Columbia Sportswear 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

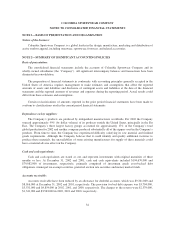

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

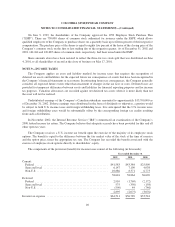

On June 9, 1999, the shareholders of the Company approved the 1999 Employee Stock Purchase Plan

(“ESPP”). There are 750,000 shares of common stock authorized for issuance under the ESPP, which allows

qualified employees of the Company to purchase shares on a quarterly basis up to fifteen percent of their respective

compensation. The purchase price of the shares is equal to eighty five percent of the lesser of the closing price of the

Company’s common stock on the first or last trading day of the respective quarter. As of December 31, 2002 and

2001, 164,164 and 120,685 shares of common stock, respectively, had been issued under the ESPP.

Share amounts above have been restated to reflect the three-for-two stock split that was distributed on June

4, 2001, to all shareholders of record at the close of business on May 17, 2001.

NOTE 9—INCOME TAXES

The Company applies an asset and liability method for income taxes that requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in

the Company’s financial statements or tax returns. In estimating future tax consequences, the Company generally

considers all expected future events other than enactment of changes in the tax laws or rates. Deferred taxes are

provided for temporary differences between assets and liabilities for financial reporting purposes and for income

tax purposes. Valuation allowances are recorded against net deferred tax assets when it is more likely than not

the asset will not be realized.

Undistributed earnings of the Company’s Canadian subsidiary amounted to approximately $15,700,000 as

of December 31, 2002. If those earnings were distributed in the form of dividends or otherwise, a portion would

be subject to both U.S. income taxes and foreign withholding taxes. It is anticipated that the U.S. income taxes

and foreign withholding taxes would be substantially offset by the corresponding foreign tax credits resulting

from such a distribution.

In November 2002, the Internal Revenue Service (“IRS”) commenced an examination of the Company’s

2000 federal income tax return. The Company believes that adequate accruals have been provided for this and all

other open tax years.

The Company receives a U.S. income tax benefit upon the exercise of the majority of its employee stock

options. The benefit is equal to the difference between the fair market value of the stock at the time of exercise

and the option price, times the appropriate tax rate. The Company has recorded the benefit associated with the

exercise of employee stock options directly to shareholders’ equity.

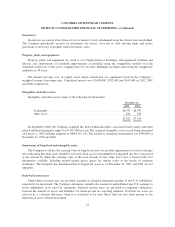

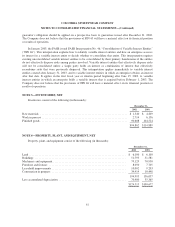

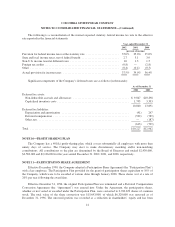

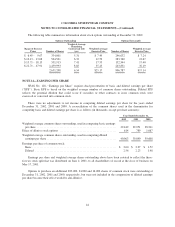

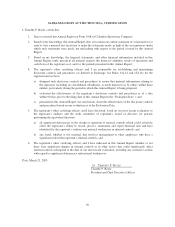

The components of the provision (benefit) for income taxes consist of the following (in thousands):

Year ended December 31

2002 2001 2000

Current:

Federal ................................................... $41,583 $43,384 $25,809

State and local ............................................. 6,147 7,109 4,038

Non-U.S................................................... 10,886 8,371 6,773

58,616 58,864 36,620

Deferred:

Federal ................................................... 2,910 (1,769) (2,172)

State and local ............................................. 575 (350) (158)

Non-U.S................................................... (590) 44 (746)

2,895 (2,075) (3,076)

Incometaxexpense ........................................... $61,511 $56,789 $33,544

40