to

27.3% because of the lowering of everyday prices, more active

promotions and increased shrink at Food Lion. The gross margin

of the Belgian operations increased from 21.9% to 22.4% due to

improved purchasing and better sales mix, despite consistently

lower everyday prices.

Miscellaneous goods and services decreased by 10.5%, and

salaries, social security and pensions by 11.0%. The decrease

in absolute terms was primarily due to the weaker dollar. When

expressed as a percentage of sales, these expenses decreased

from 6.8% to 6.7%, and from 13.1% to 12.8%, respectively. These

improvements are primarily the result of the ongoing cost and

expense savings at Food Lion and other operating companies within

the Group. In January 2003, Food Lion launched a major initiative to

identify and implement cost and expense savings of approximately

USD 100 million through the closing of 41 underperforming stores,

improved purchasing of supplies, the streamlining of its support

structure and other initiatives. Store labor costs decreased as a

result of productivity and operational improvements. Retirement

plan expenses were reduced as a result of changes in the

retirements plans of Food Lion and Kash n’ Karry.

Depreciation of intangible and tangible fi xed assets decreased

by 14.9% to EUR 538.7 million due to the weakening of the U.S.

dollar against the euro, the closing of 42 stores in the U.S. in

the fi rst quarter of 2003 and a reduction in capital expenditures.

Amortization of goodwill arising on consolidation decreased in

2003 by 7.7% to EUR 85.1 million, also due to the weakening of the

U.S. dollar.

The operating margin of Delhaize Group increased signifi cantly,

from 3.9% in 2002 to 4.3% in 2003, due to the sharp reduction of

Certain non-GAAP measures are provided throughout this annual report. We do

not represent these measures as alternative measures to net earnings, or other

financial or liquidity measures determined in accordance with Belgian GAAP.

These measures as reported by Delhaize Group might differ from similarly titled

measures by other companies. We believe that these measures are important

indicators of our business and are widely used by investors, analysts and other

parties. A reconciliation of these measures to Belgian GAAP measures can be

found in the notes to the financial statements:

• Net debt ........................................................................................note 16 (p. 50)

• Adjusted EBITDA ..........................................................................note 21 (p. 52)

• Earnings before goodwill and exceptionals ................................ note 26 (p. 53)

• Free cash flow ..............................................................................note 27 (p. 53)

• Identical exchange rates ............................................................. note 28 (p. 54)

A definition of non-GAAP measures and ratios composed of non-GAAP measures

can be found in the glossary on page 76.

Re v ie w