Aetna 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Page 3

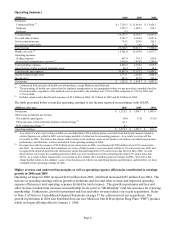

During 2005 and 2006, we managed our capital in support of both new and ongoing initiatives.

During 2006 and 2005, we used substantial capital to repurchase our common stock, make voluntary contributions

to our tax qualified pension plan and fund targeted acquisitions in support of our strategy.

In 2006 and 2005, we repurchased approximately 60 million and 42 million shares of common stock at a cost of

approximately $2.3 billion and $1.7 billion, respectively, under share repurchase programs authorized by our Board

of Directors (the “Board”).

Over the past two years, we have continued to invest in the development of our business by acquiring companies

that support our strategy as well as continuing the introduction or enhancement of new products and services.

In 2006, we acquired a disability and leave management business for approximately $161 million. In 2005, we

completed five acquisitions for approximately $1.2 billion, expanding our Health Care product offerings to include

group limited benefit plans, as well as other specialty product offerings including specialty pharmacy services,

medical management and data analytics services, behavioral health plans and products that provide access to our

provider network in certain markets. The acquisitions in 2006 and 2005 were funded with available cash. Refer to

Note 3 of Notes to Consolidated Financial Statements on page 57 for additional information on our recent

acquisition activity.

Also during 2006 and 2005, we continued development of our consumer-directed health care plan products, such as

the Aetna HealthFund® and HSA products, and our web based tools to support consumerism and transparency and

made changes to our other health products and medical management programs, including the launch of our new

Medicare Part D prescription drug program.

In addition during each of 2006 and 2005, we made a $245 million voluntary cash contribution to our tax qualified

pension plan.

In June 2006, we issued $2.0 billion of senior notes, the proceeds of which were used to redeem our 8.5% senior

notes, to repay approximately $400 million of commercial paper borrowings and for general corporate purposes,

including share repurchases. Refer to Liquidity and Capital Resources beginning on page 17 and Note 13 of Notes

to Consolidated Financial Statements on page 75 for additional information.

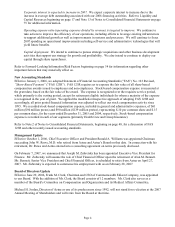

Outlook for 2007

Our goals for 2007 are to profitably grow market share in targeted geographic areas and customer bases; to

profitably grow operating earnings; to demonstrate superior medical cost, quality and clinical integration for our

customers; to achieve competitive operating expenses; to use technology to enhance our competitive position; and

to deliver best-in-class service for all our constituents. Our 2007 outlook is as follows:

Health Care membership is targeted for growth in 2007. We continue to take actions to increase

membership, including efforts to reach customers via an integrated product approach in generating sales to

new customers, as well as increased cross-sell penetration within our existing membership base and targeted

geographic marketing, to achieve membership growth in 2007. We expect this membership growth to be a

combination of both ASC and Risk medical members. If we achieve these projected membership increases

combined with price increases, it would contribute to higher revenue in our Health Care segment.

Group Insurance operating earnings are expected to remain generally level with 2006. We expect Group

Insurance operating earnings in 2007 to be generally level with those of 2006.

Large Case Pensions earnings are expected to reflect continued run-off of the business. We expect

operating earnings in our Large Case Pensions segment to be lower than in 2006, consistent with the

continued run-off of underlying liabilities and assets. However, operating earnings for Large Case Pensions

can vary from current expectations depending on, among other matters, future investment performance of

the assets supporting existing liabilities.