Cigna 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

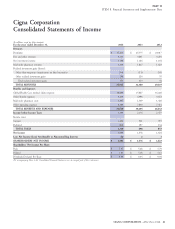

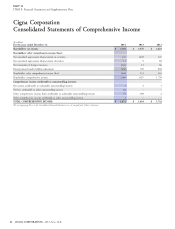

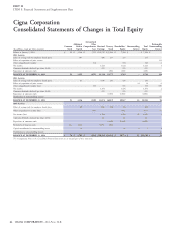

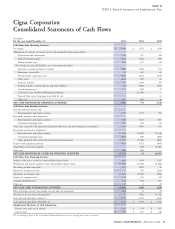

PART II

ITEM 8. Financial Statements and Supplementary Data

Notes to the Consolidated Financial Statements

Description of Business

Cigna Corporation, together with its subsidiaries (either individually products are offered through employers and other groups

or collectively referred to as ‘‘Cigna,’’ the ‘‘Company,’’ ‘‘we,’’ ‘‘our’’ or (e.g. governmental and non-governmental organizations, unions and

‘‘us’’) is a global health services organization dedicated to a mission of associations). Cigna also offers commercial health and dental

helping individuals improve their health, well-being and sense of insurance, Medicare and Medicaid products and health, life and

security. To execute on our mission, Cigna’s strategy is to ‘‘Go Deep’’, accident insurance coverages to individuals in the U.S. and selected

‘‘Go Global’’ and ‘‘Go Individual’’ with a differentiated set of medical, international markets. In addition to its ongoing operations described

dental, disability, life and accident insurance and related products and above, Cigna also has certain run-off operations.

services offered by our subsidiaries. The majority of these

Summary of Significant Accounting Policies

non-grandfathered individual plans are eligible for recoveries if

A. Basis of Presentation

claims exceed a specified threshold, up to a reinsurance cap.

The Consolidated Financial Statements include the accounts of Cigna Reinsurance contributions associated with non-grandfathered

Corporation and its subsidiaries. Intercompany transactions and individual plans are reported as a reduction in premium revenue,

accounts have been eliminated in consolidation. These Consolidated and estimated reinsurance recoveries are established with an

Financial Statements were prepared in conformity with accounting offsetting reduction in Global Health Care medical claims expense.

principles generally accepted in the United States of America Reinsurance fee contributions for other insured business are

(‘‘GAAP’’). Amounts recorded in the Consolidated Financial reported in other operating expenses. Final recoverable amounts are

Statements necessarily reflect management’s estimates and determined and settled with HHS in the year following the policy

assumptions about medical costs, investment valuation, interest rates year.

and other factors. Significant estimates are discussed throughout these A premium stabilization program is comprised of two components:

Notes; however, actual results could differ from those estimates. The 1) a permanent component that reallocates funds from insurers with

impact of a change in estimate is generally included in earnings in the lower risk populations to insurers with higher risk populations based

period of adjustment. Certain reclassifications have been made to on the relative risk scores of participants in non-grandfathered plans

prior year amounts to conform to the current presentation. Beginning in the individual and small group markets, both on and off the

in the first quarter of 2014, the Company combined the results of its exchanges. We estimate our receivable or payable based on the risk

run-off reinsurance business with Other Operations for segment of our members compared to the risk of other members in the same

reporting purposes. See Note 22 for additional information. state and market, considering data obtained from industry studies;

and 2) a temporary (2014-2016) component designed to limit insurer

Variable interest entities. As of December 31, 2014 and 2013, the

gains and losses by comparing allowable medical costs to a target

Company determined it was not a primary beneficiary in any material

amount as defined by HHS. This program applies to individual and

variable interest entities.

small group qualified health plans, operating on and off the

exchanges. Variances from the target amount exceeding certain

B. Recent Accounting Changes

thresholds may result in amounts due to or due from HHS.

For the premium stabilization program, the Company records

Accounting for Health Care Reform’s Risk Mitigation Programs. receivables or payables as adjustments to premium revenue based on

Beginning in 2014, as prescribed by the Patient Protection and our year-to-date experience when the amounts are reasonably

Affordable Care Act (referred to as ‘‘Health Care Reform’’), programs estimable and collection is reasonably assured. Final revenue

went into effect to reduce the risk for participating health insurance adjustments are determined by HHS in the year following the policy

companies selling coverage on the public exchanges. year.

A three-year (2014-2016) reinsurance program is designed to provide

Revenue from Contracts with Customers (Accounting Standards

reimbursement to insurers for high cost individual business sold on

Update (‘‘ASU’’) 2014-09). In May 2014, the Financial Accounting

or off the public exchanges. The reinsurance entity established by

Standards Board (‘‘FASB’’) issued new revenue recognition guidance

the U.S. Department of Health and Human Services (‘‘HHS’’) is

that will apply to various contracts with customers to provide goods or

funded by a per-customer reinsurance fee assessed on all insurers,

services, including the Company’s non-insurance, administrative

HMOs and self-insured group health plans, excluding certain

services contracts. It will not apply to certain contracts within the

products such as Medicare Advantage and Medicare Part D. Only

66 CIGNA CORPORATION - 2014 Form 10-K

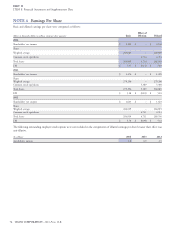

NOTE 1

NOTE 2

•

•