eBay 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

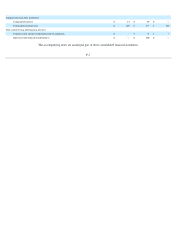

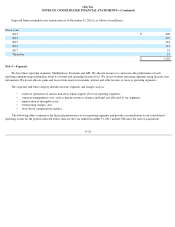

Note 3 – Business Combinations and Divestitures

Our acquisition activity in 2012 , 2011 and 2010 , was as follows:

2012 Acquisition and Divestiture Activity

During 2012, we completed three acquisitions, two of which are included in our Marketplaces segment and one in our Payments segment,

for aggregate purchase consideration of approximately $149 million , consisting primarily of cash. The allocation of the purchase consideration

resulted in net liabilities of approximately $21 million , purchased intangible assets of $70 million and goodwill of $100 million

. The allocations

of the purchase price for these acquisitions have been prepared on a preliminary basis and are subject to estimates, assumptions and other

uncertainties, and changes to those allocations may occur as additional information becomes available. The consolidated financial statements

include the operating results of the acquired businesses since the respective dates of the acquisitions. Pro forma results of operations have not

been presented because the effect of the acquisitions was not material to our financial results.

In May 2012, we completed the sale of Rent.com for proceeds of approximately $145 million , resulting in a gain of approximately $118

million . The results of operations from Rent.com are not material to any period presented.

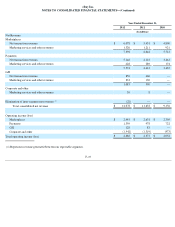

2011 Acquisition and Divestiture Activity

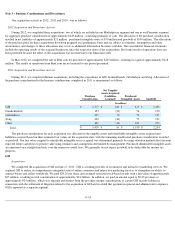

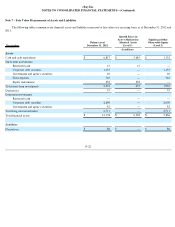

During 2011, we completed thirteen acquisitions, including the acquisitions of GSI, brands4friends, GittiGidiyor and Zong. Allocation of

the purchase consideration for the business combinations completed in 2011 is summarized as follows:

The purchase consideration for each acquisition was allocated to the tangible assets and identifiable intangible assets acquired and

liabilities assumed based on their estimated fair values on the acquisition date, with the remaining unallocated purchase consideration recorded

as goodwill. The fair value assigned to identifiable intangible assets acquired was determined primarily by using valuation methods that discount

expected future cash flows to present value using estimates and assumptions determined by management. Purchased identifiable intangible assets

are amortized on a straight-line basis over the respective useful lives. We generally do not expect goodwill to be deductible for income tax

purposes.

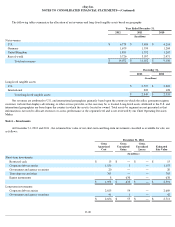

GSI

Acquisition

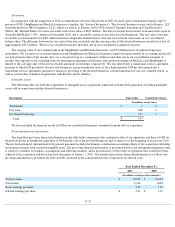

We completed the acquisition of GSI on June 17, 2011 . GSI is a leading provider of ecommerce and interactive marketing services. We

acquired GSI to utilize its comprehensive integrated suite of online commerce and interactive marketing services to strengthen our ability to

connect buyers and sellers worldwide. We paid $29.25 per share, and assumed restricted stock-based awards with a fair value of approximately

$25 million , resulting in total consideration of approximately $2.4 billion . In addition, we paid an amount equal to $0.33 per share or

approximately $24 million , which was separate and distinct from the per share merger consideration, to certain GSI security holders in

connection with the settlement of litigation related to the acquisition of GSI and recorded that payment in general and administrative expenses.

GSI is reported as a separate segment.

F-14

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed) Purchased

Intangible Assets

Goodwill

(In millions)

GSI

$

2,377

$

128

$

819

$

1,430

brands4friends

193

(33

)

76

150

GittiGidiyor

235

(9

)

53

191

Zong

232

(36

)

77

191

Other

402

(34

)

164

272

Total

$

3,439

$

16

$

1,189

$

2,234