eBay 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

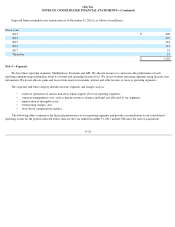

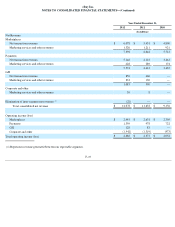

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

At December 31, 2012 and 2011, we held $6 million and $5 million

, respectively, of time deposits classified as held to maturity which are

recorded at amortized cost.

We had no material long-term or short-term investments that have been in a continuous unrealized loss position for greater than 12 months

as of December 31, 2012 . Amounts reclassified to earnings from unrealized gains and losses were not material in 2012, 2011 and 2010,

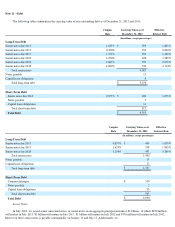

Our fixed-income investment portfolio consists of corporate debt securities and government and agency securities that have a maximum

maturity of six years. The corporate debt and government and agency securities that we invest in are generally deemed to be low risk based on

their credit ratings from the major rating agencies. The longer the duration of these securities, the more susceptible they are to changes in market

interest rates and bond yields. As interest rates increase, those securities purchased at a lower yield show a mark-to-market unrealized loss. The

unrealized losses are due primarily to changes in credit spreads and interest rates. We expect to realize the full value of all these investments

upon maturity or sale. As of December 31, 2012 , these securities had a weighted average remaining duration of approximately 18 months.

Restricted cash is held primarily in money market funds and interest bearing accounts for letters of credit related primarily to our global

sabbatical program and various lease arrangements.

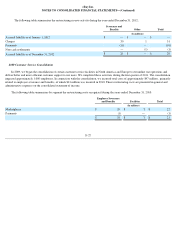

The estimated fair values of our short-term and long-term investments classified as available for sale by date of contractual maturity at

December 31, 2012 are as follows:

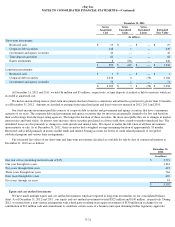

Equity and cost method investments

We have made multiple equity and cost method investments which are reported in long-term investments on our consolidated balance

sheet. As of December 31, 2012 and 2011 , our equity and cost method investments totaled $327 million and $190 million , respectively. During

2012, we entered into a joint venture arrangement with a third party resulting in an equity investment of $130 million in exchange for our

contribution of $12 million cash and commitment to contribute certain assets of a business unit upon obtaining further regulatory approvals.

F-21

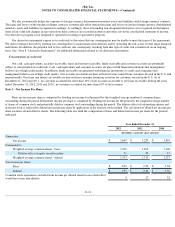

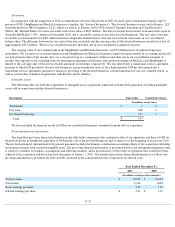

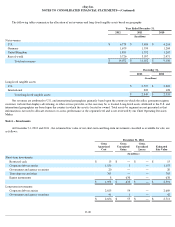

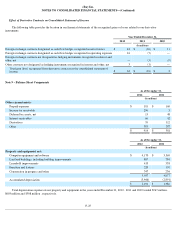

December 31, 2011

Gross

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(In millions)

Short-term investments:

Restricted cash

$

19

$

—

$

—

$

19

Corporate debt securities

448

1

—

449

Government and agency securities

42

—

—

42

Time deposits and other

82

—

—

82

Equity instruments

8

638

—

646

$

599

$

639

$

—

$

1,238

Long-term investments:

Restricted cash

$

1

$

—

$

—

$

1

Corporate debt securities

2,238

6

(58

)

2,186

Government and agency securities

70

1

—

71

$

2,309

$

7

$

(58

)

$

2,258

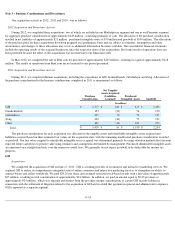

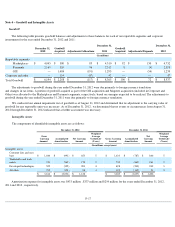

December 31,

2012

(In millions)

One year or less (including restricted cash of $15)

$

2,591

One year through two years

1,016

Two years through three years

493

Three years through four years

766

Four years through five years

420

Five years through six years

16

$

5,302