Aetna 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006

Aetna Annual Report,

Financial Report to Shareholders

Table of contents

-

Page 1

2006 Aetna Annual Report, Financial Report to Shareholders -

Page 2

-

Page 3

... new accounting standards and significant changes to our management and Board of Directors. 5 Health Care - We provide a quantitative and qualitative discussion about the factors affecting Health Care revenues and operating earnings in this section. 10 Group Insurance - We provide a quantitative... -

Page 4

... consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life, long-term care and disability plans and medical management capabilities. Our customers include employer groups, individuals, college students, part-time and hourly... -

Page 5

...as other specialty product offerings including specialty pharmacy services, medical management and data analytics services, behavioral health plans and products that provide access to our provider network in certain markets. The acquisitions in 2006 and 2005 were funded with available cash. Refer to... -

Page 6

...recorded in each of our segments (primarily Health Care and Group Insurance). Refer to Note 2 of Notes to Consolidated Financial Statements, beginning on page 48, for a discussion of FAS 123R and other recently issued accounting standards. Management Update Effective October 1, 2006, Chief Executive... -

Page 7

.../or dental coverage, subject to a deductible, with an accumulating benefit account. Health Care also offers specialty products, such as medical management and data analytics services, behavioral health plans and stop loss insurance, as well as products that provide access to our provider network in... -

Page 8

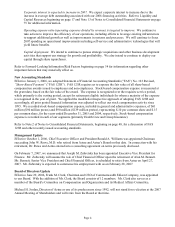

... of health care costs related to capitated arrangements (a fee arrangement where we pay providers a monthly fixed fee for each member, regardless of the medical services provided to the member) was 5.9% for 2006 compared to 7.9% for 2005 and 9.1% for 2004. Includes salaries and related benefit... -

Page 9

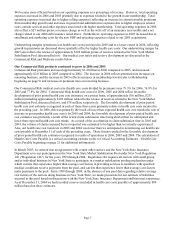

... in general and administrative expenses due to higher employee related costs, outside services and other expenses associated with higher membership. Total operating expenses in 2006 also reflect a $27 million pretax severance charge as well as the write off of an insurance recoverable and a net... -

Page 10

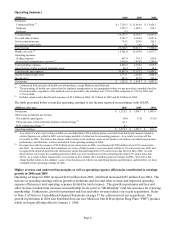

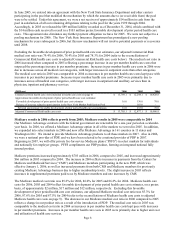

..., in 2005 we released the $89 million liability recorded as of December 31, 2004, which combined with the $14 million cash received to result in a $103 million pretax favorable development of prior period health care costs. This agreement also eliminates any further payment obligation we have for... -

Page 11

...) Medical: Commercial Medicare Advantage Medicare Health Support Program (1) Medicaid Total Medical Membership Consumer-Directed Health Plans (2) Dental Pharmacy: Commercial Medicare PDP (stand-alone) Medicare Advantage PDP Total Pharmacy Benefit Management Services Mail Order (3) Total Pharmacy... -

Page 12

...: Life Disability Long-term care Total premiums Fees and other revenue Net investment income Net realized capital gains Total revenue Current and future benefits Operating expenses: Selling expenses General and administrative expenses (1) Total operating expenses Amortization of other acquired... -

Page 13

... Large Case Pensions manages a variety of retirement products (including pension and annuity products) primarily for tax qualified pension plans. These products provide a variety of funding and benefit payment distribution options and other services. The Large Case Pensions segment includes certain... -

Page 14

... management in 2006 primarily reflects additional deposits to fund guaranteed benefits. The increases in non-guaranteed assets under management in 2006 and 2005 primarily reflect additional deposits and investment appreciation. The table presented below reconciles operating earnings to net income... -

Page 15

... transferred to other plan investment options at the direction of plan participants, without market value adjustment, subject to plan, contractual and income tax provisions. Discontinued Products We discontinued the sale of our fully guaranteed large case pension products (single-premium annuities... -

Page 16

...gains on futures contracts. Net realized capital gains for 2004 reflect gains on sales of debt securities in a low interest rate environment, receipt of mortgage loan equity participations, gain on the sale of a real estate investment and gains from futures contracts. The activity in the reserve for... -

Page 17

...) Debt securities available for sale: Available for use in current operations Loaned securities On deposit, as required by regulatory authorities Debt securities available for sale Equity securities available for sale Short-term investments Mortgage loans Other investments Total investments Current... -

Page 18

... Equity Securities," FASB Staff Position FAS 115-1 and FAS 124-1, "The Meaning of Other-ThanTemporary Impairment and its Application to Certain Investments," ("FSP 115-1") and the Securities and Exchange Commission' s Staff Accounting Bulletin No. 59, "Accounting for Noncurrent Marketable & Equities... -

Page 19

... overall cash flows from premiums, deposits and income received on investments. We monitor the duration of our portfolio of debt securities (which is highly marketable) and mortgage loans, and execute purchases and sales of these investments with the objective of having adequate funds available to... -

Page 20

...of certain Internal Revenue Service audits associated with businesses previously sold by our former parent company (refer to Note 21 of Notes to Consolidated Financial Statements on page 88 for additional information). The cash flows provided by operating activities for 2005 also include payments of... -

Page 21

... future services provided under fee-for-service arrangements and the level of future membership levels for capitated arrangements). We believe that funds from future operating cash flows, together with cash, investments and other funds available under our credit agreements or from public or private... -

Page 22

... of the related cash flows is unpredictable due to contract holder discretion. Future policy benefits consist primarily of reserves for limited payment pension and annuity contracts in our Large Case Pensions business and long-duration group paid-up life and long-term care insurance contracts in... -

Page 23

... credit ratings of Aetna Inc. and Aetna Life Insurance Company ("ALIC") from the respective nationally recognized statistical rating organizations ("Rating Agencies") were as follows: Moody's Investors Service A3 P-2 Standard & Poor's AA-2 Aetna Inc. (senior debt) (1) Aetna Inc. (commercial paper... -

Page 24

...per member utilization and per unit costs. Changes in health care practices, inflation, new technologies, increases in the cost of prescription drugs, direct-to-consumer marketing by pharmaceutical companies, clusters of high cost cases, changes in the regulatory environment, health care provider or... -

Page 25

... million of reserves related to the New York Market Stabilization Pool), respectively (refer to Health Care beginning on page 5 and Note 6 of Notes to Consolidated Financial Statements on page 58 for additional information). During 2006, our claim submission and processing times were consistent with... -

Page 26

... health care costs payable for benefit claims related to our Group Insurance segment. We refer to these liabilities as other insurance liabilities. These liabilities relate to our life, disability and long-term care products. Life and Disability The liabilities for our life and disability products... -

Page 27

... million in reserves for life claims incurred but not yet reported to us. Long-term Care We establish a reserve for future policy benefits for our long-term care products at the time each policy is issued based on the present value of future benefit payments less the present value of future premiums... -

Page 28

...for 2005. Our expected return on pension plan assets is based on asset range allocations assumptions of 60% - 70% U.S. and international public and private equity securities, 20% - 30% fixed income securities and 5% - 15% real estate and other assets. We regularly review actual asset allocations and... -

Page 29

... expense. Our expected return on plan assets and discount rate discussed above will not affect the cash contributions we are required to make to our pension and OPEB plans because we have met all minimum funding requirements set forth by the Employee Retirement Income Security Act of 1974 ("ERISA... -

Page 30

... Accounts) Our revenue is principally derived from premiums and fees billed to customers in the Health Care and Group Insurance businesses. In Health Care, revenue is recognized based on customer billings, which reflect contracted rates per employee and the number of covered employees recorded... -

Page 31

... Eligibility requirements Service areas Market conduct Utilization review activities Payment of claims, including timeliness and accuracy of payment Member rights and responsibilities Sales and marketing activities Quality assurance procedures Disclosure of medical and other information Provider... -

Page 32

... and Accountability Act of 1996 ("HIPAA") generally requires insurers and other carriers that write small business in any market to accept for coverage any small employer group applying for a basic and standard plan of benefits. HIPAA also mandates guaranteed renewal of health care coverage for... -

Page 33

...the terms and conditions of that plan). Imposing payment level limits for out-of-network care. Exempting physicians from the antitrust laws that prohibit price fixing, group boycotts and other horizontal restraints on competition. Restricting health plan claim processing, review, payment and related... -

Page 34

... coverage determinations. We cannot predict whether these measures will be enacted into law in 2007 or what form any such legislation might take. ERISA The provision of services to certain employee benefit plans, including certain Health Care, Group Insurance and Large Case Pensions benefit plans... -

Page 35

... transactions and general business operations. In addition, various notice or prior regulatory approval requirements apply to transactions between insurance companies, HMOs and their affiliates within an insurance holding company system, depending on the size and nature of the transactions... -

Page 36

...our core insured membership (including strategies to increase membership for targeted product types and customers, such as commercial or public sector business) could materially adversely affect our results of operations. Competitive factors and ongoing changes in the health benefits industry create... -

Page 37

...and retain membership is dependent upon providing quality customer service operations (such as call center operations, claim processing, mail order pharmacy prescription delivery, specialty pharmacy prescription delivery and customer case installation) that meet or exceed our customers' expectations... -

Page 38

... operating results. Various factors particular to the health and related benefits industry including, among others, the rapid evolution of the business model, shifts in public policy, consumerism, pricing actions by competitors, competitor consolidation and a shrinking number of commercially insured... -

Page 39

... things, addressing rising medical costs, achieving profitable membership growth, further improving the efficiency of our operations, managing certain significant technology projects, further improving relations with health care providers, negotiating customer or provider contracting changes, and... -

Page 40

... other human resource management techniques are not aligned with our strategic objectives. Epidemics, pandemics, terrorists attacks, natural disasters or other extreme events or the continued threat of these extreme events could materially increase health care utilization, pharmacy costs, life and... -

Page 41

..., we are dispensing medications at our mail order and specialty pharmacies directly to members. In addition, we are party to a number of lawsuits, certain of which are purported to be class actions. The majority of these cases relate to the conduct of our health care business and allege various... -

Page 42

...risk, to acquire attractive companies. General market conditions affect our investments in debt and equity securities, mortgage loans and other investments and our income on those investments. As an insurer, we have substantial investment portfolios of assets that support our policy liabilities. The... -

Page 43

... mechanisms related to employee compliance with internal policies, including data system security, and/or unethical conduct by managers and/or employees; • Health benefits provider fraud that is not prevented or detected and impacts our medical costs or those of our self-insured customers; and... -

Page 44

... data) Revenue Income from continuing operations Net income (loss) Net realized capital gains, net of tax Assets Short-term debt Long-term debt Shareholders' equity Per common share data: Dividends declared Earnings (loss) per share: Income from continuing operations: Basic Diluted Net income (loss... -

Page 45

...$ 1.79 1.64 3.43 * Fees and other revenue includes administrative services contract member co-payment revenue and plan sponsor reimbursements related to our mail order and specialty pharmacy operations of $38.0 million, $21.3 million and $14.7 million (net of pharmaceutical and processing costs of... -

Page 46

..., net Deferred income taxes Other long-term assets Separate Accounts assets Total assets Liabilities and shareholders' equity Current liabilities: Health care costs payable Future policy benefits Unpaid claims Unearned premiums Policyholders' funds Collateral payable under securities loan agreements... -

Page 47

... losses on securities * Net foreign currency losses Net derivative gains * Pension liability adjustment Other comprehensive loss: Total comprehensive income Adjustment to initially recognize the funded status of pension and OPEB plans (Note 2) Common shares issued for benefit plans, including tax... -

Page 48

...Cash flows from financing activities: Net issuance of short-term debt Proceeds from issuance of long-term debt, net of issuance costs Repayment of long-term debt Deposits and interest credited for investment contracts Withdrawals of investment contracts Common shares issued under benefit plans Stock... -

Page 49

... business segments: • Health Care consists of medical, pharmacy benefits management, dental and vision plans offered on both a Risk basis (where we assume all or a majority of the risk for medical and dental care costs) and an employer-funded basis (where the plan sponsor under an administrative... -

Page 50

... appreciation rights, restricted stock units and other stock-based awards) issued to employees and non-employees, eliminating the alternative of measuring such awards using the intrinsic value method. FAS 123R requires the fair value to be calculated using a quoted market price or a valuation model... -

Page 51

... equal to the difference between the fair value of plan assets and the benefit obligation as of the latest measurement date, which we refer to as the plan' s funded status. The difference between each plan' s funded status and its existing balance sheet position prior to the adoption of FAS 158 is... -

Page 52

... FASB Staff Position ("FSP") No. FAS 115-1 and FAS 124-1, "The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments." An impairment of an investment occurs when the fair value of the investment is less than its amortized cost. This FSP provides accounting guidance... -

Page 53

...: Health Care Costs Payable, Other Insurance Liabilities, Recoverability of Goodwill and Other Intangible Assets, Measurement of Defined Benefit Pension and Other Postretirement Benefit Plans, Other-Than-Temporary Impairment of Investment Securities and Revenue Recognition. We use information... -

Page 54

... reflected in shareholders' equity, net of related income taxes, as a component of accumulated other comprehensive income. We reflect purchases and sales of debt and equity securities on the trade date. We reflect purchases and sales of mortgage loans and investment real estate on the closing date... -

Page 55

...enter into agreements with other insurance companies under which we assume reinsurance, primarily related to our group life and health products (refer to Note 17 beginning on page 78 for additional information). We do not transfer any portion of the financial risk associated with our HMO products to... -

Page 56

... providers and consider claims experience under the contracts through the balance sheet date. Future policy benefits consist primarily of reserves for limited payment pension and annuity contracts in the Large Case Pensions business and long-duration group life and long-term care insurance contracts... -

Page 57

... revenue for group life, long-term care and disability products is recognized as income, net of allowances for termination and uncollectable accounts, over the term of the coverage. Other premium revenue for Large Case Pensions' limited payment pension and annuity contracts is recognized as revenue... -

Page 58

... for self-insured health and disability members and are recognized as revenue over the period the service is provided. Some of our contracts include guarantees with respect to certain functions such as customer service response time, claim processing accuracy and claim processing turnaround time, as... -

Page 59

... were funded with available cash. • Broadspire Disability operates as a third party administrator, offering absence management services, including short and long-term disability administration and leave management, to employers. We acquired Broadspire Disability from Broadspire Services, Inc... -

Page 60

... reduce general and administrative expenses. Salaries and related benefits for 2004 include a curtailment benefit of $31.8 million related to the elimination of the dental subsidy for all retirees. 6. Health Care Costs Payable The following table shows the components of the change in health care... -

Page 61

... assets: Provider networks Customer lists Technology Other Trademarks Total other acquired intangible assets 2005 Other acquired intangible assets: Customer lists Provider networks Technology Other Trademarks Total other acquired intangible assets (1) Cost Accumulated Amortization Net Balance... -

Page 62

... Long-term (1) (Millions) Debt securities available for sale: Available for use in current operations Loaned securities On deposit, as required by regulatory authorities Debt securities available for sale Equity securities available for sale Short-term investments Mortgage loans Other investments... -

Page 63

... commercial mortgage loan securitization that we retained. Net realized capital gains and losses on debt securities supporting our discontinued products and experience-rated products generally do not impact our results of operations (refer to Note 2 beginning on page 48 for additional information... -

Page 64

...related fair value, aggregated by the length of time the investments have been in an unrealized loss position: Less than 12 months Fair Unrealized Value Losses Greater than 12 months (1) Fair Unrealized Value Losses Total Fair Unrealized Value Losses (Millions) 2006 Debt securities: U.S. government... -

Page 65

...fund partnerships had total assets of approximately $70 billion and $123 million at December 31, 2006 and 2005, respectively. Net Investment Income Sources of net investment income in 2006, 2005 and 2004 were as follows: (Millions) Debt securities Mortgage loans Cash equivalents and other short-term... -

Page 66

... realized capital gains and losses on investments supporting Group Insurance and Health Care liabilities and Large Case Pensions products (other than experience-rated and discontinued products) are reflected in our results of operations. The components of such net realized capital gains (losses) in... -

Page 67

... the funded status of pension and OPEB plans Balance at December 31, 2006 (1) (1) (2) (2) The amount recognized reflects the $8.8 million pretax charge to record the minimum pension liability adjustment of the pension plan in accordance with the provisions of FAS 87, "Employers' Accounting for... -

Page 68

... related to the audits, and we are currently reviewing them. The proposed adjustments are not material to our financial position or results of operations. In 2004, the IRS commenced an audit of our 2002 and 2003 tax returns and a limited examination of our 2001 life insurance subsidiary tax return... -

Page 69

... medical, dental and life insurance benefits for retired employees, including those of our former parent company. A comprehensive medical plan is offered to all full-time employees who terminate employment at age 45 or later with at least five years of service. We provide subsidized health benefits... -

Page 70

... payments for each plan. The following table reconciles the beginning and ending balances of the fair value of plan assets during 2006 and 2005 for the pension and OPEB plans: (Millions) Fair value of plan assets, beginning of year Actual return of plan assets Employer contributions Benefits paid... -

Page 71

... asset or liability for each of our pension and OPEB plans equal to the plan' s funded status. The difference between each plan' s funded status and its existing balance sheet position is recognized net of tax as a component of accumulated other comprehensive income. Prior to the adoption of FAS 158... -

Page 72

...retirees, as discussed above. The weighted average assumptions used to determine net periodic benefit cost (income) in 2006, 2005 and 2004 for the pension and OPEB plans were as follows: Pension Plans 2005 6.00% 8.75 3.00 OPEB Plans 2005 6.00% 6.50 - Discount rate Expected long-term return on plan... -

Page 73

Our pension plans invest in a diversified mix of traditional asset classes. Investments in U.S. and international equity securities, fixed income securities, real estate and cash are intended to maximize long-term returns while recognizing the need for adequate liquidity to meet on-going benefit and... -

Page 74

... the Plans. Executive, middle management and non-management employees may be granted stock options, SARs and RSUs. Stock options are granted to purchase our common stock at or above the market price on the date of grant. SARs granted will be settled in stock, net of taxes, based on the appreciation... -

Page 75

... no SARs transactions prior to January 1, 2006. During 2006, 2005 and 2004, the following activity occurred under the Plans: (Millions) Cash received from stock option exercises Intrinsic value (the excess of stock price on the date of exercise over the exercise price) (1) Tax benefits realized for... -

Page 76

...also have an Employee Stock Purchase Plan (the "ESPP"). Activity related to the ESPP was not material to us in 2006, 2005 or 2004. Performance Units - During 2005 and 2004, we granted performance unit awards to certain executives as part of a long-term incentive program. The value of the performance... -

Page 77

...31, 2006. We paid $159 million, $121 million and $104 million in interest in 2006, 2005 and 2004, respectively. In addition, at December 31, 2006, certain of our subsidiaries have a one-year $45 million variable funding credit program with a bank to provide short-term liquidity to those subsidiaries... -

Page 78

... declared an annual cash dividend of $.04 per common share to shareholders of record at the close of business on November 15, 2006. The $21 million dividend was paid on November 30, 2006. In addition to the capital stock disclosed on the Consolidated Balance Sheets, we have authorized 7.6 million... -

Page 79

... based on quoted market prices or dealer quotes. Non-traded debt securities are priced independently by a third party vendor and non-traded equity securities are priced based on our internal analysis of the investment' s financial statements and cash flow projections. Mortgage loans: Fair values are... -

Page 80

...Surplus Our business operations are conducted through subsidiaries that principally consist of HMOs and insurance companies. In addition to general state law restrictions on payments of dividends and other distributions to shareholders applicable to all corporations, HMOs and insurance companies are... -

Page 81

... Commercial HMO (includes premiums related to POS members who access primary care physicians and referred care through an HMO Network), Medicare HMO and Medicaid HMO business. Includes all other medical, dental and Group Insurance products offered by us, except life insurance and HMO products... -

Page 82

...relating to the pool for the years 1999 through 2004. Accordingly, in 2005 we released the $89 million liability recorded at December 31, 2004, which combined with the $14 million cash received to result in a $103 million pretax favorable development of prior period health care costs. This agreement... -

Page 83

... for information from, various state insurance and health care regulatory authorities and other state and federal authorities. There also continues to be heightened review by regulatory authorities of the managed health care industry' s business practices, including utilization management, complaint... -

Page 84

...$ Corporate Interest Total Company (Millions) 2006 Revenue from external customers (1) Net investment income Interest expense Depreciation and amortization expense Income taxes (benefits) Operating earnings (loss) (2) Segment assets (3) 2005 Revenue from external customers (1) Net investment income... -

Page 85

... reflect the underlying business performance of Group Insurance. Revenues from external customers by product in 2006, 2005 and 2004 were as follows: (Millions) Health risk Health fees and other revenue Group life Group disability Group long-term care Large case pensions Total revenue from external... -

Page 86

... the sale of our fully guaranteed large case pension products (single-premium annuities ("SPAs") and guaranteed investment contracts ("GICs")) in 1993. Under our accounting for these discontinued products, a reserve for anticipated future losses from these products was established and we review it... -

Page 87

... 2004 were as follows (pretax): Charged (Credited) to Reserve for (Millions) 2006 Net investment income Net realized capital gains Interest earned on receivable from continuing products Other revenue Total revenue Current and future benefits Operating expenses Total benefits and expenses Results of... -

Page 88

... sale Mortgage loans Investment real estate Loaned securities Other investments (2) Total investments Collateral received under securities loan agreements Current and deferred income taxes Receivable from continuing products (3) Total assets Liabilities: Future policy benefits Policyholders' funds... -

Page 89

... of future investment results considers assumptions for interest rates, bond discount rates and performance of mortgage loans and real estate. Mortgage loan cash flow assumptions represent management' s best estimate of current and future levels of rent growth, vacancy and expenses based upon market... -

Page 90

... the 1990s by our former parent company. Also in 2004, we filed for, and were approved for, an additional $35 million tax refund related to other businesses that were sold by our former parent company. The tax refunds were recorded as income from discontinued operations in 2004. The Joint Committee... -

Page 91

... of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate. Under the supervision and with the participation of management, including our Chief Executive and Chief Financial Officers, management assessed the effectiveness of our system of internal control... -

Page 92

... provide a reasonable basis for our opinion. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Aetna Inc. and subsidiaries as of December 31, 2006 and 2005, and the results of their operations and their cash... -

Page 93

... purposes in accordance with U.S. generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and... -

Page 94

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Aetna Inc. and subsidiaries as of December 31, 2006 and 2005, and the related consolidated statements of income, shareholders' equity and cash flows for each of the years... -

Page 95

... Income from discontinued operations, net of tax Net income Per common share results: (1) Net income Basic Diluted Common stock data: Dividends declared Common stock prices, high Common stock prices, low 2005 Total revenue Income from continuing operations before income taxes Income taxes Net income... -

Page 96

... Black Enterprise Magazine Gerald Greenwald Founding Principal Greenbriar Equity Group Retired Chairman and Chief Executive Officer UAL Corporation Ellen M. Hancock President and Chief Operating Officer Jazz Technologies, Inc. * Mr. Jordan will not stand for re-election at the 2007 Annual Meeting of... -

Page 97

... or complaints about the Company' s accounting, internal accounting controls or auditing matters by calling AlertLine®, an independent toll-free service, at 1-888-891-8910 (available seven days a week, 24 hours a day), or by writing to: Corporate Compliance P.O. Box 370205 West Hartford, CT 06137... -

Page 98

... investors should contact: David W. Entrekin Vice President Phone: 860-273-7830 Fax: 860-273-3971 E-mail address: [email protected] Shareholder Services Computershare Trust Company, N.A. ("Computershare"), Aetna' s transfer agent and registrar, maintains a telephone response center and a website... -

Page 99

... Hartford, CT 06156-3215 Phone: 860-273-4970 Fax: 860-293-1361 E-mail address: [email protected] Aetna Equity-Based Grant Participants and Aetna Employee Stock Purchase Plan Participants Employees with outstanding equity-based grants (stock options, stock appreciation rights, restricted... -

Page 100

-

Page 101

-

Page 102

www.aetna.com 31.05.902.1-06