Columbia Sportswear 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

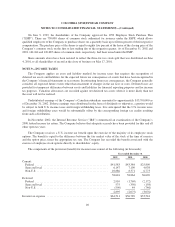

amortized to compensation expense as shares are earned during the vesting period. Compensation expense related

to the Participation Plan and the 1996 conversion totaled $682,000 for each of the years ended December 31,

2002, 2001, and 2000. As of December 31, 2002, 234,833 shares of common stock awarded were subject to

future vesting and included in issued and outstanding shares of common stock.

As provided in the Agreement and because the executive’s employment terminated January 3, 2003, the

234,833 unvested shares will vest automatically unless the executive is compensated by the Company within 180

days from the termination date. The amount of such compensation would be $498,000, and would be accounted

for as a reduction to shareholders’ equity upon cancellation of the unvested shares.

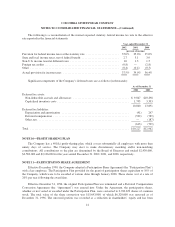

NOTE 12—COMMITMENTS AND CONTINGENCIES

The Company leases certain operating facilities from related parties of the Company. Total rent expense,

including month-to-month rentals, for these leases amounted to $370,000, $381,000 and $408,000 for the years

ended December 31, 2002, 2001 and 2000, respectively.

Rent expense was $2,587,000, $2,568,000 and $2,464,000 for non-related party leases during the years

ended December 31, 2002, 2001 and 2000, respectively.

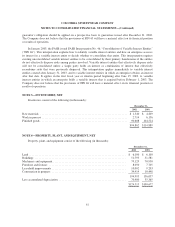

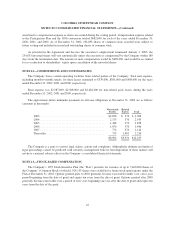

The approximate future minimum payments on all lease obligations at December 31, 2002 are as follows

(amounts in thousands):

Non-related

Parties

Related

Parties Total

2003 ............................................. $2,658 $ 370 $ 3,028

2004 ............................................. 2,175 370 2,545

2005 ............................................. 1,488 370 1,858

2006 ............................................. 1,076 370 1,446

2007 ............................................. 772 370 1,142

Thereafter ........................................ 735 1,481 2,216

$8,904 $3,331 $12,235

The Company is a party to various legal claims, actions and complaints. Although the ultimate resolution of

legal proceedings cannot be predicted with certainty, management believes that disposition of these matters will

not have a material adverse effect on the Company’s consolidated financial statements.

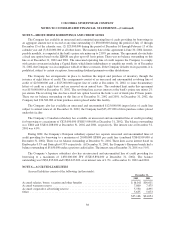

NOTE 13—STOCK-BASED COMPENSATION

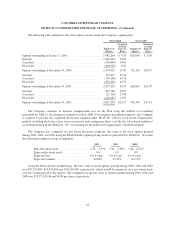

The Company’s 1997 Stock Incentive Plan (the “Plan”) provides for issuance of up to 5,400,000 shares of

the Company’s Common Stock of which 1,024,153 shares were available for future stock option grants under the

Plan at December 31, 2002. Options granted prior to 2001 generally become exercisable ratably over a five-year

period beginning from the date of grant and expire ten years from the date of grant. Options granted after 2000

generally become exercisable over a period of four years beginning one year after the date of grant and expire ten

years from the date of the grant.

42