Columbia Sportswear 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

cost of sales when the underlying hedged transaction affects earnings. Unrealized derivative gains and losses

recorded in current and non-current assets and liabilities and amounts recorded in other comprehensive income

are non-cash items and therefore are taken into account in the preparation of the consolidated statement of cash

flows based on their respective balance sheet classifications.

Stock-based compensation:

The Company has elected to follow the accounting provisions of Accounting Principles Board Opinion No.

25 (“APB 25”), “Accounting for Stock Issued to Employees”, for stock-based compensation and to furnish the

pro forma disclosures required under SFAS No. 148, “Accounting for Stock-Based Compensation—Transition

and Disclosure.” No stock-based employee compensation cost is reflected in net income, as all options granted

under those plans had an exercise price equal to the market value of the underlying common stock on the date of

the grant.

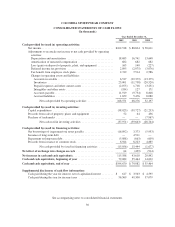

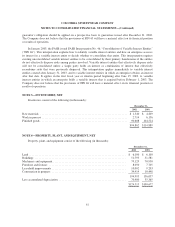

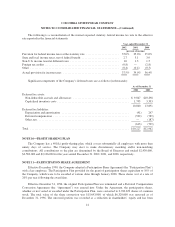

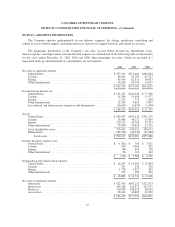

The following table illustrates the effect on net income and earnings per share if the Company had applied

the fair value recognition provisions of SFAS No. 123 to stock-based compensation (in thousands, except per

share amounts):

2002 2001 2000

Net income, as reported ............................................. $102,518 $88,824 $58,611

Adjustment to net earnings for:

Pro forma stock-based compensation expense, net of tax ................. 6,611 3,852 2,176

Proformanetincome ............................................... $ 95,907 $84,972 $56,435

Earnings per share—basic

As reported ..................................................... $ 2.60 $ 2.27 $ 1.52

Proforma ...................................................... 2.43 2.18 1.46

Earnings per share—diluted

As reported ..................................................... $ 2.56 $ 2.23 $ 1.48

Proforma ...................................................... 2.39 2.13 1.42

The effects of applying SFAS No. 123 in this pro forma disclosure are not necessarily indicative of future

amounts.

Advertising costs:

Advertising costs are expensed as incurred. Through cooperative advertising programs, the Company

reimburses its retail customers for some of their costs of advertising the Company’s products. The Company

records these costs in selling, general and administrative expense at the time when it is obligated to its customers

for the costs. This obligation may arise prior to the related advertisement being run. Advertising expense was

$36,273,000, $35,011,000 and $27,343,000 for the years ended December 31, 2002, 2001, and 2000,

respectively.

Product warranty:

The Company’s outerwear and Sorel products carry lifetime limited warranty provisions for defects in

quality and workmanship. A reserve is established at the time of sale to cover estimated warranty costs based on

35