Aetna 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Page 4

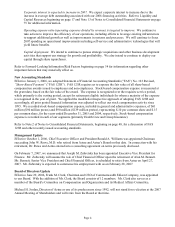

Corporate interest is expected to increase in 2007. We expect corporate interest to increase due to the

increase in average debt outstanding associated with our 2006 financing activities. Refer to Liquidity and

Capital Resources beginning on page 17 and Note 13 of Notes to Consolidated Financial Statements on page

75 for additional information.

Operating expense ratio (operating expenses divided by revenue) is targeted to improve. We continue to

take actions to improve the efficiency of our operations, including efforts to leverage existing infrastructure

to support additional growth as well as improvements in systems and processes. We will continue to focus

2007 spending on operational improvements including self-service and administrative technologies that will

yield future benefits.

Capital deployment. We intend to continue to pursue strategic acquisitions and other business development

activities that support our strategy for growth and profitability. We also intend to continue to deploy our

capital through share repurchases.

Refer to Forward-Looking Information/Risk Factors beginning on page 34 for information regarding other

important factors that may materially affect us.

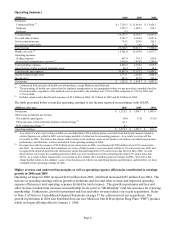

New Accounting Standards

Effective January 1, 2006, we adopted Statement of Financial Accounting Standards (“FAS”) No. 123 Revised,

“Share-Based Payment” (“FAS 123R”). FAS 123R requires us to expense the fair value of all share-based

compensation awards issued to employees and non-employees. Stock-based compensation expense is measured at

the grant date, based on the fair value of the award. The expense is recognized over the requisite service period,

which primarily is the vesting period, except for retirement eligible individuals for whom a majority of the expense

is recognized in the year of grant. We applied the modified-retrospective approach of adopting FAS 123R and

accordingly, all prior period financial information was adjusted to reflect our stock compensation activity since

1995. We recorded stock-based compensation expense, included in general and administrative expenses, of $61

million ($94 million pretax) and $90 million ($139 million pretax), representing $.10 per common share and $.15

per common share, for the years ended December 31, 2005 and 2004, respectively. Stock-based compensation

expense is recorded in each of our segments (primarily Health Care and Group Insurance).

Refer to Note 2 of Notes to Consolidated Financial Statements, beginning on page 48, for a discussion of FAS

123R and other recently issued accounting standards.

Management Update

Effective October 1, 2006, Chief Executive Officer and President Ronald A. Williams was appointed Chairman

succeeding John W. Rowe, M.D. who retired from Aetna and Aetna’ s Board on that date. In connection with his

retirement, Dr. Rowe and Aetna entered into a consulting agreement on terms previously disclosed.

On February 7, 2007, we announced that Joseph M. Zubretsky has been appointed Executive Vice President for

Finance. Mr. Zubretsky will assume the role of Chief Financial Officer upon the retirement of Alan M. Bennett.

Mr. Bennett, Senior Vice President and Chief Financial Officer, is scheduled to retire from Aetna on April 27,

2007. Mr. Zubretsky is expected to commence his employment with us on February 28, 2007.

Board of Directors Update

Effective June 29, 2006, Frank M. Clark, Chairman and CEO of Commonwealth Edison Company, was appointed

to our Board. With the addition of Mr. Clark, the Board consists of 12 members. Mr. Clark also serves as a

member of the Board’ s Committee on Compensation and Organization and its Medical Affairs Committee.

Michael H. Jordan, Director of Aetna or one of its predecessors since 1992, will not stand for re-election at the 2007

Annual Meeting of Shareholders and will retire from the Board at that time.