eBay 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

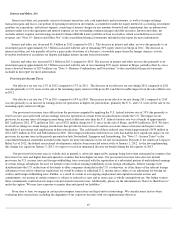

Based on our results for the year ended December 31, 2012 , a one-percentage point change in our provision for income taxes as a

percentage of income before taxes would have resulted in an increase or decrease in the provision of approximately $31 million , resulting in an

approximate $0.02 change in diluted earnings per share.

Revenue Recognition

We may enter into certain revenue transactions, primarily related to arrangements in our GSI segment and certain advertising contracts,

that are considered multiple element arrangements (arrangements with more than one deliverable). We also may enter into arrangements to

purchase goods and/or services from certain customers. As a result, significant interpretation and judgment is sometimes required to determine

the appropriate accounting for these transactions including: (1) how the arrangement consideration should be allocated among potential multiple

deliverables; (2) developing an estimate of the stand-alone selling price of each deliverable; (3) whether revenue should be reported gross (as

eBay is acting as a principal), or net (as eBay is acting as an agent); (4) when we provide cash consideration to our customers, determining

whether we are receiving an identifiable benefit that is separable from the customer's purchase of our products and/or services and for which we

can reasonably estimate fair value; and (5) whether the arrangement would be characterized as revenue or reimbursement of costs incurred.

Changes in judgments with respect to these assumptions and estimates could impact the timing or amount of revenue recognition.

Goodwill and Intangible Assets

The purchase price of an acquired company is allocated between intangible assets and the net tangible assets of the acquired business with

the residual of the purchase price recorded as goodwill. The determination of the value of the intangible assets acquired involves certain

judgments and estimates. These judgments can include, but are not limited to, the cash flows that an asset is expected to generate in the future

and the appropriate weighted average cost of capital.

At December 31, 2012, our goodwill totaled $8.5 billion and our identifiable intangible assets, net totaled $1.1 billion. We assess the

impairment of goodwill of our reporting units annually, or more often if events or changes in circumstances indicate that the carrying value may

not be recoverable. Goodwill is tested for impairment at the reporting unit level by first performing a qualitative assessment to determine

whether it is more likely than not that the fair value of the reporting unit is less than its carrying value. If the reporting unit does not pass the

qualitative assessment, then the reporting unit's carrying value is compared to its fair value. The fair values of the reporting units are estimated

using market and discounted cash flow approaches. Goodwill is considered impaired if the carrying value of the reporting unit exceeds its fair

value. The discounted cash flow approach uses expected future operating results. Failure to achieve these expected results may cause a future

impairment of goodwill at the reporting unit. We conducted our annual impairment test of goodwill as of August 31, 2012 and 2011. As a result

of this test, we determined that no adjustment to the carrying value of goodwill for any reporting units was required. See “Note 4 -

Goodwill and

Intangible Assets” to the consolidated financial statements included in this report. As of December 31, 2012, we determined that no events or

circumstances from August 31, 2012 through December 31, 2012 indicated that a further assessment was necessary.

Stock-Based Compensation

We measure and recognize stock-based compensation expense based on the fair value measurement for all share-based payment awards

made to our employees and directors, including employee stock options, employee stock purchases and restricted stock awards over the service

period for awards expected to vest. Stock-based compensation expense recognized for 2012 , 2011 and 2010 was $488 million , $458 million

and $381 million , respectively. See “Note 16 - Stock-Based and Employee Savings Plans” to the consolidated financial statements included in

this report.

75