Columbia Sportswear 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

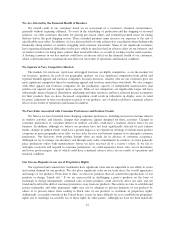

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

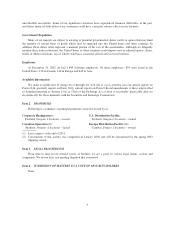

Our Common Stock is listed on the Nasdaq National Market and trades under the symbol “COLM.” At

February 28, 2003, there were approximately 193 holders of record and approximately 7,400 beneficial

shareholders.

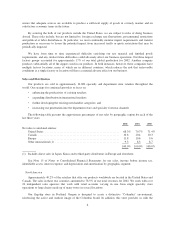

Following are the quarterly high and low closing prices for our Common Stock for the years ended

December 31, 2002 and 2001:

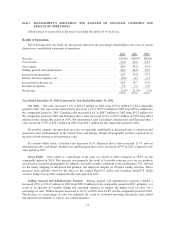

HIGH LOW

2002

First Quarter ................................................. $36.30 $29.90

Second Quarter ............................................... $39.88 $32.00

Third Quarter ................................................. $39.50 $28.79

Fourth Quarter ................................................ $47.55 $31.21

2001

First Quarter ................................................. $40.13 $30.32

Second Quarter ............................................... $50.99 $30.00

Third Quarter ................................................. $47.40 $20.75

Fourth Quarter ................................................ $35.05 $20.21

The stock prices in the table above have been restated to reflect the three-for-two stock split effective June

4, 2001.

Since the completion of our initial public offering in April 1998, we have not declared any dividends. We

currently anticipate that all of our earnings in the foreseeable future will be retained for the development and

expansion of our business and, therefore, we have no current plans to pay cash dividends. Future dividend policy

will depend on our earnings, capital requirements, financial condition, restrictions imposed by our credit

agreement, and other factors considered relevant by our Board of Directors. For various restrictions on our ability

to pay dividends, see Note 5 of Notes to Consolidated Financial Statements.

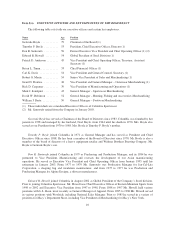

Equity Compensation Plan Information

The following table provides information about compensation plans (including individual compensation

arrangements) under which our equity securities are authorized for issuance to employees or non-employees

(such as directors and consultants), as of December 31, 2002:

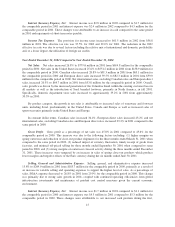

Plan Category

Number of

securities to be

issued upon

exercise of

outstanding options,

warrants and rights

Weighted-average

exercise price of

outstanding

options, warrants

and rights

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(a) (b) (c)

Equity compensation plans approved by security

holders:

1997 Stock Incentive Plan ................. 2,651,208 $25.17 1,024,153

1999 Employee Stock Purchase Plan ......... — — 585,836

Equity compensation plans not approved by security

holders(1) ................................ — — 234,833

Total ...................................... 2,651,208 $25.17 1,844,822

(1) See Note 11 of Notes to Consolidated Financial Statements.

12