Aetna 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

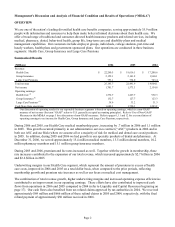

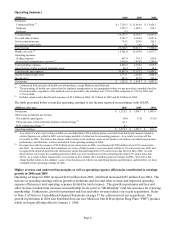

The table presented below reconciles operating earnings to net income reported in accordance with GAAP:

(Millions, after tax) 2006 2005 2004

Net income 133.9$ 136.4$ 143.1$

Other items included in net income:

Net realized capital gains (7.4) (8.7) (19.8)

Acquisition-related software charge

(1)

6.2 - -

Operating earnings 132.7$ 127.7$ 123.3$

(1) As a result of the acquisition of Broadspire Disability in 2006 (refer to Note 3 of Notes to Consolidated Financial Statements on

page 57), we acquired certain software which eliminated the need for similar software we had been developing internally. As a

result, we ceased our own software development and impaired amounts previously capitalized, resulting in a $6.2 million ($8.3

million pretax) charge to net income, reflected in general and administrative expenses for 2006. This charge does not reflect the

underlying business performance of Group Insurance, and therefore, we have excluded it from operating earnings in 2006.

Operating earnings for 2006 increased $5 million, compared to 2005, reflecting higher fees and other revenue and a

lower benefit cost ratio partially offset by higher general and administrative expenses. The 2006 growth in fees and

other revenue and general and administrative expenses primarily related to the March 2006 acquisition of

Broadspire Disability (refer to Note 3 of Notes to Consolidated Financial Statements beginning on page 57). Our

Group Insurance benefit cost ratios were 93.5% for 2006, 94.7% for 2005 and 94.2% for 2004. The decrease in our

benefit cost ratio for 2006 was primarily due to a decrease in our disability benefit cost ratio due to favorable

experience.

Operating earnings for 2005 increased $4 million, compared to 2004, reflecting higher premiums from increased

membership and higher net investment income (primarily due to the receipt of mortgage loan prepayment fees),

substantially offset by a higher benefit cost ratio and operating expenses. Operating expenses increased in 2005

primarily due to higher employee related costs and selling expenses associated with higher premium revenue.

Net realized capital gains for 2006 were due primarily to gains on sales of debt securities and real estate gains. Net

realized capital gains for 2005 were due primarily to real estate gains, gains on sales of debt securities in a low

interest rate environment and recoveries from investments previously written-down, partially offset by losses from

futures contracts used for correlating the maturities of invested assets with the payment of expected liabilities. Net

realized capital gains for 2004 were due primarily to gains on sales of debt securities in a low interest rate

environment and gains on the sale of certain real estate investments partially offset by losses from the write-down of

other invested assets.

Membership

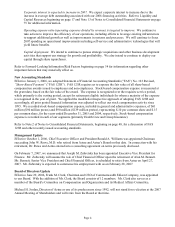

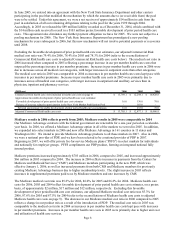

Group Insurance’s membership as of December 31, 2006 and 2005 was as follows:

(Thousands) 2006 2005

Life 10,070 10,812

Disability

(1)

4,801 2,571

Long-term care 216 235

Total 15,087 13,618

(1) Includes approximately 2.1 million members acquired in the Broadspire Disability acquisition on March 31, 2006.

Total Group Insurance membership as of December 31, 2006 increased by approximately 1.5 million members,

compared to December 31, 2005. New membership in Group Insurance was 4.2 million and 1.5 million for 2006

and 2005, respectively. Lapses and in-force membership reductions were 2.7 million for 2006, compared to 1.4

million for 2005. The increase in Group Insurance membership was primarily due to the Broadspire Disability

acquisition partially offset by lapses in several large life cases.

LARGE CASE PENSIONS

Large Case Pensions manages a variety of retirement products (including pension and annuity products) primarily

for tax qualified pension plans. These products provide a variety of funding and benefit payment distribution

options and other services. The Large Case Pensions segment includes certain discontinued products.

Page 11