Delta Airlines 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Cash flows from financing activities

For the twelve months ended December 31, 2005, cash provided by financing activities totaled $830 million and includes the

following significant amounts:

• During the March 2005 quarter, we received the final installment of $250 million under our Amex Pre- Petition

Facility. The Amex Pre-Petition Facility was repaid in connection with our post-petition financing. For additional

information regarding our financing agreement with Amex, see Note 8 of the Notes to the Consolidated Financial

Statements.

• During the September 2005 quarter, in conjunction with the sale of ASA, we were required to repay $100 million

pursuant to the GE Pre-Petition Facility.

• In conjunction with our Chapter 11 proceedings, we obtained post-petition financing including net proceeds of

approximately $1.2 billion. For additional information regarding our post-petition financing, see Note 8 of the Notes to

the Consolidated Financial Statements.

• We paid approximately $384 million of our pre-petition debt obligations. This amount includes $216 million of

principal payments made prior to our Petition Date and $168 million of principal payments that are not classified as

liabilities subject to compromise.

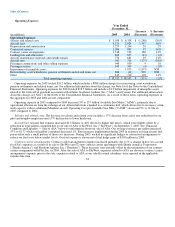

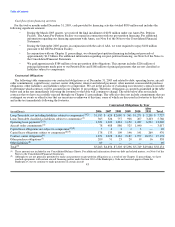

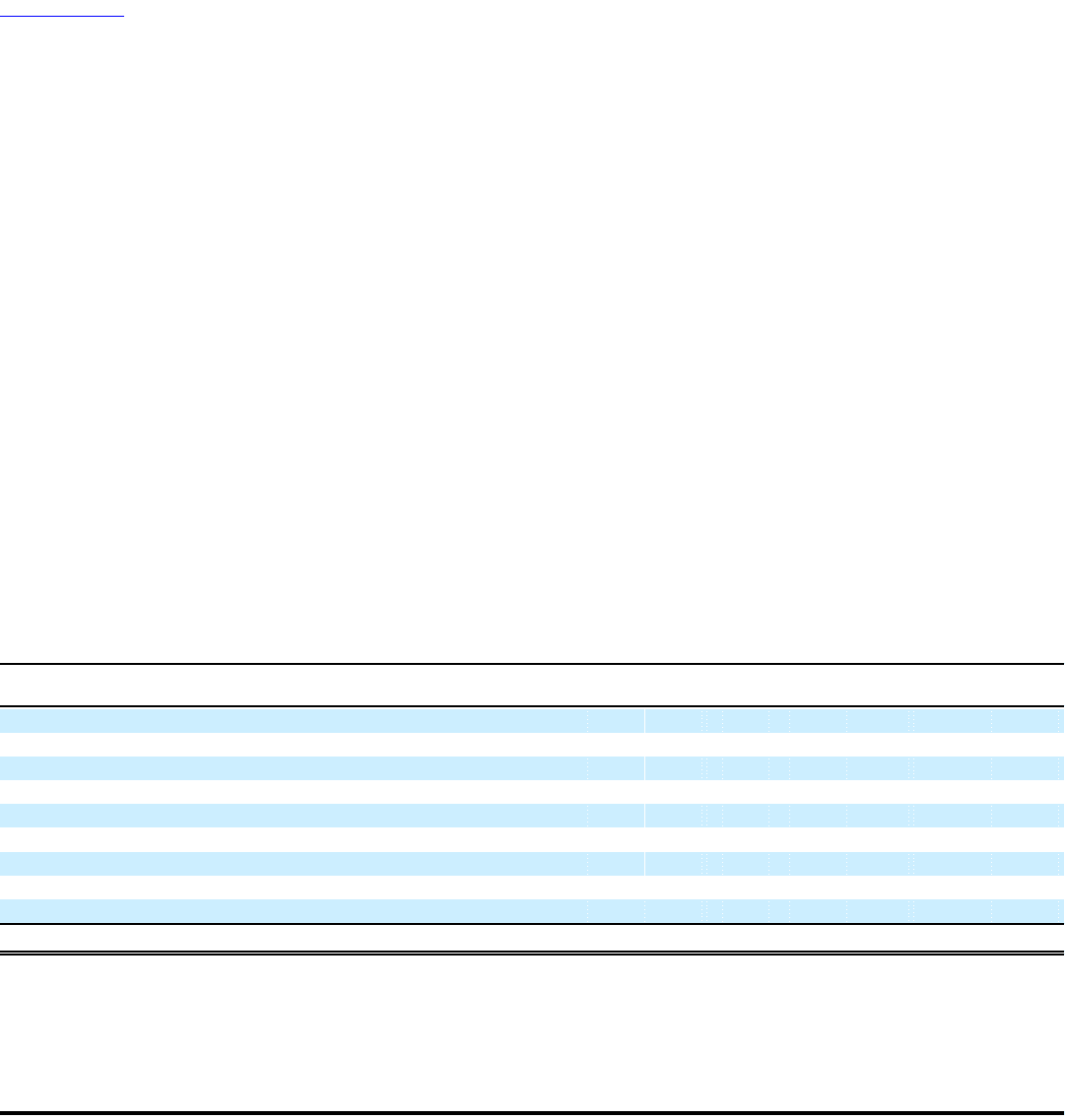

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2005 and related to debt; operating leases; aircraft

order commitments; capital leases; contract carrier obligations; interest and related payments; other material, noncancelable purchase

obligations; other liabilities; and liabilities subject to compromise. We are in the process of evaluating our executory contracts in order

to determine which contracts will be assumed in our Chapter 11 proceedings. Therefore, obligations as currently quantified in the table

below and in the text immediately following the footnotes to the table will continue to change. The table below does not include

contracts that we have successfully rejected through our Chapter 11 proceedings. The table also does not include commitments that are

contingent on events or other factors that are uncertain or unknown at this time, some of which are discussed in footnotes to this table

and in the text immediately following the footnotes.

Contractual Obligations by Year

After

(in millions) 2006 2007 2008 2009 2010 2010 Total

Long-Term debt, not including liabilities subject to compromise(1)(2) $1,183 $ 624 $2,080 $ 361 $1,271 $ 2,208 $ 7,727

Long-Term debt classified as liabilities subject to compromise(1) 365 326 757 908 207 3,203 5,766

Operating lease payments(2)(3) 1,324 1,202 1,281 1,150 1,089 6,994 13,040

Aircraft order commitments(4) 78 488 886 525 1,040 — 3,017

Capital lease obligations not subject to compromise(2)(5) 5 4 4 4 3 — 20

Capital lease obligations subject to compromise(2)(5) 178 133 109 146 141 269 976

Contract carrier obligations(6) 1,852 2,028 2,163 2,182 1,979 16,974 27,178

Other purchase obligations(7) 209 51 23 20 19 16 338

Other liabilities(8) 69 — — — — — 69

Total(9) $5,263 $4,856 $7,303 $5,296 $5,749 $29,664 $58,131

(1) These amounts are included in our Consolidated Balance Sheets. For additional information about our debt and related matters, see Note 8 of the

Notes to the Consolidated Financial Statements.

(2) Although we are not generally permitted to make any payments on pre-petition obligations as a result of our Chapter 11 proceedings, we have

reached agreements with certain aircraft financing parties under Section 1110 of the Bankruptcy Code and received approval from the

Bankruptcy Court to continue to make payments on certain aircraft 43