Cigna 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

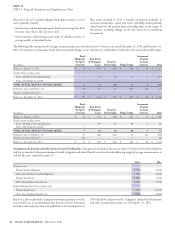

Pension benefits. The Company’s pension plans were underfunded Security Act of 1974 and the Pension Protection Act of 2006. For

by $1.1 billion in 2014 and $0.6 billion in 2013 and had related 2015, the Company expects to make minimum required

accumulated benefit obligations of $5.3 billion as of December 31, contributions totaling approximately $5 million. Future years’

2014 and $4.7 billion as of December 31, 2013. contributions will ultimately be based on a wide range of factors

including but not limited to asset returns, discount rates, and funding

The Company funds its qualified pension plans at least at the targets.

minimum amount required by the Employee Retirement Income

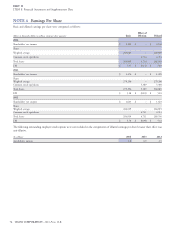

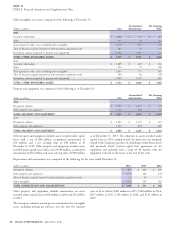

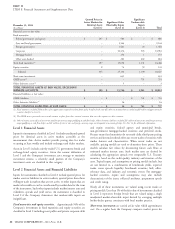

Components of net pension cost for the years ended December 31 were as follows:

(In millions)

2014 2013 2012

Service cost $ 2 $3 $3

Interest cost 206 181 198

Expected long-term return on plan assets (264) (272) (270)

Amortization of:

Net loss from past experience 57 74 58

Settlement loss 6–6

NET PENSION COST $ 7 $ (14) $ (5)

The Company expects to recognize pre-tax losses of $70 million in Other postretirement benefits. Unfunded retiree health benefit plans

2015 from amortization of past experience. This estimate is based on a had accumulated benefit obligations of $206 million at December 31,

weighted average amortization period for the frozen and inactive plans 2014 and $190 million at December 31, 2013. Retiree life insurance

that is based on the average expected remaining life of plan plans had accumulated benefit obligations of $129 million as of

participants of approximately 29 years. December 31, 2014 and $133 million as of December 31, 2013.

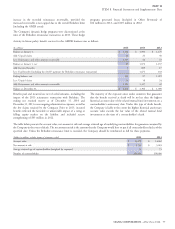

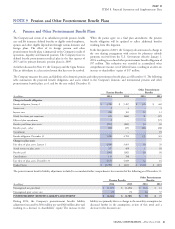

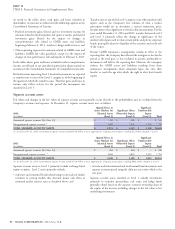

Components of net other postretirement benefit cost for the years ended December 31 were as follows:

(In millions)

2014 2013 2012

Service cost $ – $1 $2

Interest cost 12 12 16

Expected long-term return on plan assets – (1) (1)

Amortization of:

Prior service cost (3) (4) (12)

Curtailment gain – (19) –

NET OTHER POSTRETIREMENT BENEFIT COST $ 9 $ (11) $ 5

The Company expects to recognize $3 million pre-tax gains related to 25% in other investments, including securities partnerships, hedge

amortization of prior service cost and no pre-tax gains from funds and real estate) are developed by management as guidelines,

amortization of past experience in 2015. The amortization period is although the fair values of each asset category are expected to vary as a

based on an average expected remaining life of plan participants of result of changes in market conditions. The Company would expect

29 years. to further reduce the allocation to equity securities and move further

into fixed income investments as funding levels improve.

The estimated rate of future increases in the per capita cost of health

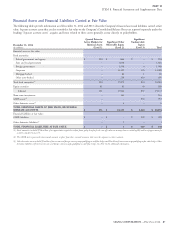

care benefits is 6.75% in 2015, decreasing by 0.25% per year to As of December 31, 2014, pension plan assets included $3.8 billion

4.75% in 2023 and beyond. This estimate reflects the Company’s invested in the separate accounts of Connecticut General Life

current claim experience and management’s estimate that rates of Insurance Company (‘‘CGLIC’’) and Life Insurance Company of

growth will decline in the future. A 1% increase or decrease in the North America, that are subsidiaries of the Company, as well as an

estimated rate in 2014 would have no impact on postretirement additional $361 million invested directly in funds offered by the buyer

benefit costs, and $1 million on the postretirement benefit obligation. of the retirement benefits business.

Plan assets. The Company’s current target investment allocation

percentages (50% fixed income, 25% public equity securities, and

82 CIGNA CORPORATION - 2014 Form 10-K