Albertsons 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

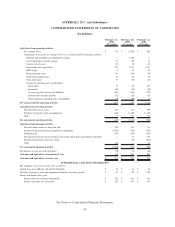

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

February 27,

2010

(52 weeks)

February 28,

2009

(53 weeks)

February 23,

2008

(52 weeks)

Cash flows from operating activities

Net earnings (loss) $ 393 $ (2,855) $ 593

Adjustments to reconcile net earnings (loss) to net cash provided by operating activities:

Goodwill and intangible asset impairment charges — 3,524 —

Asset impairment and other charges 74 169 14

Gain on sale of assets (33) (9) (23)

Depreciation and amortization 957 1,057 1,017

LIFO charge 87830

Deferred income taxes 151 (118) (74)

Stock-based compensation 31 44 52

Other adjustments 27 (25) (15)

Changes in operating assets and liabilities:

Receivables 55 68 103

Inventories 326 (12) (20)

Accounts payable and accrued liabilities (267) (216) (278)

Income taxes currently payable (172) (83) 319

Other changes in operating assets and liabilities (76) (88) 14

Net cash provided by operating activities 1,474 1,534 1,732

Cash flows from investing activities

Proceeds from sale of assets 215 117 195

Purchases of property, plant and equipment (681) (1,186) (1,191)

Other 75528

Net cash used in investing activities (459) (1,014) (968)

Cash flows from financing activities

Proceeds from issuance of long-term debt 943 215 41

Payment of long-term debt and capital lease obligations (1,830) (581) (692)

Dividends paid (147) (145) (142)

Net proceeds from the sale of common stock under option plans and related tax benefits — 11 153

Payment for purchase of treasury shares — (23) (218)

Other (10) — 52

Net cash used in financing activities (1,044) (523) (806)

Net decrease in cash and cash equivalents (29) (3) (42)

Cash and cash equivalents at beginning of year 240 243 285

Cash and cash equivalents at end of year $ 211 $ 240 $ 243

SUPPLEMENTAL CASH FLOW INFORMATION

The Company’s non-cash activities were as follows:

Capital lease asset additions and related obligations $ 10 $ 26 $ 36

Purchases of property, plant and equipment included in Accounts payable $ 69 $ 98 $ 154

Interest and income taxes paid:

Interest paid (net of amount capitalized) $ 538 $ 614 $ 743

Income taxes paid (net of refunds) $ 187 $ 274 $ 107

See Notes to Consolidated Financial Statements.

40