Delta Airlines 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

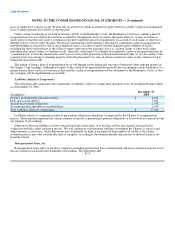

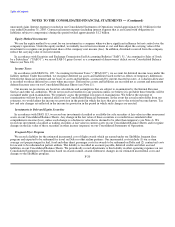

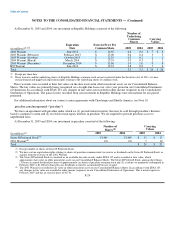

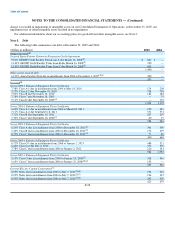

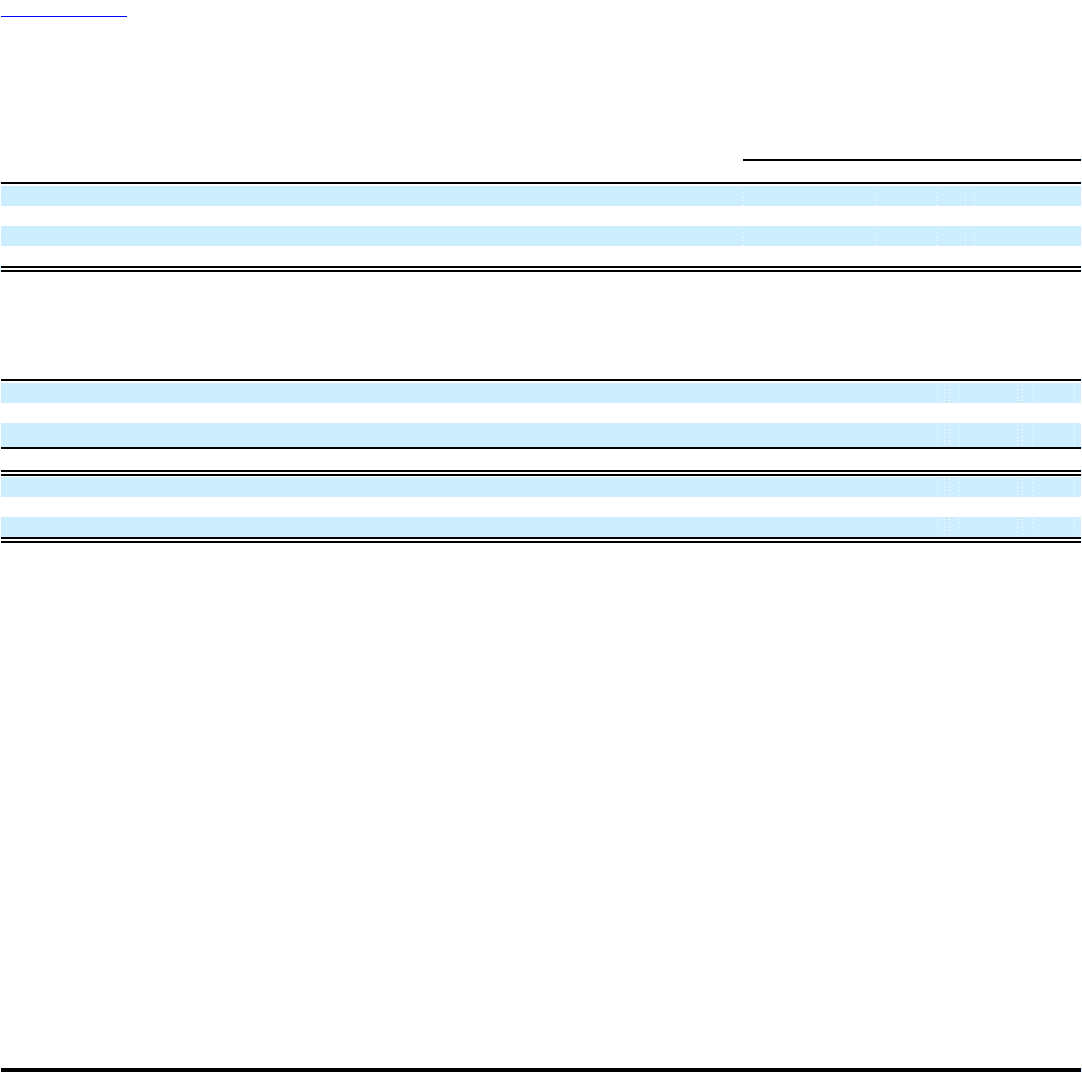

estimating fair values and the resulting weighted average fair value of a stock option granted in the periods presented:

Stock Options Granted

Assumption 2005 2004 2003

Risk-free interest rate 3.8% 3.1% 2.2%

Average expected life of stock options (in years) 3.0 3.2 2.9

Expected volatility of common stock 73.6% 68.8% 66.4%

Weighted average fair value of a stock option granted $ 2 $ 3 $ 5

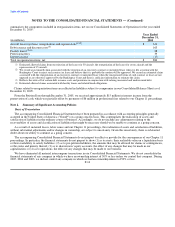

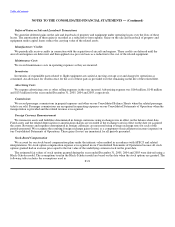

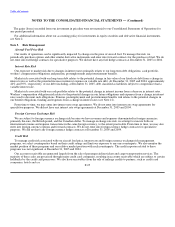

The following table shows what our net loss and loss per share would have been for the years ended December 31, 2005, 2004 and

2003 had we accounted for our stock-based compensation plans under the fair value method of SFAS 123, using the assumptions in

the table above:

(in millions, except per share data) 2005 2004 2003

Net loss:

As reported $(3,818) $(5,198) $ (773)

Deduct: total stock option compensation expense determined under the fair value based method, net of tax(1) (108) (38) (33)

As adjusted for the fair value method under SFAS 123 $(3,926) $(5,236) $ (806)

Basic and diluted loss per share:

As reported $(23.75) $(41.07) $(6.40)

As adjusted for the fair value method under SFAS 123 $(24.42) $(41.36) $(6.66)

(1) In 2004, we discontinued recording tax benefits for losses. Accordingly, there is no tax effect in 2005 and 2004.

For additional information about our stock option plans and the motion we filed with the Bankruptcy Court seeking authority to

reject the outstanding stock options issued under these plans, see Note 13. For additional information about new accounting standards

related to stock-based compensation, see "New Accounting Standards" in this Note.

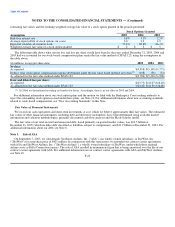

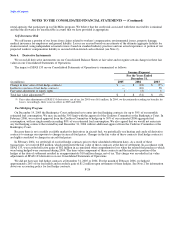

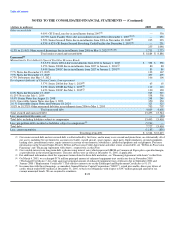

Fair Value of Financial Instruments

We record our cash equivalents and short-term investments at cost, which we believe approximates their fair values. The estimated

fair values of other financial instruments, including debt and derivative instruments, have been determined using available market

information and valuation methodologies, primarily discounted cash flow analyses and the Black-Scholes model.

The fair value of our total secured and unsecured debt, based primarily on quoted market values, was $10.5 billion at

December 31, 2005 (which includes debt classified as liabilities subject to compromise), and $11.9 billion at December 31, 2004. For

additional information about our debt, see Note 8.

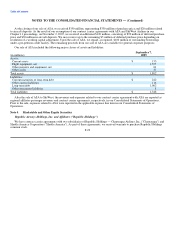

Note 3. Sale of ASA

On September 7, 2005, we sold Atlantic Southeast Airlines, Inc. ("ASA"), our wholly owned subsidiary, to SkyWest, Inc.

("SkyWest") for a purchase price of $425 million. In conjunction with this transaction, we amended our contract carrier agreements

with ASA and SkyWest Airlines, Inc. ("SkyWest Airlines"), a wholly owned subsidiary of SkyWest, under which those regional

airlines serve as Delta Connection carriers. The sale of ASA resulted in an immaterial gain that is being amortized over the life of our

contract carrier agreement with ASA. For additional information on our contract carrier agreements with ASA and SkyWest Airlines,

see Note 10. F-22