Columbia Sportswear 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

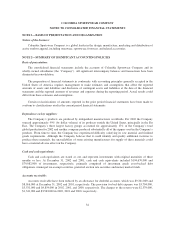

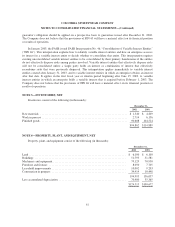

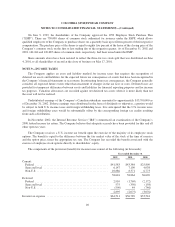

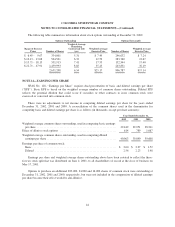

NOTE 7—LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

December 31,

2002 2001

Senior promissory notes payable ............................................... $21,429 $25,000

Termloan ................................................................. 3,705 4,177

Mortgagenotepayable ....................................................... — 645

25,134 29,822

Less current portion .......................................................... (4,498) (4,775)

$ 20,636 $25,047

In connection with a distribution center expansion project, the Company entered into a note purchase

agreement. Pursuant to the note purchase agreement, the Company issued senior promissory notes in the

aggregate principal amount of $25 million, bearing an interest rate of 6.68% and maturing August 11, 2008.

Proceeds from the notes were used to finance the expansion of the Company’s distribution center in Portland,

Oregon. The Senior Promissory Notes require the Company to comply with certain ratios related to indebtedness

to earnings before interest, taxes, depreciation and amortization (“EBITDA”) and tangible net worth. As of

December 31, 2002, the Company was in compliance with these covenants.

In June 2001, the Company’s Japanese subsidiary borrowed 550,000,000 Japanese yen (US$3,705,000 at

December 31, 2002), bearing an interest rate of 1.73% at December 31, 2002 and 2001, for general working

capital requirements. Principal and interest are paid semi-annually from July 2001 through June 2006.

The Company assumed a mortgage note payable, at an interest rate of 8.76%, in connection with a domestic

distribution center expansion project. This note was repaid in October 2002.

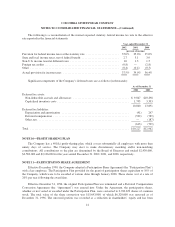

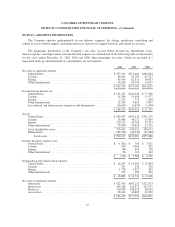

Principal payments due on these notes as of December 31, 2002 were as follows (in thousands):

Year ended

December 31,

2003 ........................................................... $ 4,498

2004 ........................................................... 4,498

2005 ........................................................... 4,498

2006 ........................................................... 4,498

2007 ........................................................... 3,571

Thereafter ....................................................... 3,571

$25,134

NOTE 8—SHAREHOLDERS’ EQUITY

On May 16, 2002, the shareholders of the Company approved an increase in the number of authorized

shares of common stock from 50,000,000 shares to 125,000,000 shares. At December 31, 2002 and 2001,

39,737,065 and 39,282,921 shares of common stock were issued and outstanding, respectively.

39