Delta Airlines 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

paid-in-capital. Due to our Chapter 11 filing, we are no longer redeeming shares of our ESOP Preferred Stock.

At our Annual Meeting of Shareowners held on May 19, 2005, shareowners approved an amendment to our Certificate of

Incorporation to increase the number of shares of common stock that we are authorized to issue from 450 million to 900 million and to

decrease the par value of the common stock from $1.50 per share to $0.01 per share. As a result of this amendment, our Consolidated

Balance Sheet at December 31, 2005 reflects a $289 million decrease in common stock and a corresponding increase in additional

paid-in capital.

Stock Option and Other Stock-Based Award Plans

Prior to the Petition Date, we adopted certain plans which provide for the issuance of common stock in connection with the

exercise of stock options and for other stock-based awards. Stock options awarded under these plans (1) have an exercise price equal

to the fair value of the common stock on the grant date; (2) become exercisable one to five years after the grant date; and (3) expire up

to 10 years after the grant date.

We believe that all of our stock options will be cancelled as part of our emergence from Chapter 11. Accordingly, in March 2006,

we filed with the Bankruptcy Court a motion seeking authority to reject our outstanding stock options to avoid the administrative and

other costs associated with our stock option plans.

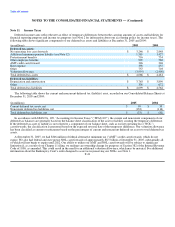

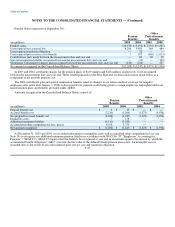

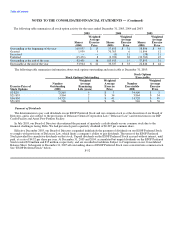

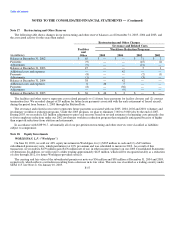

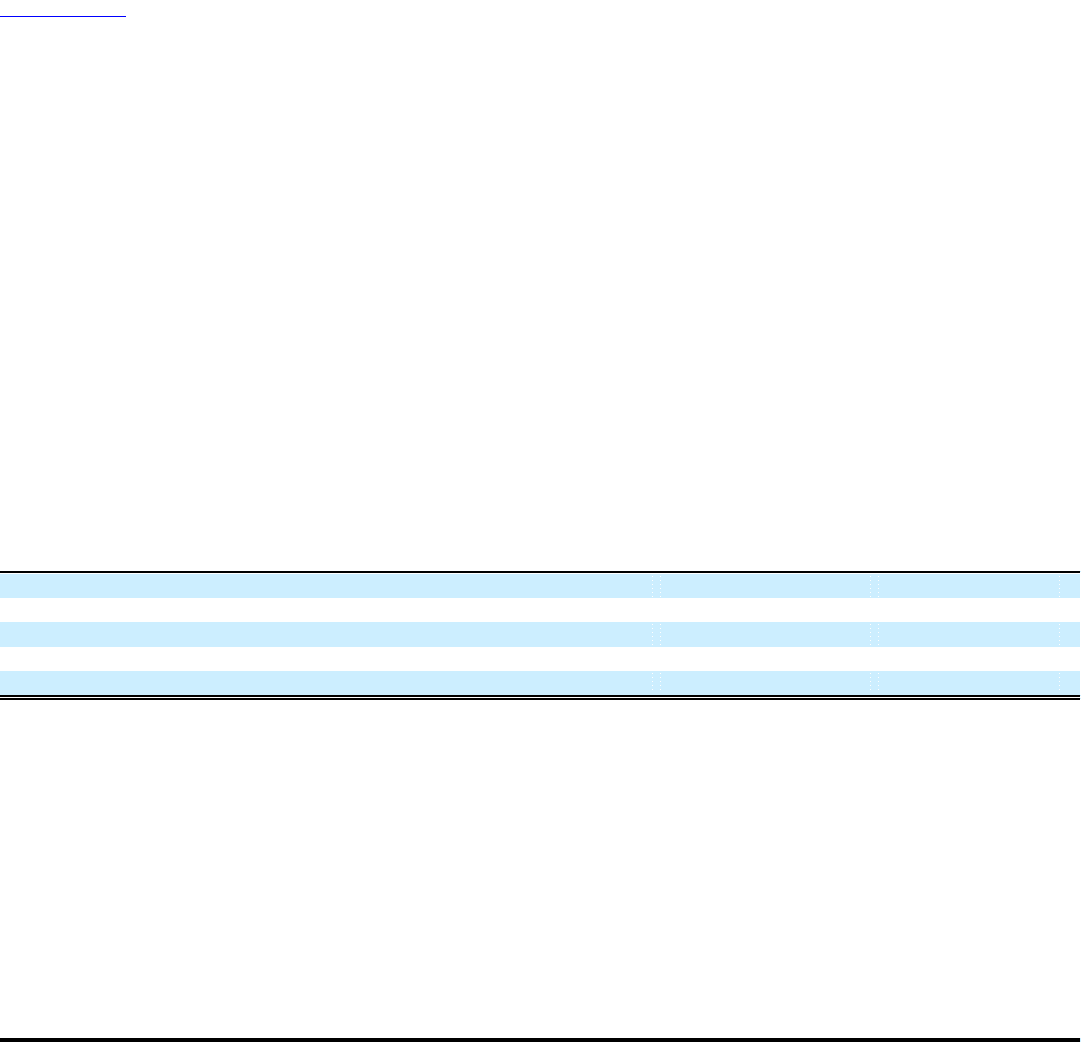

The following table includes additional information about these plans as of December 31, 2005. Except as set forth in Note 1 to the

table, due to our Chapter 11 proceedings, no future awards will be made under these plans:

Total Shares Non-Qualified

Authorized for Stock Options

Plan Issuance Granted

2004 broad-based employee stock option plans(1) 62,340,000 62,216,100

1996 broad-based employee stock option plans(2) 49,400,000 49,400,000

Delta 2000 Performance Compensation Plan(3) 16,000,000 13,942,075

Non-Employee Directors' Stock Option Plan(4) 250,000 119,245

Non-Employee Directors' Stock Plan(5) 500,000 —

(1) During the December 2004 quarter, we adopted these nonpilot and pilot plans due to the substantial contributions made by employees to our

out-of-court restructuring efforts. We did not seek shareowner approval to adopt these plans because the Audit Committee of our Board of

Directors determined that the delay necessary in obtaining such approval would seriously jeopardize our financial viability. The New York

Stock Exchange accepted our reliance on this exception to its shareowner approval policy. The plans provide that shares reserved for awards

that are forfeited are available for future stock option grants. At December 31, 2005, a total of approximately 8.8 million shares were

available for future stock option grants under this forfeiture provision.

(2) In 1996, shareowners approved broad-based nonpilot and pilot stock option plans. Under these two plans, we granted eligible employees

non-qualified stock options to purchase a total of 49.4 million shares of common stock in three approximately equal installments on

October 30, 1996, 1997 and 1998.

(3) On October 25, 2000, shareowners approved this plan, which authorized the grant of stock options and a limited number of other stock

awards. The plan amends and restates a prior plan which was also approved by shareowners.

(4) On October 22, 1998, the Board of Directors approved this plan under which each non-employee director could have received an annual

grant of non-qualified stock options.

(5) In 1995, shareowners approved this plan, under which a portion of each non-employee director's compensation for serving as a director was

paid in shares of common stock. F-51