Dollar Tree 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

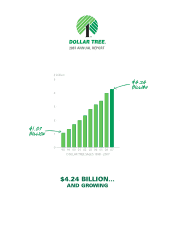

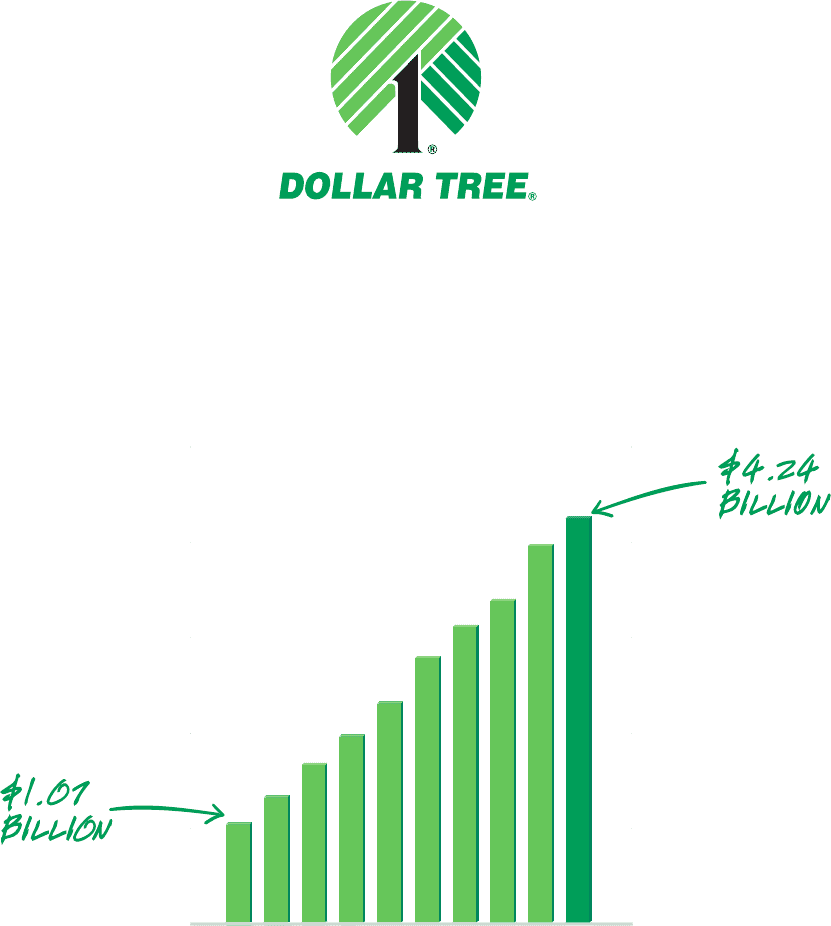

DOLLAR TREE SALES 1998 - 2007

98 99 00 01 02 03 04 05 06 07

1

2

3

4

5

$ billion

$4.24 BILLION...

AND GROWING

2007 ANNUAL REPORT

Table of contents

-

Page 1

2007 ANNUAL REPORT $ billion 5 4 3 2 1 0 98 99 00 01 02 03 04 05 06 07 DOLLAR TREE SALES 1998 - 2007 $4.24 BILLION...AND GROWING -

Page 2

... 27 28 29 Headquartered in Chesapeake, Virginia, Dollar Tree is the World's leading $1 price point variety store. For more than twenty years, we have remained dedicated to a single vision - offering incredible value and a fun, friendly shopping experience. Today, there are more than 3,400 locations... -

Page 3

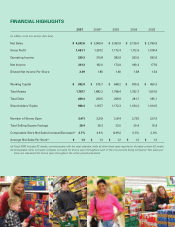

...2007 (in millions, except store and per share data) 2006(a) 2005 2004 2003 Net Sales Gross Profit Operating Income Net Income Diluted Net Income Per Share...014.5 Number of Stores Open Total Selling Square Footage Comparable Store Net Sales Increase/(Decrease)(b) Average Net Sales Per Store(b) $... -

Page 4

... our Distribution Center in Briar Creek, PA. We generated significant cash flow, and returned value to our long-term shareholders by investing more than $473 million on share repurchases without increasing our long-term debt. Bob Sasser President and Chief Executive Officer REVIEW OF 2007 GOALS AND... -

Page 5

... previous year, and our in-stock position on basics continues to improve. Fourth, refine the multi-price model at Deal$. We acquired the Deal$ chain in 2006, as a platform to develop a multi-price format, lifting the 03 04 05 06 07 03 04 05 06 07 DOLLAR TREE, INC. • 2007 ANNUAL REPORT 3 -

Page 6

... merchandise opportunities at the higher prices and the lift that it gives us in average ticket. The key elements of a Deal$ store are surprising value, convenience and a fun and friendly shopping experience. Our best test of the concept is in the opening of new Deal$ stores in new markets. In 2007... -

Page 7

... have a solid, scalable infrastructure, and we continue to deliver sector-leading profitability. I believe that Dollar Tree is right for the times and, now more than ever, I believe the best is yet to come! Bob Sasser President and Chief Executive Officer DOLLAR TREE, INC. • 2007 ANNUAL REPORT 5 -

Page 8

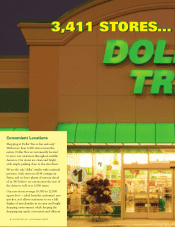

...new stores average 10,000 to 12,000 square feet - ideal from the customers' perspective, as it allows customers to see a full display of merchandise in an open and bright shopping environment, while keeping the shopping trip quick, convenient and efficient. 6 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 9

...275 new stores with 100 relocated or expanded stores are planned for 2008. We added freezers and coolers to 340 stores in 2007, and now have freezers and coolers in 972 of our stores at year-end. We plan to add them to approximately 150 more stores in 2008. DOLLAR TREE, INC. • 2007 ANNUAL REPORT 7 -

Page 10

... Salt Lake City, Utah June 2003 Stockton, California January 2000 Joliet, Illinois June 2004 Briar Creek, Pennsylvania August 2001 Chesapeake, Virginia January 1998 Olive Branch, Mississippi January 1999 Marietta, Oklahoma February 2003 Ports of Entry (for non-U.S.-sourced product) Savannah... -

Page 11

CARTONS SHIPPED...AND GROWING DOLLAR TREE, INC. • 2007 ANNUAL REPORT 9 -

Page 12

... and average transaction size. In addition, point-of-sale data allows us to track sales by merchandise category at the store level - assisting our inventory planning. This has helped us to lower our per-store inventory levels and increase inventory turns. 10 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 13

CUSTOMER TRANSACTIONS...AND GROWING DOLLAR TREE, INC. • 2007 ANNUAL REPORT 11 -

Page 14

... company, carries with it a responsibility to be above reproach when making operational and financial decisions. Our management team visits and shops our stores like every customer; we have an open door policy for all our associates, where ideas and individual creativity are encouraged. Dollar Tree... -

Page 15

...• our growth plans, including our plans to add, expand or relocate stores, our anticipated square footage increase, and our ability to renew leases at existing store locations; • the average size of our stores to be added in 2008 and beyond; • the effect of a slight shift in merchandise mix to... -

Page 16

...AND RESULTS OF OPERATIONS In Management's Discussion and Analysis, we explain the general financial condition and the results of operations for our company, including: • what factors affect our business; • what our net sales, earnings, gross margins and costs were in 2007, 2006 and 2005; • why... -

Page 17

... rate, plus a margin, or an alternate base rate, plus a margin. Our March 2004, $450.0 million unsecured revolving credit facility was terminated concurrent with entering into the Agreement. • In November 2007, we completed the 400,000 square foot expansion of our Briar Creek distribution center... -

Page 18

...and earnings by increasing the number of shopping trips made by our customers and increasing the average transaction size. Our point-of-sale technology provides us with valuable sales and inventory information to assist our buyers and improve our merchandise allocation to our stores. We believe that... -

Page 19

...15 basis points primarily due to increased repairs and maintenance costs in the current year. February 2, 2008 New stores Deal$ acquisition Acquired leases Expanded or relocated stores Closed stores February 3, 2007 190 138 21 85 (44) 208 - 32 102 (48) DOLLAR TREE, INC. • 2007 ANNUAL REPORT 17 -

Page 20

...expansion programs from internally generated funds and borrowings under our credit facilities. February 3, 2007 New stores Deal$ acquisition Acquired leases Expanded or relocated stores Closed stores January 28, 2006 197 - 35 93 (53) 190 138 21 85 (44) 18 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 21

...Then, in October 2007, our Board of Directors authorized the repurchase of an additional $500.0 million of our common stock. This authorization was in addition to the November 2006 authorization which had approximately $98.4 million remaining at the time. DOLLAR TREE, INC. • 2007 ANNUAL REPORT 19 -

Page 22

...cap" or high-end of the price range of the collar. The number of shares received under the agreement was determined based on the weighted average market price of our common stock, net of a predetermined discount, during the time after the initial execution date through a period of up to four and one... -

Page 23

...of credit, payable quarterly. The term loan is due and payable in full at the five year maturity date of the Agreement. The Agreement also bears an administrative fee payable annually. The Agreement, among other things, requires the maintenance of certain DOLLAR TREE, INC. • 2007 ANNUAL REPORT 21 -

Page 24

... purchases committed under these letters of credit at February 2, 2008. We also have approximately $19.8 million of letters of credit or surety bonds outstanding for our selfinsurance programs and certain utility payment obligations at some of our stores. 22 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 25

... averaging method that has been widely used in the retail industry and results in valuing inventories at lower of cost or market when markdowns are taken as a reduction of the retail value of inventories on a timely basis. Inventory valuation methods require certain significant management estimates... -

Page 26

... in economies in the United States or in foreign countries where we purchase some of our merchandise. These and other factors could increase our merchandise costs and other costs that are critical to our operations, such as shipping and wage rates. 24 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 27

... No. 157). SFAS No. 157, effective for interim or annual reporting periods beginning after November 15, 2007, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. We will adopt this statement in the first... -

Page 28

Management's Discussion & Analysis of Financial Condition and Results of Operations The following table summarizes the financial terms of our interest rate swap agreement and the fair value of the interest rate swap at February 2, 2008: Hedging Instrument $18.5 million interest rate swap Receive ... -

Page 29

... Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated April 1, 2008 expressed an unqualified opinion on the effectiveness of the Company's internal control over financial reporting. Norfolk, Virginia April 1, 2008 DOLLAR TREE, INC. • 2007 ANNUAL REPORT 27 -

Page 30

...61 1.60 Net sales Cost of sales (Note 4) Gross profit Selling, general and administrative expenses (Notes 8 and 9) Operating income Interest income Interest expense (Notes 5 and 6) Income before income taxes Provision for income taxes (Note 3) Net income Basic net income per share (Note 7) Diluted... -

Page 31

Consolidated Balance Sheets (in millions, except share data) February 2, 2008 February 3, 2007 ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred tax assets (Note 3) Prepaid expenses and other current assets Total current assets Property, ... -

Page 32

...year ended February 3, 2007 Other comprehensive income (Note 7) Total comprehensive income Issuance of stock under Employee Stock Purchase Plan (Note 9) Exercise of stock options, including income tax benefit of $5.6 (Note 9) Repurchase and retirement of shares (Note 7) Stock-based compensation, net... -

Page 33

... under long-term debt and capital lease obligations Borrowings from revolving credit facility Repayments of revolving credit facility Payments for share repurchases Proceeds from stock issued pursuant to stock-based compensation plans Tax benefit of stock options exercised Net cash used in financing... -

Page 34

... names of Dollar Tree, Deal$ and Dollar Bills. The Company's stores average approximately 8,300 selling square feet. The Company's headquarters and one of its distribution centers are located in Chesapeake, Virginia. The Company also operates distribution centers in Mississippi, Illinois, California... -

Page 35

... Inventories Merchandise inventories at the distribution centers are stated at the lower of cost or market, determined on a weighted average cost basis. Cost is assigned to store inventories using the retail inventory method, determined on a weighted average cost basis. Costs directly associated... -

Page 36

... of operations. The fair value of this interest rate swap at February 2, 2008 was $0.5 million. The fair value at February 3, 2007 was less than $0.1 million. Lease Accounting The Company leases all of its retail locations under operating leases. The Company recognizes minimum rent expense starting... -

Page 37

... of certain (in the money) options. The Company recognizes expense related to the fair value of restricted stock units (RSUs) over the requisite service period. The fair value of the RSUs is determined using the closing price of the Company's common stock on the date of grant. On March 14, 2008... -

Page 38

... financial instruments to fair value Stockholders' equity, tax benefit on exercise of stock options Year Ended February 2, 2008 $118.5 - (13.0) $105.5 Year Ended February 3, 2007 $110.9 - (5.6) $105.3 Year Ended January 28, 2006 $101.3 0.2 (1.2) $100.3 36 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 39

...rate Year Ended February 3, 2007 35.0% 3.3 (1.7) 36.6% Year Ended January 28, 2006 35.0% 3.4 (1.6) 36.8% 35.0% 2.9 (0.8) 37.1% The rate reduction in "other, net" consists primarily of benefits from the resolution of tax uncertainties, interest on tax reserves, federal jobs credits and tax exempt... -

Page 40

... the effective tax rate was $12.4 million (net of the federal tax benefit). The following is a reconciliation of Dollar Tree's total gross unrecognized tax benefits for the year-to-date period ended February 2, 2008: (in millions) Balance at February 4, 2007 Additions, based on tax positions related... -

Page 41

... Ended February 3, 2007 $261.8 0.9 Year Ended January 28, 2006 $225.8 0.7 Non-Operating Facilities The Company is responsible for payments under leases for certain closed stores. The Company was also responsible for payments under leases for two former distribution centers whose leases expired in... -

Page 42

... 2007, the Company was served with a lawsuit filed in federal court in the state of California by one present and one former store manager. They claim they should have been classified as non-exempt employees under both the California Labor Code and the Fair Labor Standards Act. They filed the case... -

Page 43

... Agreement provides for a $300.0 million revolving line of credit, including up to $150.0 million in available letters of credit, and a $250.0 million term loan. The interest rate on the facility will be based, at the Company's option, on a LIBOR rate, plus DOLLAR TREE, INC. • 2007 ANNUAL REPORT... -

Page 44

... the Company initially received 1.7 million shares based on the market price of the Company's stock of $30.19 as of the trade date (December 8, 2006). A weighted average price of $32.17 was calculated using stock prices from December 16, 2006 - March 8, 2007. This represented the calculation period... -

Page 45

... high-end of the price range of the collar. The number of shares received under the agreement was determined based on the weighted average market price of the Company's common stock, net of a predetermined discount, during the time after the initial execution date through a period of up to four and... -

Page 46

... the market price of the Company's stock at the date of grant. The options generally vest over a three-year period and have a maximum term of 10 years. The 2004 Executive Officer Equity Plan (EOEP) is available only to the Chief Executive Officer and 44 DOLLAR TREE, INC. • 2007 ANNUAL REPORT -

Page 47

... Annual dividend yield Risk free interest rate Weighted average fair value of options granted during the period Options granted Fiscal 2006 6.0 30.2% - 4.8% Fiscal 2005 4.7 48.7% - 3.7% 6.0 28.4% - 4.5% $14.33 $10.93 $11.27 386,490 342,216 320,220 DOLLAR TREE, INC. • 2007 ANNUAL REPORT... -

Page 48

..., or a shorter period based on the retirement eligibility of the grantee. The fair value was determined using the Company's closing stock price on the date of grant. The Company recognized $7.7 million, $4.5 million and $1.7 million of expense related to these RSUs during 2007, 2006 and 2005. As... -

Page 49

... Average Grant Date Fair Value $26.57 38.12 26.60 32.96 26.57 NOTE 10 - ACQUISITION On March 25, 2006, the Company completed its acquisition of 138 Deal$ stores. These stores are located primarily in the Midwest part of the United States and the Company has existing logistics capacity to service... -

Page 50

... cost method and is included in "other assets" in the accompanying consolidated balance sheets. NOTE 12 - QUARTERLY FINANCIAL INFORMATION (Unaudited) The following table sets forth certain items from the Company's unaudited consolidated statements of operations for each quarter of fiscal year 2007... -

Page 51

... 25, 2009 * Dates are subject to change. INVESTORS' INQUIRIES Requests for interim and annual reports, Forms 10-K, or more information should be directed to: Shareholder Services Dollar Tree, Inc. 500 Volvo Parkway Chesapeake, VA 23320 (757) 321-5000 Or from our company web site: www.DollarTree.com -

Page 52

500 Volvo Parkway Chesapeake, Virginia 23320 Phone (757) 321-5000 www.DollarTree.com