Delta Airlines 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

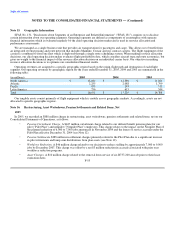

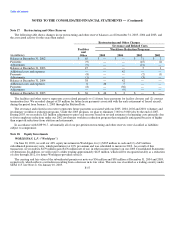

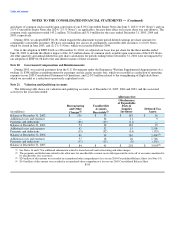

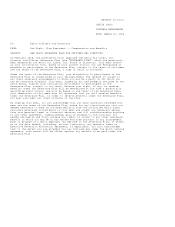

Note 17. Restructuring and Other Reserves

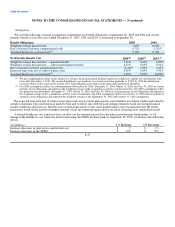

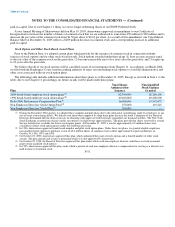

The following table shows changes in our restructuring and other reserve balances as of December 31, 2005, 2004 and 2003, and

the associated activity for the years then ended:

Restructuring and Other Charges

Severance and Related Costs

Facilities Workforce Reduction Programs

and

(in millions) Other 2005 2004 2002 2001

Balance at December 31, 2002 $ 65 $ — $ — $ 71 $ 3

Payments (9) — — (45) (2)

Adjustments (9) — — (21) —

Balance at December 31, 2003 47 — — 5 1

Additional costs and expenses — — 42 — —

Payments (8) — — (2) (1)

Adjustments (1) — — (3) —

Balance at December 31, 2004 38 — 42 — —

Additional costs and expenses 6 46 5 — —

Payments (8) — (36) — —

Adjustments — — (9) — —

Balance at December 31, 2005 $ 36 $ 46 $ 2 $ — $ —

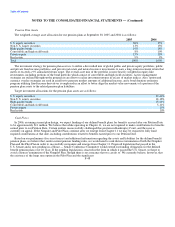

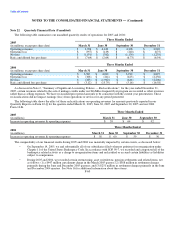

The facilities and other reserve represents costs related primarily to (1) future lease payments for facility closures and (2) contract

termination fees. We recorded charges of $5 million for future lease payments associated with the early retirement of leased aircraft,

during the period from January 1, 2005 through the Petition Date.

The severance and related costs reserve represents future payments associated with our 2005, 2004, 2002 and 2001 voluntary and

involuntary workforce reduction programs. Under the 2005 program, we plan to eliminate 7,000 to 9,000 jobs by the end of 2007.

During 2003, we recorded a $21 million adjustment to prior year reserves based on revised estimates of remaining costs primarily due

to fewer employee reductions under our 2002 involuntary workforce reduction program than originally anticipated because of higher

than expected reductions from attrition and retirements.

In accordance with SOP 90-7, substantially all of our pre-petition restructuring and other reserves were classified as liabilities

subject to compromise.

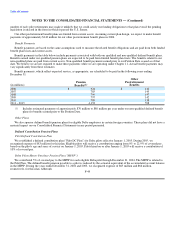

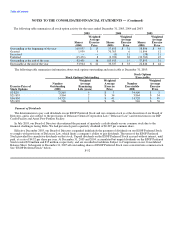

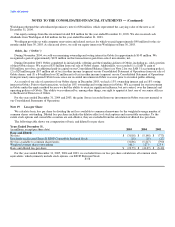

Note 18. Equity Investments

WORLDSPAN, L.P. ("Worldspan")

On June 30, 2003, we sold our 40% equity investment in Worldspan, for (1) $285 million in cash and (2) a $45 million

subordinated promissory note, which paid interest at 10% per annum and was scheduled to mature in 2012. As a result of this

transaction, we recorded a $279 million gain ($176 million net of tax) in other income (expense) on our 2003 Consolidated Statements

of Operations. In addition, we will receive credits totaling approximately $125 million, which will be recognized ratably as a reduction

of costs through 2012, for future Worldspan-provided services.

The carrying and fair value of the subordinated promissory note was $36 million and $38 million at December 31, 2004 and 2003,

respectively, which reflects a writedown resulting from a decrease in its fair value. This note was classified as a trading security under

SFAS 115 (see Note 2). On January 10, 2005, F-57