Ameriprise 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

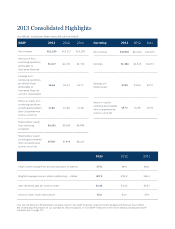

A recognized

leader

Leading financial

planning company

in the U.S.

#1 customer

experience —

investment firm

category

#3 full-service

investment

online brand

#2 mutual fund

advisory program

in assets

#8 IRA provider

#8 long-term

mutual fund

assets in the U.S.

#5 VUL/IUL

provider

Strong financial

strength ratings

See page 12 for sources.

6 Ameriprise Financial Annual Report 2013

prudent product features, and nancial strength help to ensure

that these businesses can continue to deliver for our clients and

shareholders. In an extended period of low interest rates, our

protection and annuity businesses are performing well with

good sales growth in our channel, strong risk characteristics

and solid returns.

We’ve taken a number of steps over the past few years to further

optimize the risk prole of our variable annuity products, including

ending new third-party sales and adding investment options

designed to help manage volatility. We are adding business where

we want and experienced a good pick up in variable annuity sales

in 2013. We're also focused on offering clients variable annuities

without guaranteed benet riders, as they look to generate tax-

deferred savings and income for retirement. While we’re growing

our variable business, xed annuity sales remained low given the

current interest rate environment. That said, we have an attractive

xed annuity book and as rates rise, we anticipate having an

opportunity to add to it.

With regard to life insurance, with $194 billion in life insurance in

force, we have a sizable business, and I feel very good about its

earnings and risk prole. In 2013, we generated strong growth in

sales of indexed universal life and variable universal life, important

solutions for clients’ protection and long-term asset accumulation

needs. And with health care concerns increasingly on the minds of

those in retirement, we introduced RiverSource TrioSourceSM — an

innovative universal life insurance product with long-term care

benets that ts well with our nancial planning approach.

In addition, we’ve steadily grown our Auto & Home policyholder

base — up 11 percent in 2013. We, like others in the industry,

were impacted by weather-related losses last year. However, we

are being recognized for high customer satisfaction and remain

focused on targeted growth opportunities in both the direct and

afnity channels.

As we serve more clients and deepen existing relationships, we

believe we can continue to grow our protection and annuity

businesses prudently. We are deriving strong returns while