Columbia Sportswear 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

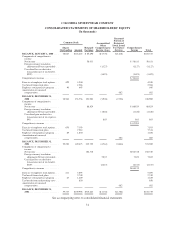

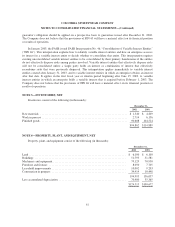

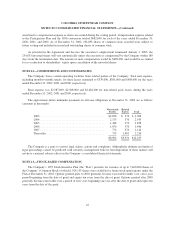

the Company’s history of warranty repairs and replacements. A summary of accrued warranties is as follows (in

thousands):

Balance at

beginning of

period

Charged to

costs and

expenses Claims paid

Balance at

end of

period

Year ended December 31, 2002 .......................... $7,475 $2,783 $2,458 $7,800

Year ended December 31, 2001 .......................... 5,780 4,094 2,399 7,475

Year ended December 31, 2000 .......................... 4,200 3,477 1,897 5,780

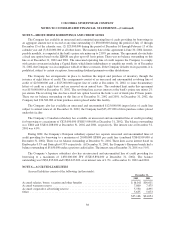

Recent Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 142, “Goodwill and

Other Intangible Assets.” This statement eliminates amortization of goodwill and certain intangible assets with

indefinite useful lives and sets forth methods to periodically evaluate these assets for impairment. The Company

adopted SFAS No. 142 on January 1, 2002 and therefore ceased amortization of certain intangible assets. Other

than the cessation of amortization, the adoption of this statement had no impact on the Company’s results of

operations or cash flows for the year ended December 31, 2002. Amortization expense for intangible assets with

indefinite useful lives was $796,000 for 2001 and $199,000 for 2000. During the fourth quarter of 2002, the

Company completed an impairment test on the intangible assets and determined that these assets were not

impaired.

In July 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities.” This statement requires that a liability for a cost associated with an exit or disposal activity be

recognized when the liability is incurred. Under previous guidance, a liability for an exit cost was recognized at

the date of the commitment to an exit plan. The provisions of this statement will be applied prospectively, as

applicable, and are effective for exit or disposal activities that are initiated after December 31, 2002.

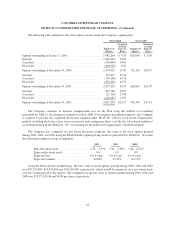

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation—

Transition and Disclosure,” an amendment of SFAS No. 123, “Accounting for Stock-Based Compensation.” This

statement provides alternative methods of transition for voluntary change to the fair value based method of

accounting for stock-based employee compensation. In addition, this statement amends the disclosure

requirements of SFAS No. 123 to require prominent disclosures in both annual and interim financial statements

about the method of accounting for stock-based employee compensation and the effect of the method used on

reported results. The Company has chosen to continue to account for stock-based compensation using the

intrinsic value method prescribed in APB 25 and related interpretations. The provisions of SFAS No. 148 are

effective for fiscal years ended after December 15, 2002. Thus, the Company has adopted the disclosure

provisions of SFAS No. 148 in the financial reports for the year ended December 31, 2002. As the adoption of

this statement involves disclosures only, the Company does not expect a material impact on its financial position

or results of operations.

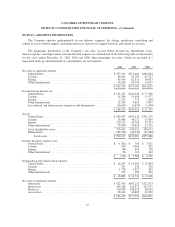

In November 2002, the FASB issued FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others” (“FIN 45”). This

interpretation elaborates on the disclosures to be made by a guarantor in its interim and annual financial

statements about its obligations under specified guarantees that it has issued. It also clarifies that a guarantor is

required to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in

issuing the guarantee. The disclosure requirements in this interpretation are effective for financial statements of

interim or annual periods ending after December 15, 2002. The Company has adopted the disclosure provisions

of FIN 45 (see Note 2 of the Notes to the Consolidated Financial Statements). Additionally, the recognition of a

36