Delta Airlines 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Worldspan redeemed the subordinated promissory note for $36 million, which represented the carrying value of the note as of

December 31, 2004.

Our equity earnings from this investment totaled $18 million for the year ended December 31, 2003. We also received cash

dividends from Worldspan of $44 million for the year ended December 31, 2003.

Worldspan provides us with computer reservation and related services for which we paid approximately $90 million for the six-

months ended June 30, 2003. As discussed above, we sold our equity interest in Worldspan on June 30, 2003.

Orbitz, Inc. ("Orbitz")

During November 2004, we sold our remaining ownership and voting interest in Orbitz for approximately $143 million. We

recognized a gain of approximately $123 million on this transaction in gain from sale of investments, net.

During December 2003, Orbitz completed its initial public offering and the founding airlines of Orbitz, including us, sold a portion

of their Orbitz shares. We received $33 million from our sale of Orbitz shares. Additionally, we recorded (1) a SAB 51 gain of

$18 million, net of tax, in additional paid-in capital on our Consolidated Balance Sheet (see Note 2 for our SAB 51 accounting policy);

(2) a $28 million gain ($17 million net of tax) in other income (expense) on our Consolidated Statement of Operations from our sale of

Orbitz shares; and (3) a $4 million loss ($2 million net of tax) in other income (expense) on our Consolidated Statement of Operations

from previously unrecognized Orbitz losses since our recorded investment in Orbitz was zero prior to its initial public offering.

As a result of our sale of a portion of our Orbitz shares in December 2003, we had a 13% ownership interest and an 18% voting

interest in Orbitz. Prior to that transaction, we had an 18% ownership and voting interest in Orbitz. We accounted for our investment

in Orbitz under the equity method because we had the ability to exercise significant influence, but not control, over the financial and

operating policies of Orbitz. This ability was evidenced by, among other things, our right to appoint at least one of our senior officers

to the Board of Directors of Orbitz.

For the years ended December 31, 2004 and 2003, the gains (losses) recorded from our investment in Orbitz were not material to

our Consolidated Statements of Operations.

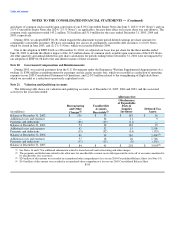

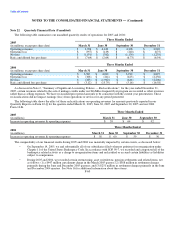

Note 19. Loss per Share

We calculate basic loss per share by dividing the net loss available to common shareowners by the weighted average number of

common shares outstanding. Diluted loss per share includes the dilutive effects of stock options and convertible securities. To the

extent stock options and convertible securities are anti-dilutive, they are excluded from the calculation of diluted loss per share.

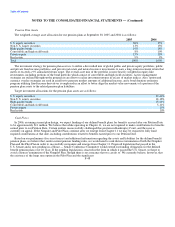

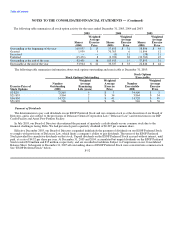

The following table shows our computation of basic and diluted loss per share:

Years Ended December 31,

(in millions, except per share data) 2005 2004 2003

Basic and diluted:

Net loss $ (3,818) $ (5,198) $ (773)

Dividends on allocated Series B ESOP Convertible Preferred Stock (18) (19) (17)

Net loss available to common shareowners (3,836) (5,217) (790)

Weighted average shares outstanding 161.5 127.0 123.4

Basic and diluted loss per share $ (23.75) $ (41.07) $ (6.40)

For the years ended December 31, 2005, 2004 and 2003, we excluded from our loss per share calculations all common stock

equivalents, which primarily include stock options, our ESOP Preferred Stock

F-58