Columbia Sportswear 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

guarantor’s obligation should be applied on a prospective basis to guarantees issued after December 31, 2002.

The Company does not believe that the provisions of FIN 45 will have a material effect on its financial position

or results of operations.

In January 2003, the FASB issued FASB Interpretation No. 46, “Consolidation of Variable Interest Entities”

(“FIN 46”). This interpretation explains how to identify variable interest entities and how an enterprise assesses

its interest in a variable interest entity to decide whether to consolidate that entity. This interpretation requires

existing unconsolidated variable interest entities to be consolidated by their primary beneficiaries if the entities

do not effectively disperse risks among parties involved. Variable interest entities that effectively disperse risks

will not be consolidated unless a single party holds an interest or combination of interest that effectively

recombines risks that were previously dispersed. This interpretation applies immediately to variable interest

entities created after January 31, 2003, and to variable interest entities in which an enterprise obtains an interest

after that date. It applies in the first fiscal year or interim period beginning after June 15, 2003, to variable

interest entities in which an enterprise holds a variable interest that it acquired before February 1, 2003. The

Company does not believe that the provisions of FIN 46 will have a material effect on its financial position or

results of operations.

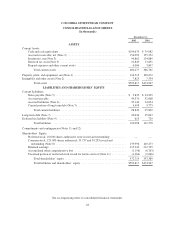

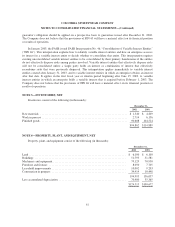

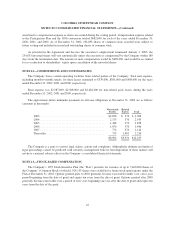

NOTE 3—INVENTORIES, NET

Inventories consist of the following (in thousands):

December 31,

2002 2001

Raw materials ............................................................. $ 1,540 $ 4,209

Work in process ............................................................ 2,714 6,156

Finished goods ............................................................. 90,608 104,524

$94,862 $114,889

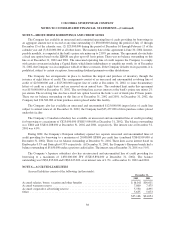

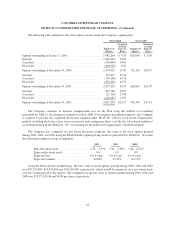

NOTE 4—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consist of the following (in thousands):

December 31,

2002 2001

Land.................................................................... $ 6,100 $ 6,100

Buildings ................................................................ 51,795 51,581

Machineryandequipment................................................... 79,129 70,950

Furnitureandfixtures ...................................................... 8,050 7,705

Leasehold improvements .................................................... 10,002 9,203

Construction in progress .................................................... 39,919 10,498

194,995 156,037

Less accumulated depreciation ............................................... 70,480 55,365

$124,515 $100,672

37