eBay 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

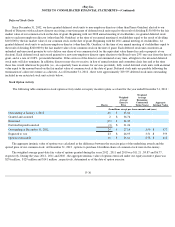

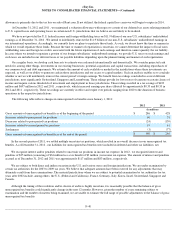

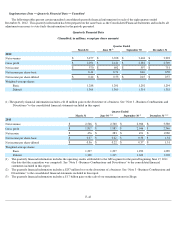

Note 18 – Loans and Interest Receivable, Net

Loans and interest receivable represent purchased consumer receivables arising from loans made by a partner chartered financial institution

to individual consumers in the U.S. to purchase goods and services through our Bill Me Later merchant network. During 2012 and 2011 , we

purchased approximately $3.2 billion and $2.3 billion , respectively, in consumer receivables. Loans and interest receivable are reported at their

outstanding principal balances, including unamortized deferred origination costs and net of allowance, and include the estimated collectible

interest and fees. We use a consumer's FICO score, among other measures, in evaluating the credit quality of our consumer receivables. A FICO

score is a type of credit score that lenders use to assess an applicant's credit risk and whether to extend credit. Individual FICO scores generally

are obtained each quarter the consumer has an outstanding loan receivable owned by Bill Me Later. The weighted average consumer FICO score

related to our loans and interest receivable balance outstanding at December 31, 2012 was 689 . As of December 31, 2012 and 2011 ,

approximately 55.8% and 59.3% , respectively, of our loans and interest receivable balance was due from consumers with FICO scores greater

than 680 , which is generally considered "prime" by the consumer credit industry. As of December 31, 2012 , approximately 90% of our loans

and interest receivable portfolio were current.

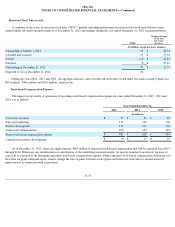

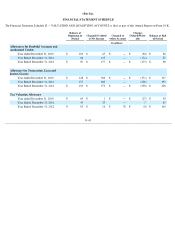

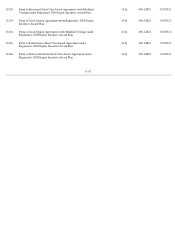

The following table summarizes the activity in the allowance for loans and interest receivable for the years ended December 31, 2012 and

2011 :

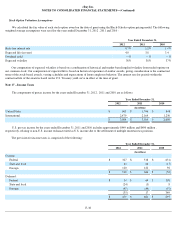

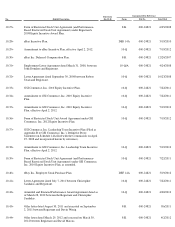

Note 19 – Interest and Other, Net

The components of interest and other, net for the years ended December 31, 2012 , 2011 and 2010 are as follows (in millions):

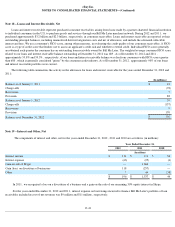

In 2011 , we recognized a loss on a divestiture of a business and a gain on the sale of our remaining 30% equity interest in Skype.

For the years ended December 31, 2012 and 2011 , interest expense on borrowings incurred to finance Bill Me Later's portfolio of loan

receivables included in cost of net revenues was $9 million and $11 million , respectively.

F-41

(In millions)

Balance as of January 1, 2011

$

42

Charge-offs

(78

)

Recoveries

7

Provision

88

Balance as of January 1, 2012

59

Charge-offs

(137

)

Recoveries

9

Provision

170

Balance as of December 31, 2012

$

101

Year Ended December 31,

2012

2011

2010

(In millions)

Interest income

$

134

$

111

$

86

Interest expense

(63

)

(25

)

(4

)

Gain on sale of Skype —

1,664

—

Gain (loss) on divestiture of businesses

118

(257

)

—

Other

7

44

(38

)

$

196

$

1,537

$

44