eBay 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

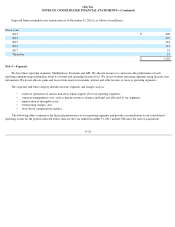

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

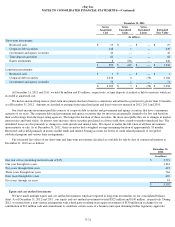

We also economically hedge our exposure to foreign currency denominated monetary assets and liabilities with foreign currency contracts.

The gains and losses on the foreign exchange contracts economically offset transaction gains and losses on certain foreign currency denominated

monetary assets and liabilities recognized in earnings. Accordingly, these outstanding non-designated derivatives are recognized on the balance

sheet at fair value and changes in fair value from these contracts are recorded in interest and other, net in the consolidated statement of income.

Our derivatives program is not designed or operated for trading or speculative purposes.

Our derivative instruments expose us to credit risk to the extent that our counterparties may be unable to meet the terms of the agreements.

We seek to mitigate this risk by limiting our counterparties to major financial institutions and by spreading the risk across several major financial

institutions. In addition, the potential risk of loss with any one counterparty resulting from this type of credit risk is monitored on an ongoing

basis. See “Note 8 - Derivative Instruments” for additional information related to our derivative instruments.

Concentration of credit risk

Our cash, cash equivalents, accounts receivable, loans and interest receivable, funds receivable and customer accounts are potentially

subject to concentration of credit risk. Cash, cash equivalents and customer accounts are placed with financial institutions that management

believes are of high credit quality. In addition, funds receivable are generated with financial institutions or credit card companies that

management believes are of high credit quality. Our accounts receivable are derived from revenue earned from customers located in the U.S. and

internationally. Our loans and interest receivable are derived from consumer financing activities for customers located in the U.S. As of

December 31, 2012 and 2011 , no customer accounted for more than 10% of net accounts receivable or net loans receivable. During the years

ended December 31, 2012, 2011 and 2010 , no customer accounted for more than 10% of net revenues.

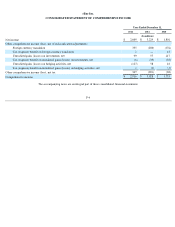

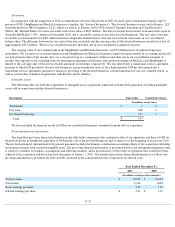

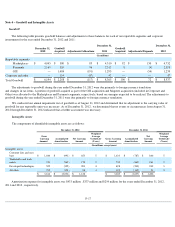

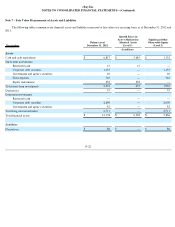

Note 2 – Net Income Per Share

Basic net income per share is computed by dividing net income for the period by the weighted average number of common shares

outstanding during the period. Diluted net income per share is computed by dividing net income for the period by the weighted average number

of shares of common stock and potentially dilutive common stock outstanding during the period. The dilutive effect of outstanding options and

restricted stock is reflected in diluted net income per share by application of the treasury stock method. The calculation of diluted net income per

share excludes all anti-dilutive shares. The following table sets forth the computation of basic and diluted net income per share for the periods

indicated:

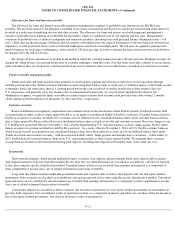

F-13

Year Ended December 31,

2012

2011

2010

(In millions, except per share amounts)

Numerator:

Net income

$

2,609

$

3,229

$

1,801

Denominator:

Weighted average common shares - basic

1,292

1,293

1,306

Dilutive effect of equity incentive plans

21

20

21

Weighted average common shares - diluted

1,313

1,313

1,327

Net income per share:

Basic

$

2.02

$

2.50

$

1.38

Diluted

$

1.99

$

2.46

$

1.36

Common stock equivalents excluded from income per diluted share because their effect

would have been anti-dilutive

4

17

32