BP 2012 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

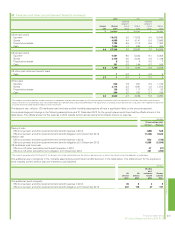

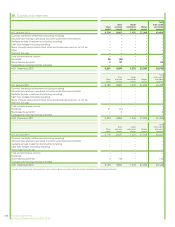

and the laws of certain non-US jurisdictions, as well as claims by private parties under US federal securities laws and other state and federal statutes.

See Legal proceedings on pages 162-171 for further information.

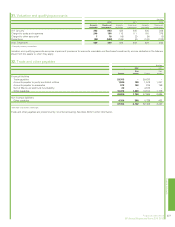

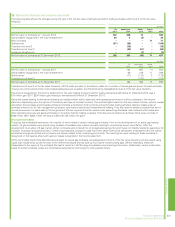

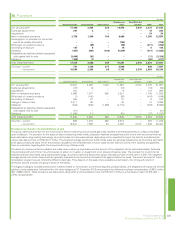

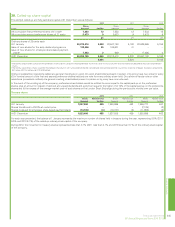

The litigation and claims provision includes amounts that can be estimated reliably for the future cost of settling Individual and Business Claims, and

State and Local Claims under OPA 90, including certain amounts as set forth below related to the settlements with the PSC, the cost of the agreement

with the US government to resolve all federal criminal claims, and claims administration costs and legal fees. During 2012, a provision was recognizedin

the amount of $525 million in respect of the cost of the agreement with the US Securities and Exchange Commission (SEC) to resolve all of the US

government’s federal securities claims against the company (the SEC settlement). The remaining obligation for the SEC settlement at 31 December

2012 has been reclassified to other payables (as discussed below).

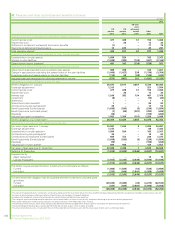

BP announced on 3 March 2012 that a proposed settlement had been reached with the Plaintiffs’ Steering Committee (PSC), subject to final written

agreement and court approvals, to resolve the substantial majority of legitimate economic loss and property damage claims and exposure-based medical

claims (Individual and Business claims) stemming from the Deepwater Horizon accident and oil spill. The PSC acts on behalf of the individual and

business plaintiffs in the multi-district litigation proceedings pending in New Orleans (MDL 2179). The proposed settlement was an adjusting event after

the 2011 reporting period and BP’s estimate at that time of the cost of the settlement of $7.8 billion was therefore reflected in the 2011 financial

statements. On 18 April 2012, BP announced that it had reached definitive and fully documented settlement agreements with the PSC consistent with

the terms of that settlement. In November 2012, the court held a fairness hearing with respect to the Economic and Property Damages Settlement

Agreement and Medical Benefits Settlement Agreement and subsequently granted final approval to the Economic and Property Damages Settlement

on 21 December 2012 and to the medical benefits settlement on 11 January 2013. See Legal proceedings on pages 162-171 for further information.

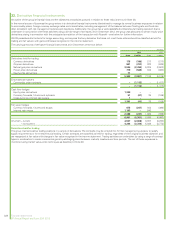

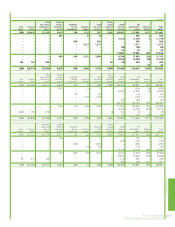

Under the terms of the PSC settlement agreement, several qualified settlement funds (QSFs) were established during the year. These QSFs, which are

funded through the Trust, each relate to specific elements of the agreement and are available to make payments to claimants in accordance with those

elements of the agreement.

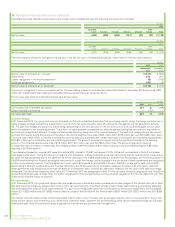

The total amount allocated to the seafood industry under the PSC settlement is fixed at $2.3 billion and thus amounts contributed from the Trust to the

seafood compensation fund extinguish BP’s liability, so the provision and related reimbursement asset are derecognized, irrespective of whether

amounts have been paid out of the fund to claimants. Utilization of the provision in 2012 included $2,230 million contributed to the seafood

compensation fund. Additionally, a further $67 million was paid to seafood industry claimants through the transition claims process. At 31 December

2012, $1,847 million remained in the seafood compensation fund for which the related provision and reimbursement asset had been derecognized.

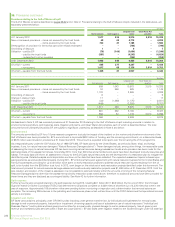

As at 31 December 2011, the provision for items covered by the settlement with the PSC for Individual and Business claims was $7.8 billion. During 2012,

BP increased its estimate of the cost of claims administration by $280 million and also increased the provision by a further $400 million as described below.

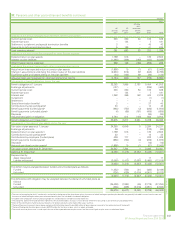

Business economic loss claims received by the Deepwater Horizon Court Supervised Settlement Program (DHCSSP) to date are being paid at a

significantly higher average amount than previously assumed by BP in formulating the original estimate of the cost. Further, BP’s initial estimate of

aggregate liability under the settlement agreements was premised on BP’s interpretation of certain protocols established in the Economic and Property

Damages Settlement Agreement. As part of its monitoring of payments made by the DHCSSP, BP identified multiple claim determinations that

appeared to result from an interpretation of the settlement agreement by the claims administrator that BP believes was incorrect. This interpretation

produced a higher number and value of awards than the interpretation BP assumed in making the initial estimate. Pursuant to the mechanisms in the

settlement agreement, the claims administrator sought clarification from the court on this matter and on 30 January 2013, the court initially upheld the

claims administrator’s interpretation of the agreement.

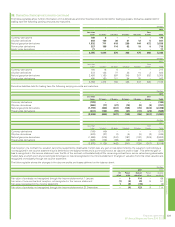

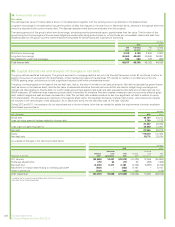

In its unaudited fourth quarter and full year 2012 results announcement dated 5 February 2013 (the ‘preliminary announcement’), BP stated that if the

initial trend of higher average payments than assumed by BP in its original estimate of the cost continued, then it was likely that BP’s provision for these

claims would be increased significantly. Management’s initial assessment of the ruling regarding the interpretation of the settlement agreement led to

an increase in the estimated cost of the settlement with the PSC of $400 million, bringing the total estimated cost to $8.5 billion. This estimate was

based upon management’s initial assessment of the ruling’s impact on claims already submitted to and processed by the DHCSSP. At that time, BP

was seeking reversal of the court’s decision in relation to this matter, and management concluded that it was not possible to estimate reliably the

impact of the interpretation on any future claims not yet received or processed by the DHCSSP.

On 6 February 2013, the court reconsidered and vacated its ruling of 30 January 2013 and stayed the processing of certain types of business economic

loss claims. The court lifted the stay on 28 February 2013. On 5 March 2013, the court affirmed the claims administrator’s interpretation of the

agreement and rejected BP’s position as it relates to business economic loss claims. BP strongly disagrees with the ruling of 5 March 2013 and the

current implementation of the agreement by the claims administrator. BP intends to pursue all available legal options including rights of appeal, to

challenge this ruling. Other business economic loss claims continue to be paid at a higher average amount than previously assumed by BP in

determining its initial estimate of the total cost. Management has continued to analyse the claims in the period since 5 February 2013 to gain a better

understanding of whether or not the number and average value of claims received and processed to date are predictive of future claims (and so would

allow management to estimate the total cost reliably). Management has concluded, based upon this analysis, that it is not possible to determine

whether the claims experience to date is, or is not, an appropriate basis for estimating the total cost. Therefore, given the inherent uncertainty that

exists as BP pursues all available legal options to challenge the recent ruling, and the higher number of claims received and higher average claims

payments than previously assumed by BP, which may or may not continue, management has concluded that no reliable estimate can be made of any

business economic loss claims not yet received or processed by the DHCSSP.

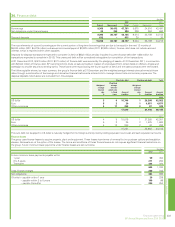

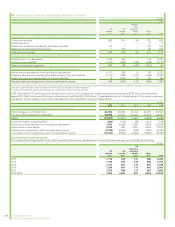

Therefore, the provision for business economic loss claims at 31 December 2012 included in these financial statements now includes only the

estimated cost of claims already received and processed by the DHCSSP. As a consequence, an amount of $0.8 billion previously provided for future

claims not yet received or processed by the DHCSSP, has been derecognized, with a corresponding reduction in the reimbursement asset and therefore

no net impact on the income statement, as no reliable estimate can be made for this liability. It is therefore disclosed as a contingent liability in Note 43.

A provision will be re-established when a reliable estimate can be made of the liability as explained more fully below.

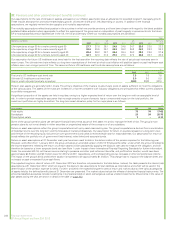

BP’s current estimate of the total cost of those elements of the PSC settlement that can be estimated reliably, which excludes any future business

economic loss claims not yet received or processed by the DHCSSP, is $7.7 billion.

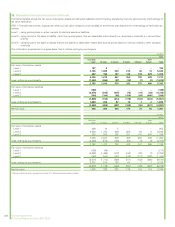

If BP is successful in its challenge to the court’s ruling, the total estimated cost of the settlement agreement will, nevertheless, be significantly higher than

the current estimate of $7.7 billion because business economic loss claims not yet received or processed are not reflected in the current estimate and the

average payments per claim determined so far are higher than anticipated. If BP is not successful in its challenge to the court’s ruling, a further significant

increase to the total estimated cost of the settlement will be required but BP will continue to challenge the current interpretation and implementation of the

settlement agreement by the claims administrator using all legal avenues available, including rights of appeal. However, there can be no certainty as to how

the dispute will ultimately be resolved or determined. To the extent that there are insufficient funds available in the Trust fund, payments under the PSC

settlement will be made by BP directly and charged to the income statement.

Financial statements 237

BP Annual Report and Form 20-F 2012

Financial statements

36. Provisions continued