Albertsons 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

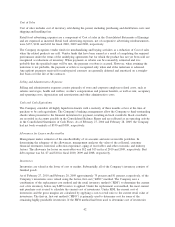

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company is exposed to market pricing risk consisting of interest rate risk related to debt obligations

outstanding, its investment in notes receivable and, from time to time, derivatives employed to hedge interest

rate changes on variable and fixed rate debt. The Company does not use financial instruments or derivatives

for any trading or other speculative purposes.

The Company manages interest rate risk through the strategic use of fixed and variable rate debt and, to a

limited extent, derivative financial instruments. Variable interest rate debt (bank loans, industrial revenue bonds

and other variable interest rate debt) is utilized to help maintain liquidity and finance business operations.

Long-term debt with fixed interest rates is used to assist in managing debt maturities and to diversify sources

of debt capital.

The Company makes long-term loans to certain Supply chain customers and as such, holds notes receivable in

the normal course of business. The notes generally bear fixed interest rates negotiated with each retail

customer. The market value of the fixed rate notes is subject to change due to fluctuations in market interest

rates.

The table below provides information about the Company’s financial instruments that are sensitive to changes

in interest rates, including notes receivable and debt obligations. For debt obligations, the table presents

principal payments and related weighted average interest rates by maturity dates, excluding the net discount on

acquired debt and original issue discounts. For notes receivable, the table presents the expected collection of

principal cash flows and weighted average interest rates by expected maturity dates.

Fair

Value Total 2011 2012 2013 2014 2015 Thereafter

February 27, 2010 Aggregate payments by fiscal year

Summary of Financial Instruments

(In millions, except rates)

Notes receivable

Principal receivable $ 48 $ 49 $ 14 $ 6 $ 13 $ 3 $ 7 $ 6

Average rate receivable 6.8% 6.5% 8.3% 5.6% 8.0% 6.7% 8.2%

Debt with variable interest rates

Principal payments $ 1,404 $ 1,444 $ 123 $ 309 $ 984 $ 10 $ 18 $ —

Average variable rate 1.4% 1.1% 1.2% 1.5% 0.3% 0.3% —%

Debt with fixed interest rates

Principal payments $ 4,910 $ 5,182 $ 856 $ 12 $ 308 $ 235 $ 490 $ 3,281

Average fixed rate 7.6% 7.6% 6.1% 7.5% 7.1% 7.5% 7.7%

32