Cigna 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

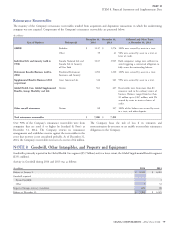

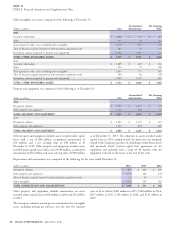

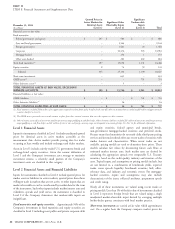

Other intangible assets were comprised of the following at December 31:

Accumulated Net Carrying

(Dollars in millions)

Cost Amortization Value

2014

Customer relationships $ 1,266 $ 779 $ 487

Other 313 91 222

Total reported in other assets, including other intangibles 1,579 870 709

Value of business acquired (reported in deferred policy acquisition costs) 165 30 135

Internal-use software (reported in property and equipment) 2,191 1,467 724

TOTAL OTHER INTANGIBLE ASSETS $ 3,935 $ 2,367 $ 1,568

2013

Customer relationships $ 1,289 $ 635 $ 654

Other 324 76 248

Total reported in other assets, including other intangibles 1,613 711 902

Value of business acquired (reported in deferred policy acquisition costs) 168 20 148

Internal-use software (reported in property and equipment) 1,942 1,307 635

TOTAL OTHER INTANGIBLE ASSETS $ 3,723 $ 2,038 $ 1,685

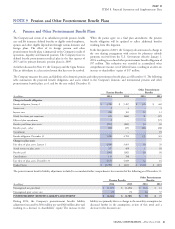

Property and equipment was comprised of the following as of December 31:

Accumulated Net Carrying

(Dollars in millions)

Cost Amortization Value

2014

Internal-use software $ 2,191 $ 1,467 $ 724

Other property and equipment 1,740 962 778

TOTAL PROPERTY AND EQUIPMENT $ 3,931 $ 2,429 $ 1,502

2013

Internal-use software $ 1,942 $ 1,307 $ 635

Other property and equipment 1,747 918 829

TOTAL PROPERTY AND EQUIPMENT $ 3,689 $ 2,225 $ 1,464

Other property and equipment includes assets recorded under capital as of December 31, 2013. The reduction in assets recorded under

leases with a cost of $84 million, accumulated amortization of capital leases in 2014, compared with the prior year, was primarily

$36 million, and a net carrying value of $48 million as of related to the Company’s purchase of a building in South Korea that it

December 31, 2014. Other property and equipment includes assets had previously leased. Current capital lease agreements are for

recorded under capital leases with a cost of $306 million, accumulated equipment and generally have a term of 48 months with the

amortization of $16 million, and a net carrying value of $290 million equipment returned to the lessor at the end of the term.

Depreciation and amortization was comprised of the following for the years ended December 31:

(Dollars in millions)

2014 2013 2012

Internal-use software $ 260 $ 225 $ 209

Other property and equipment 153 160 144

Value of business acquired (reported in deferred policy acquisition costs) 12 19 2

Other intangibles 163 193 205

TOTAL DEPRECIATION AND AMORTIZATION $ 588 $ 597 $ 560

Other property and equipment includes amortization on assets years to be as follows: $425 million in 2015, $348 million in 2016,

recorded under capital leases of $20 million in 2014 and $16 million $237 million in 2017, $154 million in 2018, and $129 million in

in 2013. 2019.

The Company estimates annual pre-tax amortization for intangible

assets, including internal-use software, over the next five calendar

80 CIGNA CORPORATION - 2014 Form 10-K