Dollar Tree 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in terms of transaction size. We expect penetration of Visa credit to continue

increasing throughout 2008.

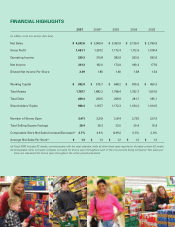

In terms of profitability, we achieved 7.8% operating margin in 2007, which

remains among the highest in the extreme-value retail sector. Gross margin

improved 20 basis points over 2006, driven by higher merchandise margins.

Our second objective was to continue growing our store base, and

refining our real estate processes. Our goals are to open stores earlier in the

year, to maximize their productivity through improved site selection, improve

the construction process and ultimately to increase our return on invested

capital. In fiscal 2007 we opened 240 New Stores, expanded and relocated

102 existing stores, and increased retail square footage by 8%. Our new stores

averaged just under 11,000 square feet, a size that is within our targeted

range, and ideal from the customers’ perspective, allowing them to see a full

display of merchandise in an open and bright shopping environment, while

keeping their shopping trip quick and convenient. We ended fiscal 2007 with

3,411 stores and room to grow. We believe that we can operate 5,000 to

7,000 Dollar Tree stores across the country and our Deal$ “multi-price point”

concept has the potential to expand that number.

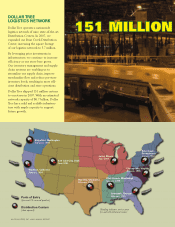

Third, leverage our infrastructure investment. Significant investments in

infrastructure over the past few years are contributing to improved performance.

Our logistics network is highly automated, efficient and capable of delivering

product to all 48 contiguous States and we have capacity to support growth

to $6.7 billion of annual sales without additional investment. Our technology

infrastructure and particularly our investment in Point of Sale applications has

given us the ability to improve our flow of product to stores, reduce back

room inventory and improve operating efficiency. Our Automated Store

Replenishment tool is improving our in-stock of basics. Demand driven

allocations of new product consistent with sales trends is driving store sales and

our sell-through of seasonal product is increasing. These investments are

enabling us to improve the efficiency and increase the capacity of our logistics

network, lower our per-store inventory investment and increase inventory turns.

Inventory per store has declined by more than 16% in the past three years, and

finished 2007 essentially unchanged from last year. In addition, inventory turns

increased 25 basis points in 2007, on top of a 45 basis point increase the previ-

ous year, and our in-stock position on basics continues to improve.

Fourth, refine the multi-price model at Deal$. We acquired the Deal$

chain in 2006, as a platform to develop a multi-price format, lifting the

DOLLAR TREE, INC. • 2007 ANNUAL REPORT

3

06 07050403

0706050403