Albertsons 2010 Annual Report Download - page 70

Download and view the complete annual report

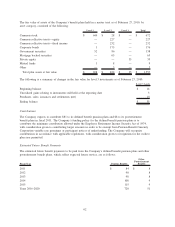

Please find page 70 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.obligations with remaining terms that range from less than one year to 20 years, with a weighted average

remaining term of approximately nine years. For each guarantee issued, if the independent retail customer

defaults on a payment, the Company would be required to make payments under its guarantee. Generally, the

guarantees are secured by indemnification agreements or personal guarantees of the independent retail

customer. The Company reviews performance risk related to its guarantees of independent retail customers

based on internal measures of credit performance. As of February 27, 2010, the maximum amount of

undiscounted payments the Company would be required to make in the event of default of all guarantees was

approximately $127 and represented approximately $93 on a discounted basis. Based on the indemnification

agreements, personal guarantees and results of the reviews of performance risk, the Company believes the

likelihood that it will be required to assume a material amount of these obligations is remote. Accordingly, no

amount has been recorded in the Consolidated Balance Sheets for these contingent obligations under the

Company’s guarantee arrangements.

The Company is contingently liable for leases that have been assigned to various third parties in connection

with facility closings and dispositions. The Company could be required to satisfy the obligations under the

leases if any of the assignees are unable to fulfill their lease obligations. Due to the wide distribution of the

Company’s assignments among third parties, and various other remedies available, the Company believes the

likelihood that it will be required to assume a material amount of these obligations is remote.

In the ordinary course of business, the Company enters into supply contracts to purchase products for resale.

These contracts typically include either volume commitments or fixed expiration dates, termination provisions

and other standard contractual considerations. As of February 27, 2010, the Company had approximately

$1,184 of non-cancelable future purchase obligations primarily related to supply contracts.

The Company is a party to a variety of contractual agreements under which the Company may be obligated to

indemnify the other party for certain matters, which indemnities may be secured by operation of law or

otherwise, in the ordinary course of business. These contracts primarily relate to the Company’s commercial

contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services

to the Company and agreements to indemnify officers, directors and employees in the performance of their

work. While the Company’s aggregate indemnification obligation could result in a material liability, the

Company is aware of no current matter that it expects to result in a material liability.

Legal Proceedings

The Company is subject to various lawsuits, claims and other legal matters that arise in the ordinary course of

conducting business, none of which, in management’s opinion, is expected to have a material adverse effect on

the Company’s financial condition, results of operations or cash flows.

In September 2008, a class action complaint was filed against the Company, as well as International

Outsourcing Services, LLC (“IOS”), Inmar, Inc., Carolina Manufacturer’s Services, Inc., Carolina Coupon

Clearing, Inc. and Carolina Services, in the United States District Court in the Eastern District of Wisconsin.

The plaintiffs in the case are a consumer goods manufacturer, a grocery co-operative and a retailer marketing

services company who allege on behalf of a purported class that the Company and the other defendants

(i) conspired to restrict the markets for coupon processing services under the Sherman Act and (ii) were part

of an illegal enterprise to defraud the plaintiffs under the Federal Racketeer Influenced and Corrupt

Organizations Act. The plaintiffs seek monetary damages, attorneys’ fees and injunctive relief. The Company

intends to vigorously defend this lawsuit, however all proceedings have been stayed in the case pending the

result of the criminal prosecution of certain former officers of IOS. Although this lawsuit is subject to the

uncertainties inherent in the litigation process, based on the information presently available to the Company,

management does not expect that the ultimate resolution of this lawsuit will have a material adverse effect on

the Company’s financial condition, results of operations or cash flows.

In December 2008, a class action complaint was filed in the United States District Court for the Western

District of Wisconsin against the Company alleging that a 2003 transaction between the Company and C&S

Wholesale Grocers, Inc. (“C&S”) was a conspiracy to restrain trade and allocate markets. In the 2003

64