BP 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

93

an increase in finance debt of $12 billion over the three-year period. During

this period, the price of Brent crude oil has averaged $100.81 per barrel.

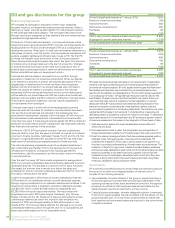

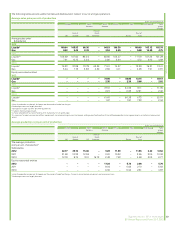

The following table summarizes the three-year sources and uses of cash.

$ billion

Sources of cash:

Net cash provided by operating activities 56

Disposals 32

88

Uses of cash:

Capital expenditure 62

Acquisitions 13

Net repurchase of shares –

Dividends paid to BP shareholders 12

Dividends paid to minority interests 1

88

Net use of cash –

Increase in finance debt 12

Increase in cash and cash equivalents 12

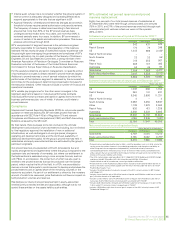

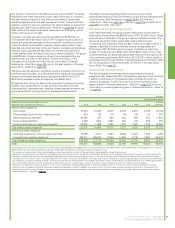

Disposal proceeds received during the three-year period exceeded cash

used for acquisitions, as a result in particular of our ongoing disposal

programme started in 2010. Net investment (capital expenditure and

acquisitions less disposal proceeds) during this period averaged $15 billion

per year. Dividends paid to BP shareholders totalled $12 billion during the

three-year period, with no ordinary share dividends being paid in respect

of the first three quarters of 2010. In the past three years, $4 billion has

been contributed to funded pension plans. This is reflected in net cash

provided by operating activities in the table above.

Trend information

For information on external market trends, see Energy outlook on

pages 12-14, Upstream on pages 63-71 and Downstream on pages 72-79.

We expect production in our Upstream segment to be lower in 2013 than

2012, mainly due to the impact of divestments, which we estimate at

around 150mboe/d.

In Downstream, the financial impact of refinery turnarounds for 2013 is

expected to be lower than in 2012. We expect the petrochemicals

margins to remain under pressure during 2013.

In 2013, we expect the average quarterly charge, excluding non-operating

items, for Other businesses and corporate to remain at around $500

million, although this will remain volatile between individual quarters.

We expect capital expenditure, excluding acquisitions and asset

exchanges, to be around $24-25 billion as we invest to grow in the

Upstream. From 2014 through to the end of the decade, we expect a

range for organic capital expenditure of between $24 billion and $27 billion

per annum.

Having essentially reached our $38-billion target of disposals since 2010,

we expect to divest on average of $2-3 billion per annum on an ongoing

basis.

We intend to target our net debt ratio within the 10-20% range while

uncertainties remain. Net debt is a non-GAAP measure.

Depreciation, depletion and amortization in 2013 is expected to be around

$0.5-1.0 billion higher than in 2012.

For 2013, the underlying effective tax rate (ETR) (which excludes

non-operating items and fair value accounting effects) is expected to be in

the range of 36-38% compared with 30% in 2012. The increase in the

forecast rate is mainly due to a lower level of equity-accounted income in

2013, which is reported net of tax in the income statement.

Forward-looking statements

The discussion above contains forward-looking statements, particularly

those regarding production in Upstream, the expected financial impact of

refinery turnarounds, expectations regarding petrochemicals margins and

the average quarterly charge for Other businesses and corporate,

estimated levels of capital expenditure in 2013 and to the end of the

decade, estimated amount of divestments, intentions regarding net debt

ratio and the expected level of depreciation, depletion and amortization,

and the expected level of underlying ETR. These forward-looking

statements are based on assumptions that management believes to be

reasonable in the light of the group’s operational and financial experience.

However, no assurance can be given that the forward-looking statements

will be realized. You should not rely on past performance as an indicator of

future performance. You are urged to read the cautionary statement on

page 32 and Risk factors on pages 38-44, which describe the risks and

uncertainties that may cause actual results and developments to differ

materially from those expressed or implied by these forward-looking

statements. The company provides no commitment to update the

forward-looking statements or to publish financial projections for

forward-looking statements in the future.