Ameriprise 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

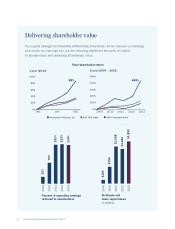

Evolving our business mix and deploying capital

As we grow our earnings over time, I believe we can consistently

generate more than 60 percent of our operating earnings from

Advice & Wealth Management and Asset Management while

prudently growing our Annuity and Protection businesses.

In 2008, 30 percent of our operating earnings came from our

higher P/E, less capital-demanding businesses. That number grew

to 45 percent in 2010, and last year, we raised it to 56 percent.

Our mix of businesses generates signicant free cash ow that

we use to invest and return to shareholders. And as we free

up capital, we are returning a large percentage through share

repurchases and dividends. Last year we devoted nearly $2 billion

to share repurchases and dividends, including raising our regular

quarterly dividend 16 percent, which represented the sixth

increase since 2010. In fact, 2013 marked the third consecutive

year we returned more of our capital to shareholders than we

earned while continuing to hold appropriate excess capital and

maintain our strong ratings.

Serving our communities and earning a strong reputation

At Ameriprise, our business is a relationship business, and our

clients are served by some of the most talented and committed

individuals in the industry. I feel very good about our people and

the values they demonstrate. We consistently achieve some of the

highest scores for employee engagement in the industry and our

advisor engagement and satisfaction are near record highs.

Our terric engagement is also reected in our giving programs

and volunteerism, including our national partnership with Feeding

America. Ameriprise and our employees, advisors and clients are

making a difference. More than 10,000 people in the United

States, including our clients, participated in the Ameriprise

Financial National Day of Service. We’re also being recognized for

the work we do and for our community involvement. Ameriprise

was recognized again as a member of The Civic 50 — a list of

the top civic-minded companies.

Ameriprise Financial Annual Report 2013 9

Operating return on

equity, excl. AOCI

2009

2010

2011

2012

2013

Operating earnings

per diluted share

2009

2010

2011

2012

2013

10.7%

13.7%

16.0%

16.2%

19.7% $7.05

$5.59

$5.17

$4.10

$2.95