Albertsons 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 2—GOODWILL AND INTANGIBLE ASSETS

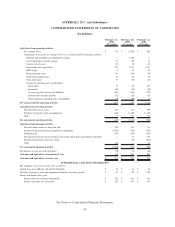

Changes in the Company’s Goodwill and Intangible assets consisted of the following:

February 23,

2008 Additions Impairments

Other net

adjustments

February 28,

2009 Additions Impairments

Other net

adjustments

February 27,

2010

Goodwill:

Retail food goodwill $6,152 $— $ — $ 12 $ 6,164 $— $— $(50) $ 6,114

Accumulated

impairment losses — — (3,223) — (3,223) — — — (3,223)

Total Retail food

goodwill, net 6,152 — (3,223) 12 2,941 — — (50) 2,891

Supply chain services

goodwill 805 — — 2 807 — — — 807

Total goodwill $6,957 $— $ (3,223) $ 14 $ 3,748 $— $— $(50) $ 3,698

February 23,

2008

Additions/

Amortization Impairments

Other net

adjustments

February 28,

2009

Additions/

Amortization Impairments

Other net

adjustments

February 27,

2010

Intangible assets:

Trademarks and

tradenames—

indefinite useful lives $1,370 $ — $ (301) $ — $1,069 $ — $(20) $ — $1,049

Favorable operating

leases, customer lists,

customer relationships

and other

(accumulated

amortization of $238

and $197, as of

February 27, 2010

and February 28,

2009, respectively) 717 14 — (25) 706 8 — (40) 674

Non-compete

agreements

(accumulated

amortization of $5

and $4 as of

February 27, 2010

and February 28,

2009, respectively) 15 1 — (6) 10 1 — 2 13

Total intangible assets 2,102 15 (301) (31) 1,785 9 (20) (38) 1,736

Accumulated amortization (150) (65) — 14 (201) (59) — 17 (243)

Total intangible assets, net $1,952 $1,584 $1,493

As a result of the planned retail market exits, as of February 27, 2010 the Company reclassified $36 of

Goodwill and $79 of Property, plant, and equipment and other intangible assets to assets held for sale. Assets

held for sale is a component of Other current assets in the Consolidated Balance Sheets. Also, the Company

recorded the sale of assets, which included $14 of Goodwill, and impairment charges of $20 to its trademarks

and tradenames.

During fiscal 2009, the Company recorded impairment charges of $3,524, comprised of $3,223 to goodwill at

certain Retail food reporting units and $301 to trademarks and tradenames related to the tradenames acquired

in the New Albertsons, Inc. acquisition.

Amortization expense of intangible assets with definite useful lives of $59, $65 and $55 was recorded in fiscal

2010, 2009 and 2008, respectively. Future amortization expense will be approximately $46 per year for each

of the next five years.

46