Delta Airlines 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

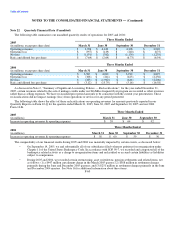

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

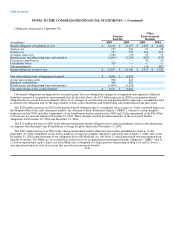

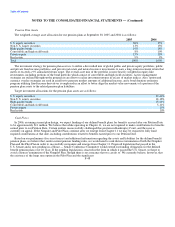

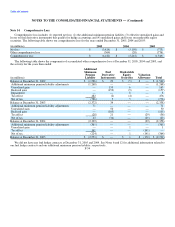

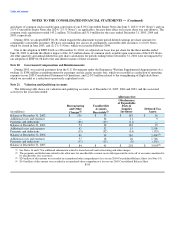

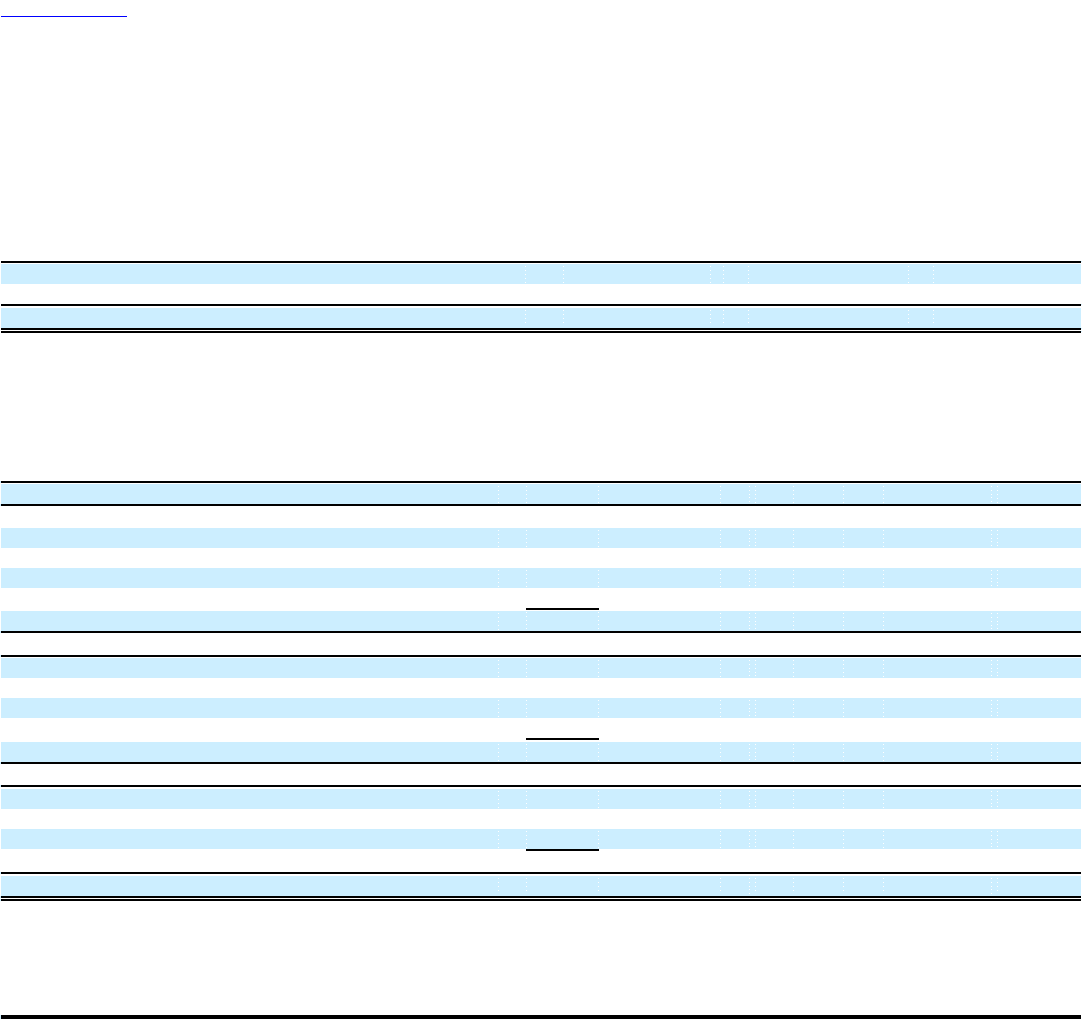

Note 14. Comprehensive Loss

Comprehensive loss includes (1) reported net loss; (2) the additional minimum pension liability; (3) effective unrealized gains and

losses on fuel derivative instruments that qualify for hedge accounting; and (4) unrealized gains and losses on marketable equity

securities. The following table shows our comprehensive loss for the years ended December 31, 2005, 2004 and 2003:

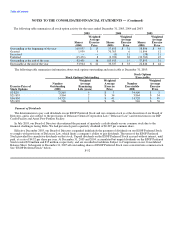

(in millions) 2005 2004 2003

Net loss $ (3,818) $ (5,198) $ (773)

Other comprehensive loss (364) (20) (776)

Comprehensive loss $ (4,182) $ (5,218) $ (1,549)

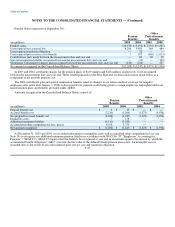

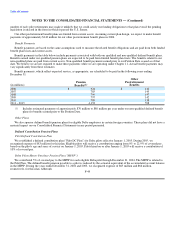

The following table shows the components of accumulated other comprehensive loss at December 31, 2005, 2004 and 2003, and

the activity for the years then ended:

Additional

Minimum Fuel Marketable

Pension Derivative Equity Valuation

(in millions) Liability Instruments Securities Allowance Total

Balance at December 31, 2002 $ (1,586) $ 29 $ (5) $ — $ (1,562)

Additional minimum pension liability adjustments (1,268) — — — (1,268)

Unrealized gain — 159 6 — 165

Realized gain — (152) (5) — (157)

Impairment — — 8 — 8

Tax effect 482 (2) (4) — 476

Net of tax (786) 5 5 — (776)

Balance at December 31, 2003 (2,372) 34 — — (2,338)

Additional minimum pension liability adjustments 71 — — — 71

Unrealized gain — 50 — — 50

Realized gain — (105) — — (105)

Tax effect (28) 21 — (29) (36)

Net of tax 43 (34) — (29) (20)

Balance at December 31, 2004 (2,329) — — (29) (2,358)

Additional minimum pension liability adjustments (365) — — — (365)

Unrealized gain — — 1 — 1

Tax effect 141 — — (141) —

Net of tax (224) — 1 (141) (364)

Balance at December 31, 2005 $ (2,553) $ — $ 1 $ (170) $ (2,722)

We did not have any fuel hedge contracts at December 31, 2005 and 2004. See Notes 6 and 12 for additional information related to

our fuel hedge contracts and our additional minimum pension liability, respectively.

F-54