Albertsons 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

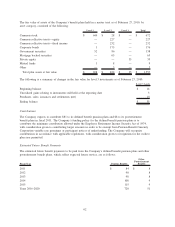

NOTE 11—NET EARNINGS (LOSS) PER SHARE

The following table reflects the calculation of basic and diluted net earnings (loss) per share:

2010 2009 2008

Net earnings (loss) per share—basic:

Net earnings (loss) $ 393 $(2,855) $ 593

Deduct: undistributed net earnings allocable to contingently convertible

debentures — — (2)

Net earnings (loss) available to common stockholders $ 393 $(2,855) $ 591

Weighted average shares outstanding—basic 212 211 211

Net earnings (loss) per share—basic $1.86 $(13.51) $2.80

Net earnings (loss) per share—diluted:

Net earnings (loss) $ 393 $(2,855) $ 593

Interest related to dilutive contingently convertible debentures, net of tax 1 — 1

Net earnings (loss) used for diluted net earnings per share calculation $ 394 $(2,855) $ 594

Weighted average shares outstanding—basic 212 211 211

Dilutive impact of options and restricted stock outstanding 1 — 3

Dilutive impact of convertible securities — — 1

Weighted average shares outstanding—diluted 213 211 215

Net earnings (loss) per share—diluted $1.85 $(13.51) $2.76

Options and restricted stock of 22 shares were outstanding during fiscal 2010 and 2009 and 6 shares were

outstanding during fiscal 2008, but were excluded from the computation of diluted net earnings per share

because they were antidilutive.

NOTE 12—BENEFIT PLANS

Substantially all employees of the Company and its subsidiaries are covered by various contributory and non-

contributory pension, profit sharing or 401(k) plans. Union employees participate in multi-employer retirement

plans under collective bargaining agreements, unless the collective bargaining agreement provides for

participation in plans sponsored by the Company. In addition to sponsoring both defined benefit and defined

contribution pension plans, the Company provides healthcare and life insurance benefits for eligible retired

employees under postretirement benefit plans. The Company also provides certain health and welfare benefits,

including short-term and long-term disability benefits to inactive disabled employees prior to retirement. The

terms of the postretirement benefit plans vary based on employment history, age and date of retirement. For

most retirees, the Company provides a fixed dollar contribution and retirees pay contributions to fund the

remaining cost.

Effective December 31, 2007, the Company authorized amendments to the SUPERVALU Retirement Plan and

certain supplemental executive retirement benefit plans whereby service crediting ended in these plans and no

employees will become eligible to participate in these plans after December 31, 2007. Pay increases will

continue to be reflected in the amount of benefit earned in these plans until December 31, 2012. The

amendments to the plans were accounted for as plan curtailments in fiscal 2008.

Effective January 1, 2009, the Company authorized an amendment to the SUPERVALU Retiree Benefit Plan

to provide for certain insured Medicare benefits. The result of this amendment was a reduction in the other

postretirement benefit obligation of $37 with a corresponding decrease to other comprehensive loss, net of tax.

57