Columbia Sportswear 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

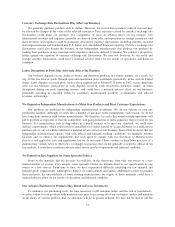

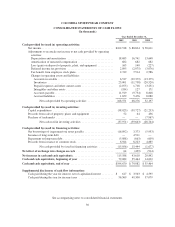

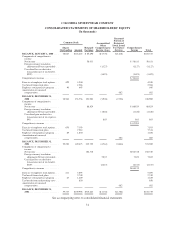

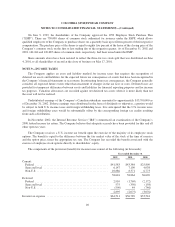

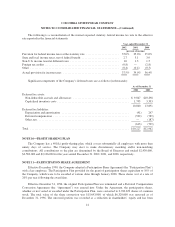

COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands)

Common Stock

Shares

Outstanding Amount

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Unearned

Portion of

Restricted

Stock Issued

For Future

Services

Comprehensive

Income Total

BALANCE, JANUARY 1, 2000 .... 38,025 $126,265 $ 65,290 $(3,770) $(3,410) $184,375

Components of comprehensive

income:

Netincome.................... 58,611 $ 58,611 58,611

Foreign currency translation

adjustment ($0 taxes provided) . . (1,127) (1,127) (1,127)

Unrealized loss on derivative

transactions (net of tax benefit,

$592) ...................... (1,023) (1,023) (1,023)

Comprehensiveincome ............ $ 56,461

Exercise of employee stock options . . . 499 4,240 4,240

Tax benefit from stock plans ........ 2,586 2,586

Employee stock purchase program . . . 40 645 645

Amortization of unearned

compensation .................. 682 682

BALANCE, DECEMBER 31,

2000 ......................... 38,564 133,736 123,901 (5,920) (2,728) 248,989

Components of comprehensive

income:

Netincome .................... 88,824 $ 88,824 88,824

Foreign currency translation

adjustment ($0 taxes provided) . . (1,646) (1,646) (1,646)

Unrealized gain on derivative

transactions (net of tax expense,

$41) ....................... 803 803 803

Comprehensiveincome ............ $ 87,981

Exercise of employee stock options . . . 670 7,193 7,193

Tax benefit from stock plans ........ 7,514 7,514

Employee stock purchase program . . . 49 1,030 1,030

Amortization of unearned

compensation .................. 682 682

BALANCE, DECEMBER 31,

2001 ......................... 39,283 149,473 212,725 (6,763) (2,046) 353,389

Components of comprehensive

income:

Netincome .................... 102,518 $102,518 102,518

Foreign currency translation

adjustment ($0 taxes provided) . . 7,822 7,822 7,822

Unrealized loss on derivative

transactions (net of tax benefit,

$329) ...................... (2,215) (2,215) (2,215)

Comprehensiveincome ............ $108,125

Exercise of employee stock options . . . 411 5,695 5,695

Tax benefit from stock plans ........ 2,749 2,749

Employee stock purchase program . . . 43 1,229 1,229

Tax benefit from underwriting costs . . 850 850

Amortization of unearned

compensation .................. 682 682

BALANCE, DECEMBER 31,

2002 ......................... 39,737 $159,996 $315,243 $(1,156) $(1,364) $472,719

See accompanying notes to consolidated financial statements.

31