Albertsons 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is listed on the New York Stock Exchange under the symbol SVU. As of

April 16, 2010, there were 26,934 stockholders of record.

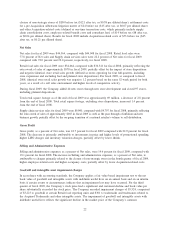

Common Stock Price

2010 2009 2010 2009

Common Stock Price Range Dividends Declared Per Share

Fiscal High Low High Low

First Quarter $ 17.93 $ 13.45 $ 35.91 $ 26.09 $ 0.1725 $ 0.1700

Second Quarter 16.16 12.13 33.65 22.95 0.1750 0.1725

Third Quarter 17.59 13.72 25.70 8.59 0.1750 0.1725

Fourth Quarter 15.88 12.40 20.38 10.52 0.0875 0.1725

Year 17.93 12.13 35.91 8.59 $ 0.6100 $ 0.6875

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to the

Board of Directors approval.

Company Purchases of Equity Securities

The following table sets forth the Company’s purchases of equity securities for the periods indicated:

(in millions, except shares and per share

amounts)

Period

(1)

Total Number

of Shares

Purchased

(2)

Average

Price Paid

Per Share

Total

Number of

Shares

Purchased

as Part of

Publicly

Announced

Treasury

Stock

Purchase

Program

(3)

Approximate

Dollar Value of

Shares that May

Yet be Purchased

Under the

Treasury Stock

Purchase

Program

(3)

First four weeks

December 6, 2009 to January 2, 2010 — $ — — $ 70

Second four weeks

January 3, 2010 to January 30, 2010 10,478 $ 14.48 — $ 70

Third four weeks

January 31, 2010 to February 27, 2010 3,093 $ 14.93 — $ 70

Totals 13,571 $ 14.59 — $ 70

(1) The reported periods conform to the Company’s fiscal calendar composed of thirteen 28-day periods. The

fourth quarter of fiscal 2010 contains three 28-day periods.

(2) These amounts include the deemed surrender by participants in the Company’s compensatory stock plans

of 12,618 shares of previously issued common stock. These are in payment of the purchase price for

shares acquired pursuant to the exercise of stock options and satisfaction of tax obligations arising from

such exercises, as well as from the vesting of restricted stock awards granted under such plans.

(3) On May 28, 2009, the Board of Directors of the Company adopted and announced a new annual share

repurchase program authorizing the Company to purchase up to $70 of the Company’s common stock.

Stock purchases will be made from the cash generated from the settlement of stock options. This annual

authorization program replaced all existing share repurchase programs and continues through June 2010.

16