Ameriprise 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

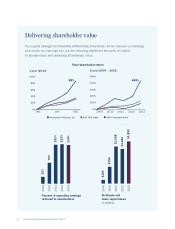

Assets under management

and administration

in billions

2009

2010

2011

2012

2013

$429

$647

$631

$681

$771

Ameriprise Financial Annual Report 2013 3

We grew assets under management and administration to a record

$771 billion at the end of 2013, up 13 percent. Operating net

revenues grew by 7 percent to $10.9 billion. Through our

combination of business growth and capital management, we

drove a 26 percent increase in operating earnings per diluted

share and generated a 19.7 percent operating return on equity,

excl. AOCI — one of the strongest in the industry — up

signicantly from 16.2 percent a year ago.

Investors demonstrated their support for Ameriprise. In 2013, the

total return of Ameriprise common stock was 88 percent, far

outpacing the S&P 500 Index and the S&P Financials Index.

In fact, of the 81 companies that comprise the S&P Financials

Index, Ameriprise delivered the fth-highest total shareholder

return last year.

Just as our strategy remains consistent, so too has our strong

share performance. As of year end, the ve-year total return for

Ameriprise common stock was 449 percent, well in excess of

many of our industry peers. And since becoming an independent,

public company in 2005, Ameriprise delivered the second-highest

total return of any rm in the S&P Financials Index.

Realizing our wealth management opportunity

2013 was an excellent year for our Advice & Wealth Management

business. We continued to build on our reputation as the company

with the right expertise to help clients feel condent about their

nancial futures — as well as the place where productive,

experienced advisors can grow even stronger practices. This

attractive value proposition is built on providing personalized

nancial advice, a broad set of products and solutions, as well

as excellent service. In fact, Forrester Research recognized

Ameriprise as offering the leading customer experience for

investment rms in its 2014 Customer Experience Index Report.

Ameriprise is the leader in nancial planning in the United States.

Retirement is one of consumers’ leading concerns, and we

developed our new Confident Retirement® approach to simplify the

conversations our advisors have with clients and prospects about

how to pursue a secure and condent retirement. Our approach