Delta Airlines 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

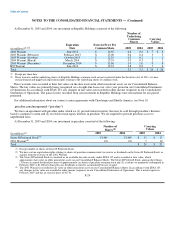

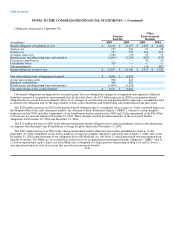

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

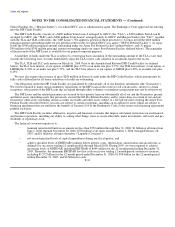

Principal and interest on the Bonds are currently paid through drawings on irrevocable, direct-pay letters of credit totaling

$403 million issued by GECC pursuant to the Reimbursement Agreement (defined below). In addition, the purchase price of tendered

Bonds that cannot be remarketed are paid by drawings on these letters of credit. The GECC letters of credit expire on May 20, 2008.

Pursuant to our reimbursement obligations under the agreement between us and GECC ("Reimbursement Agreement"), we are

required to reimburse GECC for drawings on the letters of credit. Our reimbursement obligation to GECC is secured by (1) nine

B767-400 and three B777-200 aircraft ("LOC Aircraft Collateral"); (2) 93 spare Mainline aircraft engines; and (3) certain other assets

(see footnote 8 to the table above in this Note). This collateral also secures other obligations we have to GECC, as discussed in the

footnotes to the table above in this Note.

If a drawing under a letter of credit is made to pay the purchase price of Bonds tendered for purchase and not remarketed, our

resulting reimbursement obligation to GECC will bear interest at a base rate or three-month LIBOR plus a margin. The principal

amount of any outstanding reimbursement obligation will be repaid quarterly through May 20, 2008.

GECC has the right to cause a mandatory tender for purchase of all Bonds and terminate the letters of credit if an event of default

occurs or if a minimum collateral value test ("Collateral Value Test") is not satisfied on May 19, 2006, in which case the principal

amount of all reimbursement obligations (including for any Bonds tendered and not remarketed) would be due and payable

immediately. We will not satisfy the Collateral Value Test if (1) the aggregate amount of the outstanding letters of credit plus any

other amounts payable by us under the Reimbursement Agreement ("Aggregate Obligations") on March 20, 2006 is more than 60% of

the appraised value of the LOC Aircraft Collateral plus the fair market value of permitted investments held as part of the collateral and

(2) within 60 days thereafter, we have not either provided additional collateral to GECC in the form of cash or aircraft or caused a

reduction in the Aggregate Obligations such that the Collateral Value Test is satisfied. If we fail to satisfy the Collateral Value Test on

May 19, 2006, an event of default will occur. We currently estimate that, in order to satisfy the Collateral Value Test on May 19,

2006, we will need to provide GECC with additional collateral in the form of cash in the amount of approximately $50 million.

Unless the GECC letters of credit are extended in a timely manner, we will be required to purchase the Bonds on May 15, 2008,

five days prior to the expiration of the letters of credit. In this circumstance, we could seek, but there is no assurance that we would be

able (1) to sell the Bonds without credit enhancement at then-prevailing fixed interest rates or (2) to replace the expiring letters of

credit with new letters of credit from an alternate credit provider and remarket the Bonds.

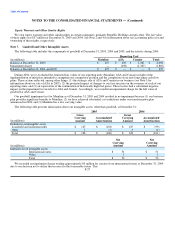

We entered into a letter of intent with GECC in December 2005 to amend the Reimbursement Agreement to eliminate the

Collateral Value Test, among other things. In February 2006, the Bankruptcy court approved the letter of intent, but because the

completion of the transactions contemplated in the letter of intent is subject to definitive documentation and certain other conditions,

there can be no assurance that the Collateral Value Test will be amended or eliminated. If the Collateral Value Test is not amended or

eliminated, we intend to satisfy it.

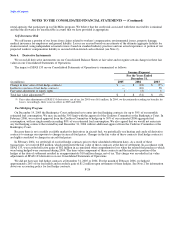

Letter of Credit Facility Related to Visa/ MasterCard Credit Card Processing Agreement

On January 26, 2006, with the authorization from the Bankruptcy Court, we entered into a letter of credit facility with Merrill

Lynch. Under the Letter of Credit Reimbursement Agreement, Merrill Lynch issued a $300 million irrevocable standby letter of credit

("Merrill Lynch Letter of Credit") for the benefit of our Visa/ MasterCard credit card processor ("Processor"). As contemplated in our

Visa/ MasterCard credit card processing agreement ("Processing Agreement"), we are providing the Merrill Lynch Letter of Credit as

a substitution for a portion of the cash reserve that the Processor maintains. Under the Processing Agreement, the Processor is

permitted to maintain a reserve from our receivables that is equal to the Processor's potential liability for tickets purchased with Visa

or MasterCard which have not yet been used for travel (the "unflown ticket liability"). We estimate that the reserve, which adjusts

daily, will range between F-34