eBay 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

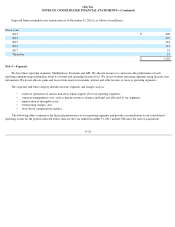

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

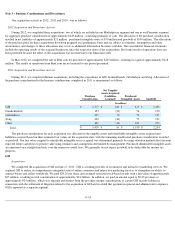

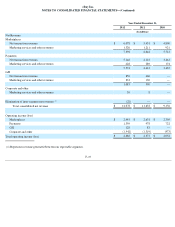

Allowance for loans and interest receivable

The allowance for loans and interest receivable represents management's estimate of probable losses inherent in our Bill Me Later

portfolio. The provision related to the principal is included in provision of transaction and loan losses and the provision related to the interest is

recorded as a reduction of marketing services and other revenue. The allowance for loans and interest receivable represents management's

estimate of probable losses inherent in our Bill Me Later portfolio, which is considered to be of one segment and one class. Management's

evaluation of probable losses is subject to judgments and numerous estimates, including forecasted principal balance delinquency rates ("roll

rates"). Roll rates are the percentage of balances that we estimate will migrate from one stage of delinquency to the next based on our historical

experience, as well as external factors such as estimated bankruptcies and levels of unemployment. The roll rates are applied to principal and

interest balances for each stage of delinquency, from current to 180 days past due, in order to estimate the loans and interest that are probable to

be charged off by the end of 180 days.

We charge off loans and interest receivable in the month in which the customer balance becomes 180 days past due. Bankrupt accounts are

charged off within 60

days of receiving notification of customer bankruptcy from the courts. Past due loans receivable continue to accrue interest

until such time as they are charged-off, with the portion of the reserve related to interest receivable balance classified as a reduction of revenue.

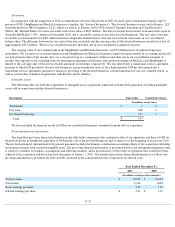

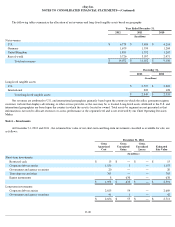

Funds receivable and funds payable

Funds receivable and funds payable relate primarily to our Payments segment and arise due to the time to clear transactions through

external payment networks. When customers fund their account using their bank account or credit card, or withdraw money to their bank account

or through a debit card transaction, there is a clearing period before the cash is received or settled, usually one to three business days for

U.S. transactions, and generally up to five business days for international transactions. To a lesser extent and primarily related to our

Marketplaces segment, we generate funds receivable in certain foreign locations from external credit providers that settle within 12 months

( $263 million and $203 million as of December 31, 2012 and 2011 , respectively).

Customer accounts

Based on differences in regulatory requirements and commercial law in the jurisdictions where PayPal operates, PayPal previously held

customer balances either as direct claims against PayPal or as an agent or custodian on behalf of PayPal's customers. Customer balances held by

PayPal as an agent or custodian on behalf of its customers are not reflected on our consolidated balance sheet, while customer balances held as

direct claims against PayPal are reflected on our consolidated balance sheet as funds receivable and customer accounts. Based on changes to our

U.S. PayPal user agreement effective November 1, 2012, PayPal began holding U.S. customer balances as direct claims against PayPal, rather

than as an agent or custodian on behalf of such PayPal customers. As a result, effective November 1, 2012, all U.S. PayPal customer balances,

which were previously not reported on our consolidated balance sheet, have been reflected as assets in our consolidated balance sheet under

"Funds receivable and customer accounts," with an associated liability under "funds payable and amounts due to customers." At December 31,

2012, PayPal held all customer balances (both in the U.S. and internationally) as direct claims against PayPal. We maintain these customer

account balances in interest and non-interest bearing bank deposits, including time deposits with maturity dates of less than one year.

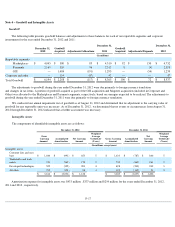

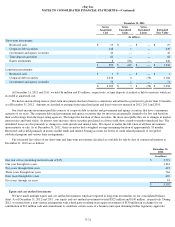

Investments

Short-term investments, which include marketable equity securities, time deposits and government bonds and corporate debt securities

with original maturities of greater than three months but less than one year when purchased, are classified as available-for-sale and are reported

at fair value using the specific identification method. Unrealized gains and losses are excluded from earnings and reported as a component of

other comprehensive income (loss), net of related estimated tax provisions or benefits.

Long-term investments include marketable government bonds and corporate debt securities, time deposits and cost and equity method

investments. Debt securities are classified as available-for-sale and are reported at fair value using the specific identification method. Unrealized

gains and losses on our available-for-sale investments are excluded from earnings and reported as a component of other comprehensive income

(loss), net of related estimated tax provisions or benefits.

Certain time deposits are classified as held to maturity and recorded at amortized cost. Our equity method investments are investments in

privately held companies. Our consolidated results of operations include, as a component of interest and other, net, our share of the net income or

loss of the equity method investments. Our share of investees' results of operations is

F-11