Dollar Tree 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE, INC. • 2007 ANNUAL REPORT

15

adoption of Statement of Financial Accounting

Standards No. 123, Share-Based Payment (revised

2004) (FAS 123R), on January 29, 2006.

Compensation expense has been reduced by

approximately $14.9 million over a period of four

years during which the options would have vest-

ed, as a result of the option acceleration program.

Overview

Our net sales are derived from the sale of merchan-

dise. Two major factors tend to affect our net sales

trends. First is our success at opening new stores or

adding new stores through acquisitions. Second, sales

vary at our existing stores from one year to the next.

We refer to this change as a change in comparable

store net sales, because we compare only those stores

that are open throughout both of the periods being

compared. We include sales from stores expanded dur-

ing the year in the calculation of comparable store net

sales, which has the effect of increasing our compara-

ble store net sales. The term ‘expanded’ also includes

stores that are relocated.

At February 2, 2008, we operated 3,411 stores in

48 states, with 28.4 million selling square feet com-

pared to 3,219 stores with 26.3 million selling square

feet at February 3, 2007. During fiscal 2007, we

opened 240 stores, expanded 102 stores and closed 48

stores, compared to 211 new stores opened, 85 stores

expanded and 44 stores closed during fiscal 2006. In

addition to the new stores opened in 2006, we

acquired 138 Deal$ stores on March 25, 2006. In the

current year we achieved 8% selling square footage

growth. Of the 2.1 million selling square foot increase

in 2007, 0.4 million was added by expanding existing

stores. The average size of our stores opened in 2007

was approximately 8,500 selling square feet (or about

10,800 gross square feet). The average new store size

decreased slightly in 2007 from approximately 9,000

selling square feet (or about 11,000 gross square feet)

for new stores in 2006. For 2008, we continue to plan

to open stores that are approximately 8,500 - 9,000

selling square feet (or about 10,000 - 12,500 gross

square feet). We believe that this store size is our opti-

mal size operationally and that this size also gives our

customers an improved shopping environment that

invites them to shop longer and buy more. We expect

the substantial majority of our future net sales growth

to come from the square footage growth resulting from

new store openings and expansion of existing stores.

Outstanding shares of the capital stock of Dollar

Tree Stores, Inc., were automatically converted, on

a share for share basis, into identical shares of

common stock of the new holding company. The

articles of incorporation, the bylaws, the executive

officers and the board of directors of our new

holding company are the same as those of the for-

mer Dollar Tree Stores, Inc. in effect immediately

prior to the reorganization. The common stock of

our new holding company will continue to be list-

ed on the NASDAQ Global Select Market under

the symbol “DLTR”. The rights, privileges and

interests of our stockholders will remain the same

with respect to our new holding company.

• On February 20, 2008, we entered into a five-year

$550.0 million Credit Agreement (the Agreement).

The Agreement provides for a $300.0 million

revolving line of credit, including up to $150.0

million in available letters of credit, and a $250.0

million term loan. The interest rate on the facility

will be based, at our option, on a LIBOR rate, plus

a margin, or an alternate base rate, plus a margin.

Our March 2004, $450.0 million unsecured

revolving credit facility was terminated concurrent

with entering into the Agreement.

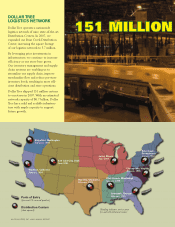

• In November 2007, we completed the 400,000

square foot expansion of our Briar Creek distribu-

tion center. Including this expansion, we believe

that our nine distribution centers will support

approximately $6.7 billion in sales annually.

• In October 2007, our Board of Directors author-

ized the repurchase of an additional $500.0 mil-

lion of our common stock. This authorization was

in addition to the November 2006 authorization

which had approximately $98.4 million remaining.

At February 2, 2008, we had approximately $453.7

million remaining under Board authorization.

• In March 2006, we completed our acquisition of

138 Deal$ stores and related assets. We paid

approximately $32.0 million for store related

assets and $22.1 million for inventory.

• On December 15, 2005, the Compensation

Committee of our Board of Directors approved

the acceleration of the vesting date of all previ-

ously issued, outstanding and unvested options

under all current stock option plans, effective as

of December 15, 2005. This decision eliminated

non-cash compensation expense that would have

been recorded in future periods following our