Delta Airlines 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

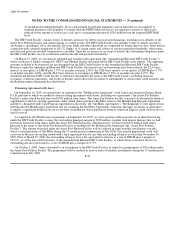

$450 million and $850 million during the term of the Processing Agreement. The Processing Agreement allows us to substitute the

Merrill Lynch Letter of Credit for a portion of the cash reserve equal to the lesser of $300 million and 45% of the unflown ticket

liability.

The Merrill Lynch Letter of Credit may only be drawn upon following certain events as described in the Processing Agreement. In

addition, the Processor must first apply both the portion of the cash reserve that the Processor will continue to hold and any offsets

from collections by the Processor before drawing on the Merrill Lynch Letter of Credit to cover fare refunds paid to passengers by the

Processor.

Our obligation to reimburse Merrill Lynch under the Merrill Lynch Letter of Credit for any draws made by the Processor is not

secured and will constitute a super-priority administrative expense claim that is subject to certain other claims, including our post-

petition financing. The Merrill Lynch Letter of Credit will expire on January 21, 2008, but will renew automatically for one year

periods thereafter unless Merrill Lynch notifies the Processor 420 days prior to the applicable expiration date that it will not renew the

Merrill Lynch Letter of Credit.

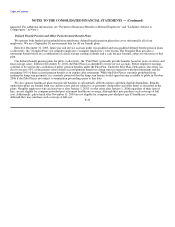

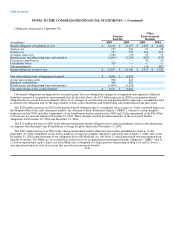

Covenants

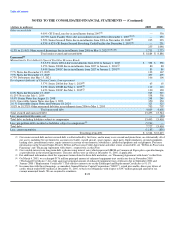

As discussed above, the DIP Credit Facility and the Amex Post-Petition Facility (collectively, the "Post-Petition Financing

Agreements") include certain affirmative, negative and financial covenants. In addition, as is customary in the airline industry, our

aircraft lease and financing agreements require that we maintain certain levels of insurance coverage, including war-risk insurance.

Failure to maintain these coverages may result in an interruption to our operations. See Note 10 for additional information about our

war-risk insurance currently provided by the U.S. government.

We were in compliance with these covenant requirements at December 31, 2005 and 2004.

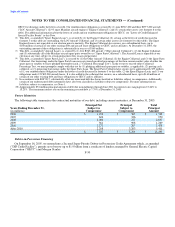

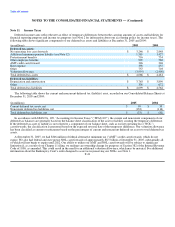

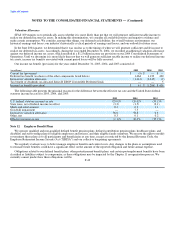

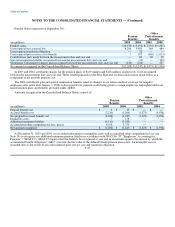

Note 9. Lease Obligations

We lease aircraft, airport terminal and maintenance facilities, ticket offices and other property and equipment from third parties.

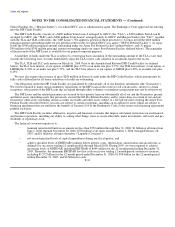

As allowed under Section 365 and other relevant sections of the Bankruptcy Code, the Debtors may assume, assume and assign, or

reject certain executory contracts and unexpired leases, including, without limitation, leases of real property, aircraft and aircraft

engines, subject to the approval of the Bankruptcy Court and certain other conditions, including compliance with Section 1110.

Consequently, we anticipate that our liabilities pertaining to leases will change significantly in the future.

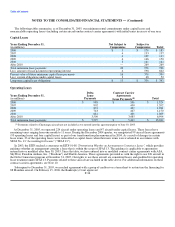

Rental expense for operating leases, which is recorded on a straight-line basis over the life of the lease, totaled $1.1 billion for the

year ended December 31, 2005 and $1.3 billion for each of the years ended December 31, 2004 and 2003. Amounts due under capital

leases are recorded as liabilities on our Consolidated Balance Sheets. Our interest in assets acquired under capital leases is recorded as

property and equipment on our Consolidated Balance Sheets. Amortization of assets recorded under capital leases is included in

depreciation and amortization expense on our Consolidated Statements of Operations. Our leases do not include residual value

guarantees. F-35