Columbia Sportswear 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ensure that adequate sources are available to produce a sufficient supply of goods in a timely manner and on

satisfactory economic terms in the future.

By sourcing the bulk of our products outside the United States, we are subject to risks of doing business

abroad. These risks include, but are not limited to, foreign exchange rate fluctuations, governmental restrictions

and political or labor disturbances. In particular, we must continually monitor import requirements and transfer

production as necessary to lessen the potential impact from increased tariffs or quota restrictions that may be

periodically imposed.

We have from time to time experienced difficulty satisfying our raw material and finished goods

requirements, and any similar future difficulties could adversely affect our business operations. Our three largest

factory groups accounted for approximately 17% of our total global production for 2002. Another company

produces substantially all of the zippers used in our products. In both instances, however, these companies have

multiple factory locations, many of which are in different countries, which reduces the risk that unfavorable

conditions at a single factory or location will have a material adverse effect on our business.

Sales and Distribution

Our products are sold to approximately 10,000 specialty and department store retailers throughout the

world. Our strategy for continued growth is to focus on:

• enhancing the productivity of existing retailers;

• expanding distribution in international markets;

• further developing the existing merchandise categories; and

• increasing our penetration into the department store and specialty footwear channels

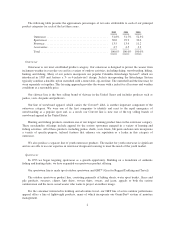

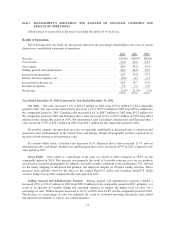

The following table presents the approximate percentages of net sales by geographic region for each of the

last three years:

2002 2001 2000

Net sales to unrelated entities:

United States .................................................... 68.3% 70.7% 71.4%

Canada ......................................................... 10.6 10.4 10.3

Europe ......................................................... 11.8 10.6 9.6

Other international (1) ............................................. 9.3 8.3 8.7

100.0% 100.0% 100.0%

(1) Includes direct sales in Japan, Korea and to third-party distributors in Europe and elsewhere.

See Note 15 of Notes to Consolidated Financial Statements for net sales, income before income tax,

identifiable assets, interest expense, and depreciation and amortization by geographic segment.

North America

Approximately 40.2% of the retailers that offer our products worldwide are located in the United States and

Canada. The sales in these two countries amounted to 78.9% of our total revenues for 2002. We work with over

20 independent sales agencies that work with retail accounts varying in size from single specialty store

operations to large chains made up of many stores in several locations.

Our flagship store in Portland, Oregon is designed to create a distinctive “Columbia” environment,

reinforcing the active and outdoor image of the Columbia brand. In addition, this store provides us with the

6