Albertsons 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain of the Company’s credit facilities and long-term debt agreements have restrictive covenants and cross-

default provisions which generally provide, subject to the Company’s right to cure, for the acceleration of

payments due in the event of a breach of the covenant or a default in the payment of a specified amount of

indebtedness due under certain other debt agreements. The Company was in compliance with all such

covenants and provisions for all periods presented.

On April 5, 2010, the Company entered into an Amended and Restated Credit Agreement (the “Credit

Agreement”). The Credit Agreement provides for an extension of the maturity of portions of the senior secured

credit facilities provided under the original credit agreement, which included a five-year revolving credit

facility (the “Revolving Credit Facility”), a five-year term loan (“Term Loan A”) and a six-year term loan

(“Term Loan B”). Under the Credit Agreement, $1,500 of the Revolving Credit Facility was extended until

April 5, 2015 and $500 of Term Loan B was extended until October 5, 2015. The remaining $600 of the

Revolving Credit Facility will expire on June 2, 2011 and the remaining $502 of Term Loan B will mature on

June 2, 2012. The maturity date of Term Loan A was not extended and will mature on June 2, 2011.

The fees and rates in effect on outstanding borrowings under the Credit Agreement are based on the

Company’s current credit ratings. Borrowings under the non-extended portion of the Revolving Credit Facility,

if any, carry an interest rate of LIBOR plus 1.00 percent, borrowings under Term Loan A carry an interest rate

of LIBOR plus 0.875 percent and borrowings under the non-extended portion of Term Loan B carry an interest

rate of LIBOR plus 1.25 percent. Borrowings under the extended portion of the Revolving Credit Facility, if

any, carry an interest rate of LIBOR plus 2.25 percent and borrowings under the extended portion of Term

Loan B carry an interest rate of LIBOR plus 2.75 percent. Facility fees under the non-extended and extended

portions of the Revolving Credit Facility are 0.20 percent and 0.50 percent, respectively. The Company pays

fees of up to 2.50 percent on the outstanding balance of the letters of credit issued under the extended

Revolving Credit Facility. Borrowings under the extended and non-extended term loans may be repaid, in full

or in part, at any time without penalty.

The Credit Agreement reset covenants which are generally less restrictive than the covenants that existed prior

to April 5, 2010. Specifically, the Company must maintain a leverage ratio no greater than 4.25 to 1.0 through

December 30, 2011, 4.0 to 1.0 from December 31, 2011 through December 30, 2012 and 3.75 to 1.0

thereafter. Additionally, the Company must maintain an interest expense coverage ratio of not less than 2.20 to

1.0 through December 30, 2011, 2.25 to 1.0 from December 31, 2011 through December 30, 2012 and 2.30 to

1.0 thereafter.

All obligations under the senior secured credit facilities are guaranteed by each material subsidiary of the

Company. The obligations are also secured by a pledge of the equity interests in those same material

subsidiaries, limited as required by the existing public indentures of the Company, such that the respective

debt issued need not be equally and ratably secured.

In May 2009, the Company amended and extended its 364-day accounts receivable securitization program.

The Company can borrow up to $200 on a revolving basis, with borrowings secured by eligible accounts

receivable, which remain under the Company’s control. The facility fee in effect on February 27, 2010, based

on the Company’s current credit ratings, was 1.00 percent. The Company intends to execute a new $200

program in May 2010.

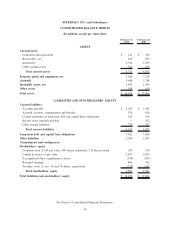

As of February 27, 2010, the Company had $479 of debt with current maturities that are classified in Long-

term debt in the Consolidated Balance Sheets due to the Company’s intent to refinance such obligations with

the Revolving Credit Facility or other long-term debt.

Annual cash dividends declared for fiscal 2010, 2009 and 2008, were $0.6100, $0.6875 and $0.6750 per share,

respectively. In October 2009, the Board of Directors of the Company voted to revise the Company’s dividend

policy, with the expectation of reducing the regular quarterly dividend to $0.0875 per share from $0.175 per

share, effective for the dividend payment to stockholders of record on March 1, 2010. The dividend reduction

would provide annual cash of approximately $75. The Company’s dividend policy will continue to emphasize

a high level of earnings retention for growth.

29