Aetna 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

General account assets supporting experience-rated products (where the contract holder, not us, assumes investment

and other risks subject to, among other things, certain minimum guarantees) may be subject to contract holder or

participant withdrawals. For the years ended December 31, 2006, 2005 and 2004, experience-rated contract holder

and participant-directed withdrawals were as follows:

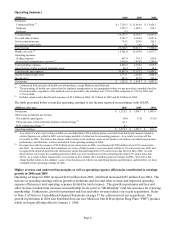

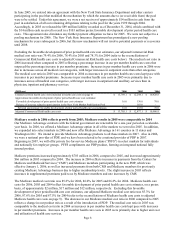

(Millions) 2006 2005 2004

Scheduled contract maturities and benefit payments

(1)

361.3$ 379.6$ 731.5$

Contract holder withdrawals other than scheduled contract maturities and benefit payments

(2)

202.2 45.6 81.9

Participant-directed withdrawals

(2)

16.9 18.4 25.7

(1) Includes payments made upon contract maturity and other amounts distributed in accordance with contract schedules.

(2) Approximately $515.5 million, $674.4 million and $638.7 million at December 31, 2006, 2005 and 2004, respectively, of

experience-rated pension contracts allowed for unscheduled contract holder withdrawals, subject to timing restrictions and formula-

based market value adjustments. Further, approximately $127.8 million, $312.4 million and $339.0 million at December 31, 2006,

2005 and 2004, respectively, of experience-rated pension contracts supported by general account assets could be withdrawn or

transferred to other plan investment options at the direction of plan participants, without market value adjustment, subject to plan,

contractual and income tax provisions.

Discontinued Products

We discontinued the sale of our fully guaranteed large case pension products (single-premium annuities (“SPAs”)

and guaranteed investment contracts (“GICs”)) in 1993. We established a reserve for anticipated future losses on

these products based on the present value of the difference between the expected cash flows from the assets

supporting these products and the cash flows expected to be required to meet our obligations under these products.

Results of operations of discontinued products, including net realized capital gains (losses), are credited (charged)

to the reserve for anticipated future losses. Our results of operations would be adversely affected to the extent that

future losses on discontinued products are greater than anticipated and favorably affected to the extent future losses

are less than anticipated.

The factors contributing to changes in the reserve for anticipated future losses are: operating income or loss

(including mortality and retirement gains or losses) and realized capital gains or losses. Operating income or loss is

equal to revenue less expenses. Realized capital gains or losses reflect the excess (deficit) of sales price over

(below) the carrying value of assets sold and any other-than-temporary impairments. Mortality and retirement

gains or losses reflect our experience related to SPAs. A mortality gain (loss) occurs when an annuitant or a

beneficiary dies sooner (later) than expected. A retirement gain (loss) occurs when an annuitant retires later

(earlier) than expected.

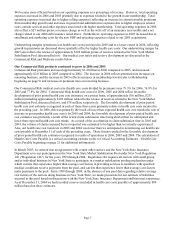

The results of discontinued products for the years ended December 31, 2006, 2005 and 2004 were as follows:

(Millions) 2006 2005 2004

Interest margin (deficit)

(1)

6.3$ (12.1)$ (23.1)$

Net realized capital gains 25.1 14.3 24.4

Interest earned on receivable from continuing products 18.8 19.9 19.6

Other, net 9.7 9.2 9.2

Results of discontinued products, after tax 59.9$ 31.3$ 30.1$

Results of discontinued products, pretax 80.6$ 39.1$ 44.0$

Net realized capital gains from bonds, after tax (included above) 14.7$ 6.4$ 12.8$

(1) The interest margin (deficit) is the difference between earnings on invested assets and interest credited to contract holders.

The interest margin for 2006 compared to the interest deficit for 2005 was primarily due to higher limited

partnership income in 2006. The interest deficit for 2005 decreased compared to 2004, primarily due to lower

interest credited to contract holders as liabilities declined.

Page 13