Cigna 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

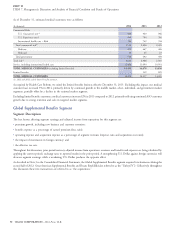

Operating expense ratio. The decrease in the operating expense ratio in both 2014 and 2013 reflected continued expense discipline.

Effective tax rate. The segment’s effective tax rate is generally lower than the federal tax rate of 35%, primarily due to tax-exempt interest

income on bonds. The increase in the effective tax rate in 2014 compared with 2013 resulted from a decline in the proportion of the segment’s

income that was attributable to tax-exempt interest and, to a lesser extent, the absence of the tax benefit reported in 2013 related to the

completion of IRS tax audits. The decline in the effective tax rate in 2013 compared with 2012 was due to the tax benefit reported in 2013 related

to the completion of IRS tax audits.

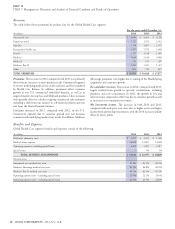

Other Operations

Description

Cigna’s COLI business contributes the majority of earnings in Other Operations. In the first quarter of 2014, we combined the results of the

Run-off Reinsurance segment with other immaterial segments in Other Operations, because the results are expected to be immaterial subsequent

to the reinsurance transaction with Berkshire in 2013. Cigna’s Other Operations segment also includes the results from the run-off settlement

annuity business, as well as the remaining deferred gains recognized from the sale of the individual life insurance and annuity and retirement

benefits businesses. Prior year information has been conformed to the current year presentation.

Results of Operations

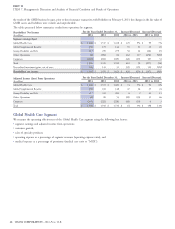

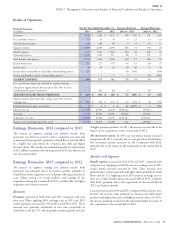

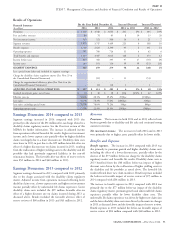

For the Years Ended December 31, Increase/(Decrease) Increase/(Decrease)

Financial Summary

2014 2013 2012 2014 vs. 2013 2013 vs. 2012

(In millions)

Premiums $ 112 $ 105 $ 121 $ 7 7% $ (16) (13)%

Fees and other revenues 14 (24) (101) 38 158 77 76

Net investment income 384 408 490 (24) (6) (82) (17)

Segment revenues 510 489 510 21 4 (21) (4)

Benefit expenses 380 1,067 377 (687) (64) 690 183

Operating expenses 33 53 8 (20) (38) 45 N/M

Benefits and expenses 413 1,120 385 (707) (63) 735 191

Income (loss) before taxes 97 (631) 125 728 115 (756) N/M

Income taxes (benefits) 29 (237) 43 266 112 (280) N/M

SEGMENT EARNINGS (LOSS) 68 (394) 82 462 117 (476) N/M

Less: results of GMIB business – 25 29 (25) (4)

Less: special items (after-tax) included in segment earnings:

Charge related to reinsurance transaction – (507) – 507 (507)

ADJUSTED INCOME FROM OPERATIONS $ 68 $ 88 $ 53 $ (20) (23)% $ 35 66%

Realized investment gains, net of taxes $ 11 $ 23 $ 3 $ (12) (52)% $ 20 N/M

Effective tax rate 29.9% 37.6% 34.4% (770)bps 320bps

$27 million and the $14 million favorable impact of completing the

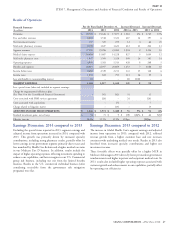

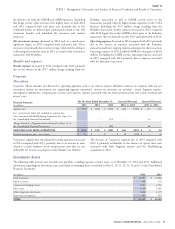

Earnings Discussion: 2014 compared to 2013

2009-2010 IRS examinations during the third quarter of 2013. See

Segment earnings increased significantly in 2014 compared with Note 19 to the Consolidated Financial Statements for additional

2013, due primarily to the absence of the 2013 charge related to the information on the IRS examinations.

reinsurance transaction with Berkshire. Adjusted income from

operations decreased in 2014 compared with 2013, primarily

Revenues

reflecting the absence of the $14 million favorable impact of the Premiums reflect revenue primarily on universal and whole life

2009-2010 IRS examinations completed during the third quarter of insurance policies in the COLI business. Premiums increased in 2014

2013 and higher COLI claims experience in 2014. compared with 2013 driven primarily by strong persistency as well as

the impact of higher mortality in 2014 on experience-rated business.

Earnings Discussion: 2013 compared to 2012

In 2013, premiums decreased compared with 2012, due to the

absence of VADBe premium in 2013 because of the reinsurance

The decrease in segment results in 2013 compared with 2012 was transaction, partially offset by higher COLI premium.

driven largely by the 2013 charge related to the reinsurance

transaction with Berkshire. The increase in adjusted income from Fees and other revenues included losses of $39 million in 2013 and

operations in 2013, compared with 2012, primarily resulted from the $119 million in 2012 associated with a dynamic hedge program for

absence of the 2012 reserve strengthening in the GMDB business of the run-off reinsurance business that was discontinued in 2013 with

54 CIGNA CORPORATION - 2014 Form 10-K