Albertsons 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars and shares in millions, except per share data, unless otherwise noted)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business Description

SUPERVALU INC. (“SUPERVALU” or the “Company”) is one of the largest companies in the United States

grocery channel. SUPERVALU conducts its retail operations under the Acme, Albertsons, Bristol Farms, Cub

Foods, Farm Fresh, Hornbacher’s, Jewel-Osco, Lucky, Save-A-Lot, Shaw’s, Shop ’n Save, Shoppers Food &

Pharmacy and Star Market banners as well as in-store pharmacies under the Osco and Sav-on banners.

Additionally, the Company provides supply chain services, primarily wholesale distribution, across the United

States retail grocery channel.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and all majority-owned subsidiar-

ies. All significant intercompany accounts and transactions have been eliminated. References to the Company

refer to SUPERVALU INC. and Subsidiaries.

Fiscal Year

The Company’s fiscal year ends on the last Saturday in February. The Company’s first quarter consists of

16 weeks while the second, third and fourth quarters each consist of 12 weeks, except for the fourth quarter of

fiscal 2009 which included 13 weeks. Because of differences in the accounting calendars of the Company and

its wholly-owned subsidiary New Albertsons, Inc., the February 27, 2010 and February 28, 2009 Consolidated

Balance Sheets include the assets and liabilities related to New Albertsons, Inc. as of February 25, 2010 and

February 26, 2009, respectively.

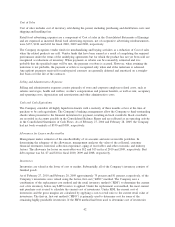

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with accounting principles

generally accepted in the United States of America (“accounting standards”) requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

Revenues from product sales are recognized at the point of sale for the Retail food segment and upon delivery

for the Supply chain services segment. Typically, invoicing, shipping, delivery and customer receipt of Supply

chain services product occur on the same business day. Revenues from services rendered are recognized

immediately after such services have been provided. Discounts and allowances provided to customers by the

Company at the time of sale, including those provided in connection with loyalty cards, are recognized as a

reduction in Net sales as the products are sold to customers. Sales tax is excluded from Net sales.

Revenues and costs from third-party logistics operations are recorded gross when the Company is the primary

obligor in a transaction, is subject to inventory or credit risk, has latitude in establishing price and selecting

suppliers, or has several, but not all of these indicators. If the Company is not the primary obligor and

amounts earned have little or no credit risk, revenue is recorded net as management fees earned.

41