Cigna 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

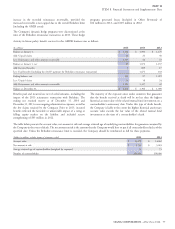

Acquisitions and Dispositions

The Company may from time to time acquire or dispose of assets, supplemental health insurance products in the U.S. for a cash

subsidiaries or lines of business. The three significant transactions purchase price of $326 million. Results of this business and the related

described below were completed in 2012. The combined pro forma goodwill and intangible assets (see Note 8 for additional information)

effect of these transactions was not material to the Company’s 2012 are reported in the Global Supplemental Benefits segment.

consolidated revenue and net income.

C. Acquisition of HealthSpring, Inc.

A. Joint Venture Agreement with

On January 31, 2012 the Company acquired the outstanding shares

Finansbank

of HealthSpring, Inc. (‘‘HealthSpring’’) for $55 per share in cash and

Cigna stock awards, representing a cost of approximately $3.8 billion.

On November 9, 2012, the Company acquired 51% of the total At the time of the acquisition, HealthSpring provided Medicare

shares of Finans Emeklilik ve Hayat A.S. (‘‘Finans Emeklilik’’), a Advantage coverage in 15 states and the District of Columbia, as well

Turkish insurance company for a cash purchase price of approximately as a large, national stand-alone Medicare prescription drug business.

$116 million. Finans Emeklilik operates in life insurance, accident Results of this business and the related goodwill and intangible assets

insurance and pension product markets. Results of this business and (see Note 8 for additional information) are reported in the Global

the related goodwill and intangible assets (see Note 8 for additional Health Care segment. During 2012, the Company recorded

information) are reported in the Global Supplemental Benefits $53 million pre-tax ($40 million after-tax: $7 million in Global

segment. The redeemable noncontrolling interest is classified as Health Care and $33 million in Corporate) of acquisition-related

temporary equity in the Company’s Consolidated Balance Sheet costs in other operating expenses.

because Finansbank has the right to require the Company to purchase

its 49% interest for the value of its net assets and the inforce business During the three years ended December 31, 2014, the Company

in 15 years. entered into other acquisition and divestiture transactions, the results

of which were not material to the Company’s results of operations,

liquidity or financial condition.

B. Acquisition of Great American

Supplemental Benefits Group

On August 31, 2012, the Company acquired Great American

Supplemental Benefits Group, one of the largest providers of

CIGNA CORPORATION - 2014 Form 10-K 73

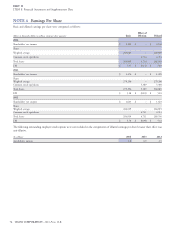

NOTE 3